Bitcoin Plunges: Is BTC Heading Into a Long-Term Downtrend? Analysts Weigh In

Jakarta, Pintu News – The price of Bitcoin fell past the psychologically important threshold of $100K. The major crypto asset saw a decline of more than 2% on Thursday, bottoming out around $98.2k before recovering slightly and trading around $98,400 in the mid-North American trading session.

Why is Bitcoin Price Down Today?

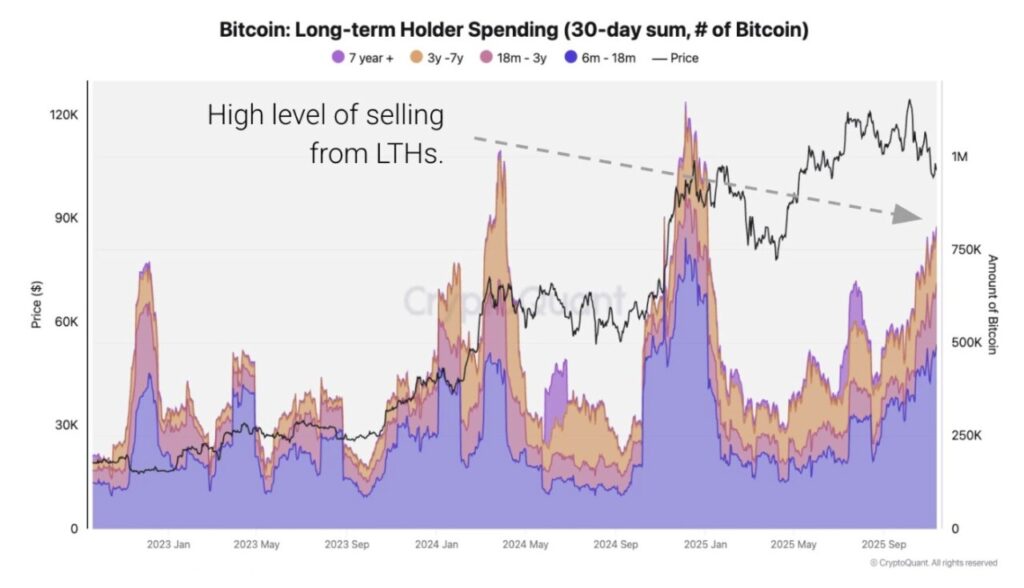

Today’s drop in Bitcoin price is due to continued selling by whales, amid strengthening gold and stock markets. Based on analysis of market data from CryptoQuant, long-term holders of Bitcoin have been aggressively selling, similar to the trend in the fourth quarter of 2024.

Read also: Fear and Greed Index Plunges to Record Low, but Crypto Analysts See Signs of Optimism

In the past 30 days, long-term holders have reportedly sold as much as 815,000 BTC. Analysis of on-chain data from Arkham also shows that one whale sold $290 million worth of Bitcoin through Kraken on Thursday.

While this massive sell-off is taking place, gold prices have been on the rise. Although the US government has reopened, capital flows into the crypto market have not been strong enough to withstand the high selling pressure.

Large liquidation of long positions amid fears of further capitulation

Following the sudden sell-off led by Bitcoin, the crypto futures market saw over $647 million liquidated. Based on data from CoinGlass, around $519 million came from the liquidation of long positions, with Bitcoin accounting for over $234 million.

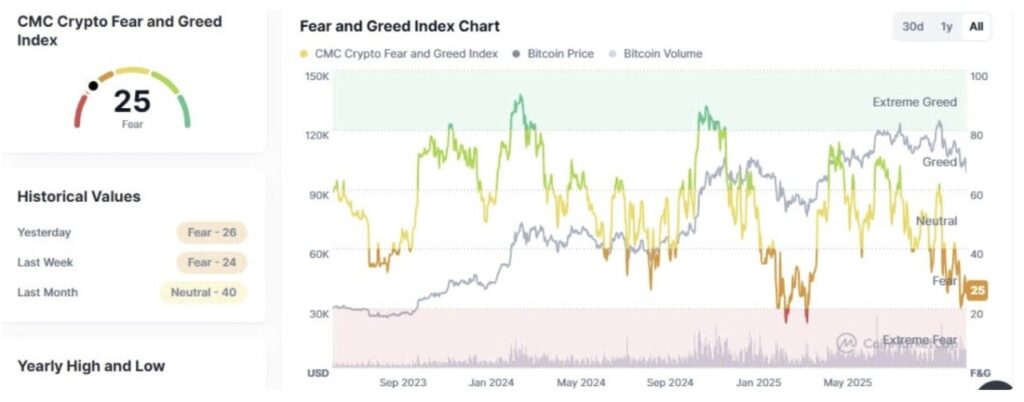

This large liquidation of long positions triggered long squeeze pressure amid growing fears of further capitulation. The crypto fear and greed index has now dropped to its lowest level in months, around 25, reflecting the extreme fear of market participants.

Technical Weakness: BTC Price Breaks Below Bullish Trend Support

The failure of BTC prices to break back through the $107K support level in recent days confirms the reversal in market direction. Currently, the major crypto asset is expected to retest its long-term logarithmic support trend line.

Read also: Michael Saylor Forecasts Bitcoin to Surpass Gold Market Capitalization by 2035!

Technically, the price of BTC has the potential to drop to $92K, where there is a gap in the CME market that has not yet been closed.

Further Prospects for the Bullish Market

Investor focus is now on Federal Reserve policy ahead of a possible quantitative easing (QE) in December. With the expectation that some of the gains from gold will be diverted to Bitcoin, a potential price recovery is expected in the next few weeks. Most Wall Street analysts project a parabolic rally is imminent.

FAQ

Why is Bitcoin price down today?

Today’s Bitcoin price drop was triggered by heavy selling by large investors and liquidation of long positions in the leveraged crypto market.

How much money was liquidated from leveraged crypto markets recently?

Over $647 million has been liquidated from the leveraged crypto market, with $519 million of that being long positions.

What to expect from the upcoming Federal Reserve policy?

The anticipated Quantitative Easing (QE) policy in December is expected to trigger profit rotation from gold to Bitcoin, which might lead to a price rebound.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpedia. Is Bitcoin Price in a Macro Bear Market? Analysts Insights. Accessed on November 14, 2025