Chainlink (LINK) Slips Below $16: Will $19 Level Test Happen Soon? (11/17/25)

Jakarta, Pintu News – Chainlink prices recently dropped below the important $16 support area, sparking concerns among short-term investors. However, a number of technical and on-chain signals suggest that selling pressure is beginning to ease, with some indicators pointing to an early recovery phase. This article examines LINK’s price dynamics, from whale behavior to top trader positioning.

LINK drops below $16, whale accumulation increases

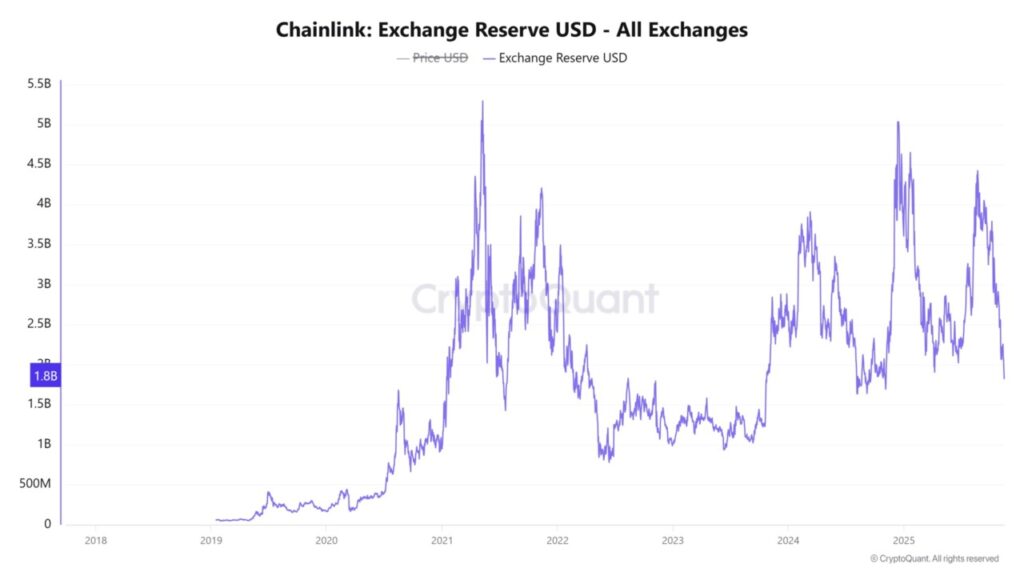

Data from CryptoQuant shows that despite the LINK price falling below $16, LINK’s reserves on exchanges continued to decline by 2.26%, now hovering around 1.8 billion tokens. This decline indicates that holders are withdrawing assets from exchanges, easing selling pressure and reflecting accumulation.

This phenomenon indicates that some market participants prefer to keep LINK in the long term, rather than distribute it. The reduction in supply on exchanges often precedes the price stabilization phase due to the lack of selling liquidity.

Also Read: 3 Powerful Altcoins Predicted to Rival Solana, What Are They?

Technical Structure Still in a Downward Channel, but There is a Rebound

Chainlink is currently trading within a descending channel formed since September 2025. The price briefly bounced off the lower boundary of the channel after completing the Elliott wave A-B-C correction, and the reaction from point “C” shows that the support of the channel is still respected by the market.

But to reverse the trend decisively, LINK price needs to break the mid-channel zone at $16.64. If this level can be reclaimed, the price has the opportunity to test the next resistance zone at $19.13, even towards $23.64 if the momentum continues to strengthen.

Support from Futures: CVD Buy Takers and Dominant Long Positions

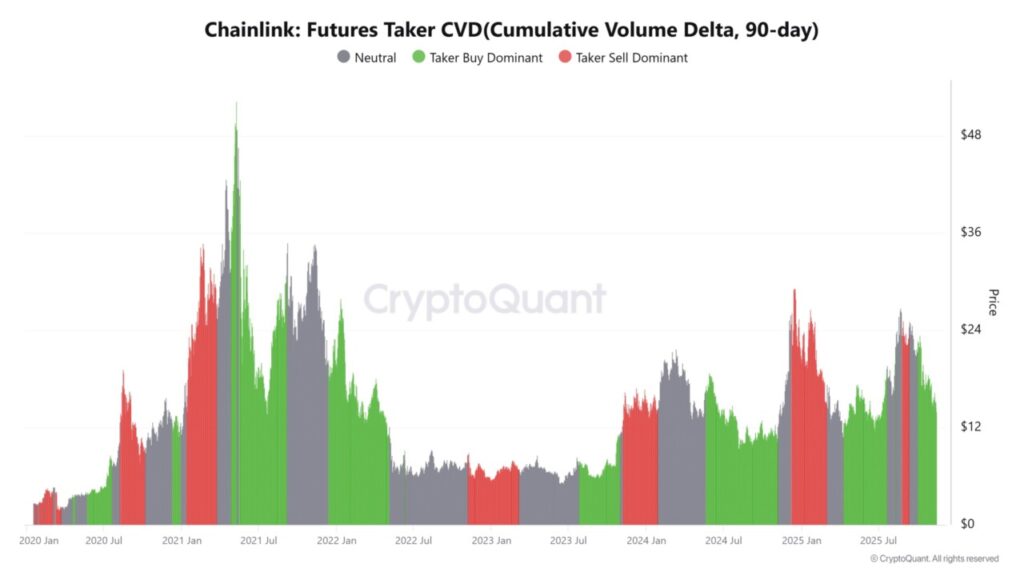

One of the most prominent recovery signals came from the derivatives market. Taker Buy CVD shows strong buying dominance, reflecting the confidence of aggressive buyers during correction phases. This trend is often associated with early accumulation by large market participants.

The long positions of top traders on Binance also stand at 74.32%, compared to 25.68% short positions. This ratio of 2.89 shows that experienced traders expect a potential reversal, especially after the price touches the lower boundary of the technical channel.

LINK Needs Confirmation at $16.64 to Validate Uptrend

Although technical and on-chain indicators are signaling positively, confirmation of the uptrend remains dependent on the price successfully reclaiming the $16.64 level. Without this, the price is still at risk of moving sideways or even dropping back to lower levels.

In conclusion, although Chainlink (LINK) is still under short-term technical pressure, the presence of whale accumulation, the reduction of stock reserves, and the dominance of long positions provide a positive basis for a potential recovery in the near term.

Also Read: 10 Most Popular Coin Memes of November 2025: The talk of the town!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

What is the main cause of Chainlink’s (LINK) price drop below $16?

Chainlink’s (LINK) price drop below $16 was due to selling pressure from the previous supply zone, which left 53.87 million tokens in the red, based on sentiment analysis and cost-based heatmaps.

Is there any indication of accumulation despite the LINK price drop?

Yes, data from CryptoQuant shows that LINK’s reserves on exchanges fell by 2.26% to around 1.8 billion, signaling accumulation action and holders’ confidence in price recovery.

What is the significance of the $16.64 price level for Chainlink (LINK)?

The $16.64 level is a mid-channel zone that needs to be broken for the trend reversal to be valid; failure to break this level opens up further downside potential.

How do derivatives traders currently position Chainlink (LINK)?

Data from CoinGlass shows that 74.32% of top traders on Binance hold long positions against LINK, reflecting positive expectations of a potential price recovery.

What role does the Taker Buy CVD indicator play in supporting the bullish narrative?

Taker Buy CVD indicates the dominance of aggressive buying in the derivatives market, which generally indicates the beginning of the accumulation phase and the strengthening of market participation to a potential price rebound.

Reference:

- Erastus Chami/AMBCrypto. Chainlink slips below $16 as whales pull supply – Will LINK test $19 soon? Accessed on November 17, 2025