Cardano investors lose IDR97 billion due to swap to illiquid stablecoins

Jakarta, Pintu News – A Cardano investor who has held ADA for five years suffered huge losses after making a swap transaction to a small-cap stablecoin through a low liquidity pool. In one transaction, he lost more than 90% of his total asset value.

Fatal Swap Mistakes

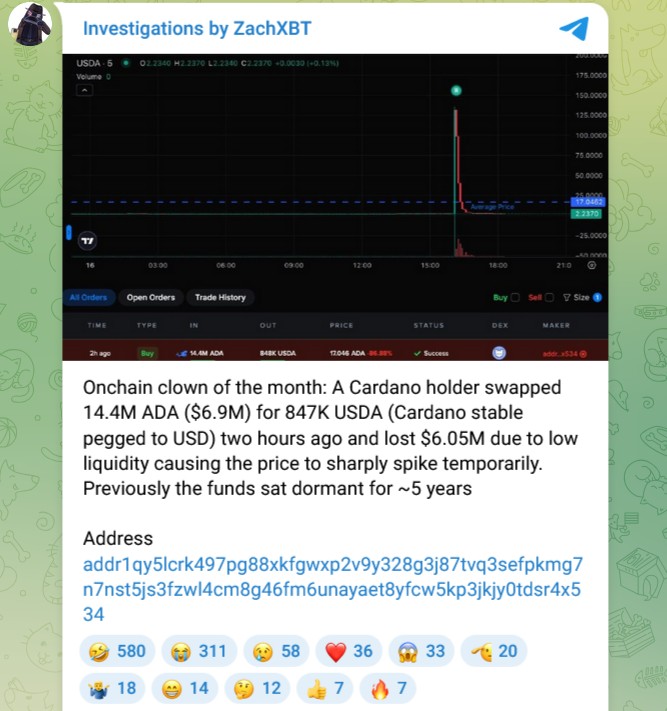

The investor, whose wallet address is “addr…4×534”, exchanged 14.4 million ADA worth around $6.9 million (approximately Rp112 billion) into just 847,695 USDA stablecoins, which are only worth around $847,695 (Rp14 billion). The transaction was conducted through a very narrow liquidity pool, which led to extreme slippage and unfavorable price execution.

Also Read: 3 Powerful Altcoins Predicted to Rival Solana, What Are They?

Pools are Illiquid and Prices are Dragged Up

The swap occurred just seconds after the small test transaction. As there was not enough liquidity in the swap pool, the price of USDA jumped dramatically to $1.26 and then fell back to around $1.04. This shows how one large transaction can distort prices in a market that is not deep.

Is this a typo?

It is unclear whether the investor intended to swap to the USDA stablecoin or simply chose the wrong asset. However, blockchain records show that the wallet had never held USDA before. This raises the possibility that the error could have stemmed from user error or miscalculation regarding the destination asset.

Lessons for Crypto Investors

This incident is an important reminder for investors to always check the liquidity of the pool before making large transactions, especially in the DeFi ecosystem. It’s also important to understand the differences between various stablecoins and be wary of projects with small capitalization and limited exposure.

Also Read: 10 Most Popular Coin Memes of November 2025: The talk of the town!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

What caused this huge loss of Cardano investors?

Investors used low-liquidity pools to exchange ADA for USDA stablecoin, resulting in extreme slippage that led to losses of more than 90% of the asset’s value.

What is USDA stablecoin?

USDA is a small-cap stablecoin that is not yet widely known and has low liquidity on most decentralized exchanges.

Can this be considered user error?

Most likely yes. There is no trace of USDA’s previous holdings, and the test transaction was made only 33 seconds earlier. This could be a result of choosing the wrong asset or not checking the depth of the market.

How to avoid similar mistakes?

Use high liquidity pools for large trades, always check for slippage, double-check the assets you want to buy, and do small trades as a test run before major trades.

Does this have any impact on the ADA price?

Not directly, but events like this can affect market sentiment towards the security and efficiency of using DeFi on the Cardano network.

Reference:

- Brayden Lindrea/Cointelegraph. 5-year Cardano hodler loses 90% of $6.9M ADA in bungled swap. Accessed November 17, 2025.