Dogecoin Rises 2% Today — Yet Chart Signals Short‑Term Weakness

Jakarta, Pintu News – Dogecoin price on November 5 was trading around $0.165 when sellers forced a significant breakdown of a multi-week triangle pattern. This move put short-term pressure on buyers, as spot outflows accelerated and the cluster EMA turned into resistance.

Then, how is the current Dogecoin price movement?

Dogecoin Price Rises 2.30% in 24 Hours

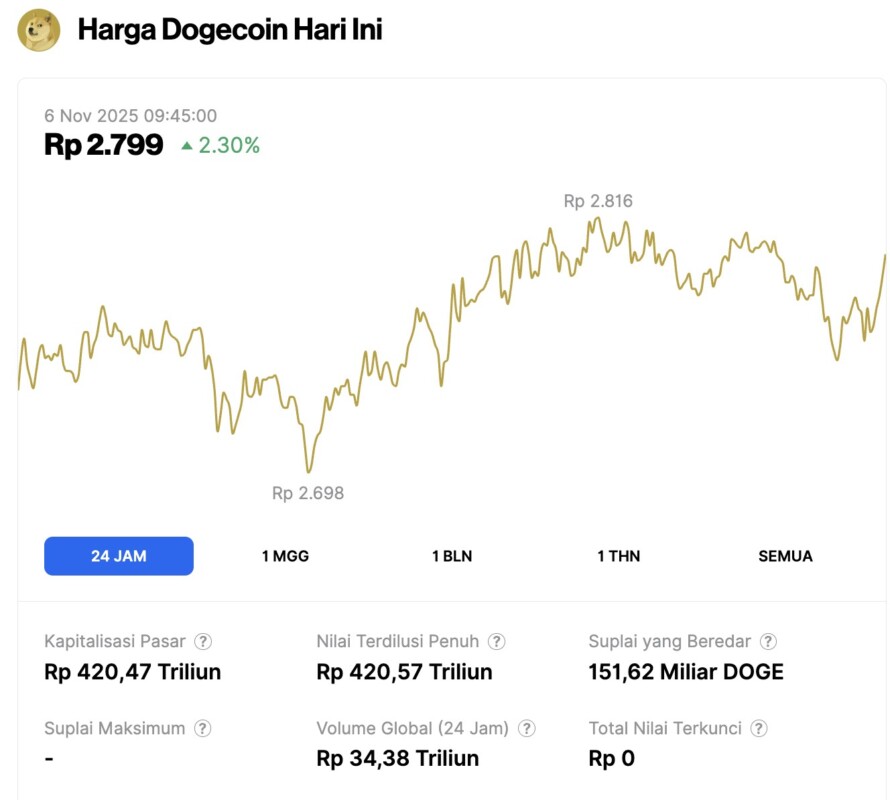

On November 6, 2025, Dogecoin saw a 2.30% increase over the past 24 hours, trading at $0.1671, which is approximately IDR 2,799. During the same period, DOGE fluctuated within a range of IDR 2,698 to IDR 2,816.

As of writing, Dogecoin’s market capitalization is estimated at IDR 420.47 trillion, with a 24-hour trading volume of around IDR 34.38 trillion.

Read also: Ethereum Price Rises to $3,400 Today as ETH Bearish Momentum Starts to Slow Down

Outflows Increase as Buyers Pull Out

According to Coinglass, Dogecoin recorded nearly $46 million in outflows yesterday, which was one of the largest distributions in a single session over the past few weeks. Today, the trend continues.

At the start of Wednesday, spot flows showed a net outflow of $936,000, indicating that sellers were still sending DOGE to exchanges rather than holding it.

When spot outflows dominate over multiple sessions, this usually reflects distribution, not accumulation. Market participants are not positioning themselves for potential upside, and liquidity is exiting the ecosystem instead of entering.

Trendline Breakout Indicates Short-Term Weakness

DOGE failed to break the descending trendline that had capped its rally since September. The rejection pushed the token down below the symmetrical triangle pattern support, a level that previously held for almost three weeks.

With that support level gone, the chart now shows:

- DOGE is trading below the 20, 50, 100, and 200-day EMAs

- EMA arranged downwards, forming resistance

- Parabolic SAR dot reverses above the price, confirming a bearish trend

The 20-day EMA around $0.189 is now the first major resistance. Above it, the 50-day EMA at $0.207 and the 200-day EMA at $0.221 become barriers to a larger price reversal.

Buyers will have to reclaim this EMA cluster to turn the momentum into neutral. Until such a move happens, any price increase is still considered a temporary bounce within the bearish structure.

Read also: Bitcoin Price Recovers to $102,000 Today: Important BTC Indicators Show “Opportunity Zones”

Intraday Momentum Shows Attempt to Stabilize

On the shorter time frame, DOGE is seen trying to defend the $0.160-$0.157 zone.

On the 30-minute chart:

- Supertrend remains red, signaling downward pressure

- RSI has recovered above 50, indicating stabilization after oversold conditions

- Price is testing the bottom of the Supertrend band

Intraday traders tried to force a small recovery, but until DOGE managed to close above $0.171, this rebound was not confirmed. The level marks the Supertrend reversal zone. Rejection here could trigger a further decline towards $0.150.

The playbook for the bulls is quite simple. A strong close above $0.189 would suggest that the buyers can regain control and invalidate the breakdown.

A breakout above $0.207 opens the way towards $0.240 and an eventual trend reversal towards the upper trendline around $0.260. Anything below $0.189 will maintain the bearish structure.

Projections: Will Dogecoin Go Up?

Further movement depends on how DOGE reacts in the $0.157-$0.150 zone, which is a demand level that has historically served as a jumping-off point.

Bullish Case: DOGE rebounded from $0.157 and closed above $0.189 with increasing volume. This would reverse the Supertrend and signal the first sign of a trend reversal.

Bearish Case: A daily close below $0.150 will confirm a clean breakdown and open the next liquidity zone around $0.140.

If the price manages to reclaim $0.189 and break the cluster EMA, the momentum will shift. Losing $0.150 will turn this move into a full correction towards $0.130-$0.110.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CoinEdition. Dogecoin Price Prediction: Sellers Flip EMAs Into Resistance as Breakdown Targets $0.13. Accessed on November 6, 2025