Antam Gold Price Chart Today November 17, 2025: Up or Down?

Jakarta, Pintu News – Antam gold prices on Friday, November 17, 2025 showed a fluctuating trend but remained in a relatively high range when compared to the beginning of the month. Based on data from HargaEmas.com, today’s price movements reflect the market’s response to global dynamics as well as the rupiah exchange rate against the United States dollar.

Gold Spot Price and Exchange Rate

At 17:20 WIB, the international gold spot price was recorded at $4,087.60 per troy ounce, an increase of $6.80 from the previous day. With a USD/IDR exchange rate of IDR16,747.52, the gold price in rupiah was at IDR2 ,200,949 per gram, an increase of IDR8,322 compared to the previous day. The daily price range (Hi-Lo) ranged from IDR2,181,643 to IDR2,201,316, indicating a fairly active market volatility throughout the day.

Also Read: 3 Powerful Altcoins Predicted to Rival Solana, What Are They?

Antam Gold Price Trend November 2025

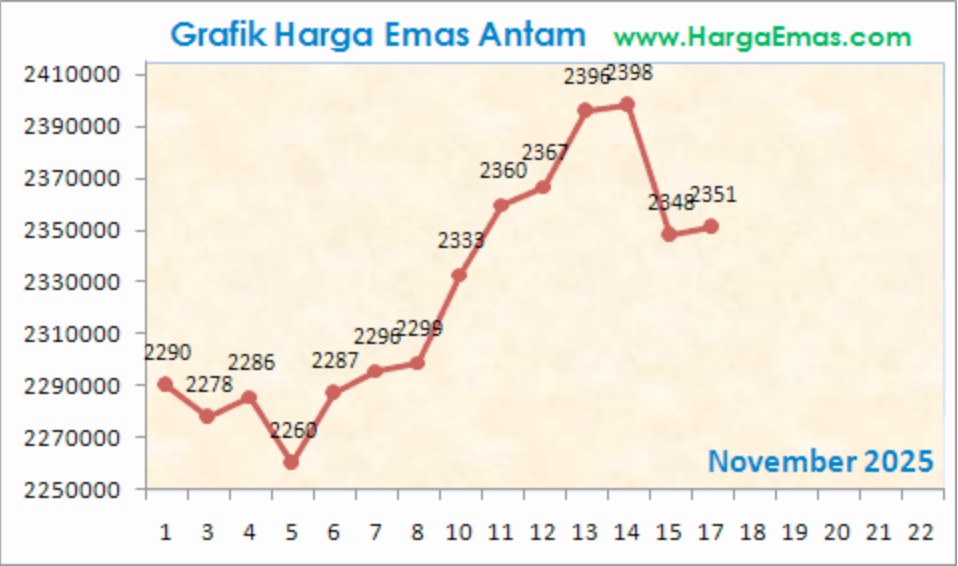

From the monthly chart of the Antam Gold Price, it can be seen that the price had reached its lowest point in the range of Rp2,260,000 on November 5, then experienced a significant increase to touch Rp2,398,000 on November 13-14. After reaching this peak, the price experienced a correction, dropping to IDR 2,348,000 on November 15 and moving slightly up to IDR 2,351,000 on November 17.

Intra-Day Movement November 17

Based on the world gold spot chart in rupiah, it can be seen that the price had strengthened since the morning and reached a peak around 08:00 WIB. However, selling pressure caused prices to fall sharply towards noon and reached a daily low around 12:20. After that, there was a gradual recovery and prices strengthened again towards the close of the market.

Conclusion

Antam gold prices today showed stability above IDR 2,200,000 per gram, with a tendency to recover after a mid-month correction. The increase in global spot prices and the decline in gold reserves in the market are the main driving factors. For gold investors, this trend shows that gold still maintains its appeal as a hedge asset amid global economic fluctuations.

Also Read: 10 Most Popular Coin Memes of November 2025: The talk of the town!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

What is Antam’s gold price per gram today?

The price of Antam gold on November 17, 2025 was recorded at IDR 2,200,949 per gram, an increase of IDR 8,322 from the previous day.

What is the trend of Antam gold price during November 2025?

Prices touched a low of IDR 2,260,000 on November 5, then rose significantly to reach IDR 2,398,000 on November 13-14. After that, the price corrected and was in the range of IDR 2,351,000 on November 17.

What influenced today’s rise in gold prices?

The increase in gold prices was influenced by strengthening global spot prices ($4,087.60/oz) and the rupiah exchange rate against the US dollar (IDR 16,747.52/USD), which strengthened rupiah-denominated prices.

How does the gold price move intraday?

Prices rose in the morning, reaching a peak around 08:00 am, then fell sharply until 12:20 pm due to selling pressure. Thereafter, there was a recovery towards the close of the market.

Is the current gold price high?

Yes, the current price is above IDR2,200,000/gram, which is high compared to the beginning of the month. This shows that gold remains attractive as a hedging instrument.

Is now the right time to buy gold?

With the recovery trend after the correction and unstable global market conditions, gold remains relevant for portfolio diversification and inflation protection, but purchasing decisions should take into account individual investment objectives.

Reference:

- HargaEmas.com. Antam Gold Price Chart Today. Accessed November 17, 2025.