3 Cryptos Defying the Bear Market — See Which Coins Are Holding Strong

Jakarta, Pintu News – The bear market hypothesis is getting stronger every day. Bitcoin price dropping below $92,000 and Ethereum losing the $3,000 level have pushed the market into a clear phase of fear.

With such a rapid change in sentiment, traders are now starting to look at bear market coins that have the potential to survive if this downward trend turns into a true cycle.

The coins on this list were not chosen at random. Each represents a different defensive style: some have outperformed Bitcoin during weak markets, some have shown an inverse correlation when Bitcoin has fallen, and some have strong momentum-signaling that there are still active buyers despite stressful market conditions.

This filter provides a simple way to assess which assets can afford deeper volatility if the market correction continues.

Filecoin (FIL)

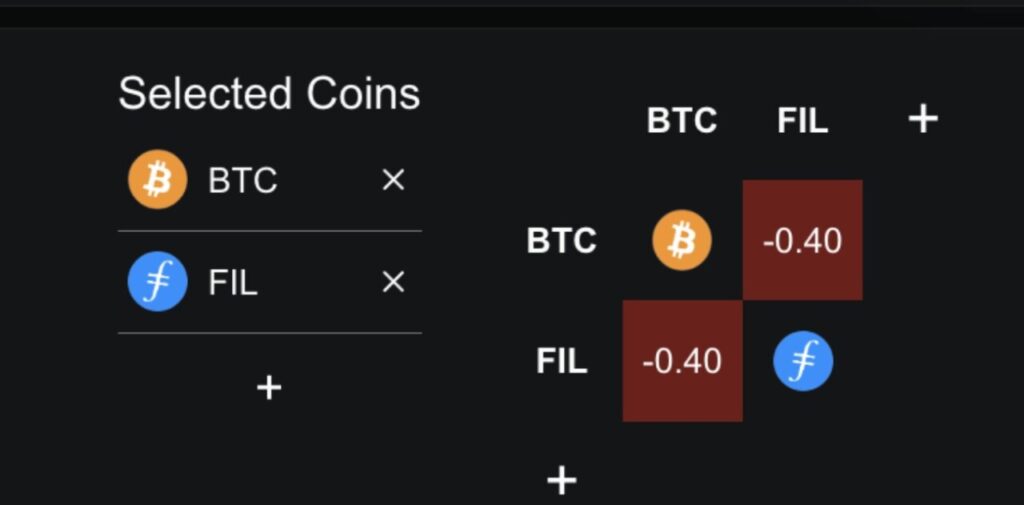

Filecoin falls into the category of bear market coins that have an inverse correlation, and this has become even more apparent in the past month. While the total crypto market capitalization fell by around 5.2% on November 18, FIL rose by roughly the same percentage. In the past month, FIL has gained around 37.6%, and this strength forms a monthly correlation of -0.40 against Bitcoin.

Read also: Crypto Market Plunges, Here are 3 US Stocks that Steal the Show

Since Bitcoin drives almost 60% of the crypto market, this inverse relationship becomes very important if the bear market hypothesis is truly proven.

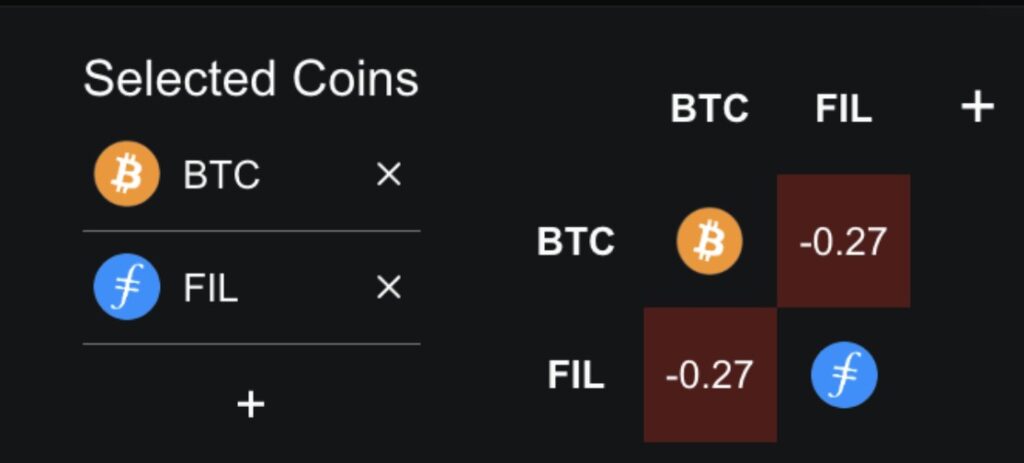

This monthly correlation is calculated using the Pearson coefficient, a statistical metric that ranges from +1 to -1. A value of +1 indicates the two assets are moving in the same direction, -1 means they are moving in opposite directions, and 0 indicates no significant relationship.

In the longer term, similar behavior remains evident. Over the past year, FIL has maintained a negative correlation of -0.27 against Bitcoin. This means that if Bitcoin continues to lose support, FIL may not fall with it. That’s why traders often include FIL in their list of preferred coins when the market is in a pressure phase.

The price chart also supports this narrative. FIL is currently still moving in a pennant pattern and is testing the upper trendline. If the recent positive momentum continues, the key level to break is $2.48. If successful, this could pave the way towards $3.49, with a higher target of $4.50.

However, this upper trend line is not very strong as it only has two clear touch points. This means that if this line is broken, the upside potential could develop into a larger move.

Meanwhile, the downside is quite simple. FIL needs to stay above $1.86 to maintain its technical structure. If this level is lost, the price could retreat back to around $1.27 – especially if the market turns up and the inverse correlation becomes a drag.

Zcash (ZEC)

Zcash is a momentum-driven pick in this list of bear market coins, mainly because of its completely opposite movement to Bitcoin. In the last three months, Bitcoin has fallen about 20%, while ZEC has surged more than 1,600%. This is a form of divergence that occurs at the level of market cycles. This trend also continues on a shorter timeframe.

In the last month alone, ZEC is up about 175%, and even in the last seven days it has still recorded a gain of almost 15%. This makes ZEC a clear example of a coin that actually rallied when the general market was weak.

The narrative around privacy coins is also growing rapidly. The arrival of Ethereum’s new privacy layer, Kohaku, has increased interest in the entire category. Some privacy coins such as XMR, Dash, and Firo are on the rise, but Zcash remains the most prominent leader.

Maria Carola, CEO of StealthEx, told BeInCrypto that this shift is part of a larger trend:

“The divergence in ZEC’s performance against large-cap assets suggests that market leadership is shifting from large-cap assets to narrative-driven sectors,” he said.

The two-day chart shows that ZEC is pressing the upper limit of the flag pattern. A breakout above $768 requires about 23% upside and could open the way to $983, even up to $1,331.

Read also: Bitcoin dominance drops below 60%, Altcoin Season is about to begin?

The only confirmation that is still lacking is volume. The OBV (On-Balance Volume), which measures buying-selling pressure, is still below the uptrend line. If the OBV manages to breakout, it will be a validation that buyers are actually supporting this move.

If the overall market continues to go into a confirmed downtrend, momentum like this could keep ZEC in the vanguard of bear market coins.

OKB (OKB)

OKB may feel like a surprising choice for those looking for a resilient coin in a bearish market, but let’s take a deeper look. This token has a strong track record of holding its value when the market is depressed.

One of the clearest signals is seen in the weekly OKB/BTC chart. From February 28, 2022 to February 13, 2023, the ratio of OKB to BTC jumped by almost 493% in a span of 350 days.

That period is the core of a bear market. While most assets struggled, OKB rallied against Bitcoin. As such, traders see it as a hedge-style option, although its short-term structure currently looks weak.

Currently, OKB is down about 14% in the past week and almost 35% in the past month. However, the daily chart shows an important small change. Between November 4 and 14, the price formed a lower low, but the RSI (Relative Strength Index) formed a higher low.

The RSI measures momentum, and this pattern often signals reversal pressure that is starting to build.

If buyers start to step in, OKB needs to hold above $108. A move above $173 will show real strength, and if it is able to cross $237, it will confirm a complete trend reversal. However, if the price drops below $108-especially if it breaks $88.5-then the setup is considered a failure.

OKB also has strong fundamentals. The token is tied to OKX, one of the largest crypto exchanges. Exchange tokens like OKB tend to stay relevant, even when the general crypto market is down.

FAQ

What is Bitcoin (BTC) and why does its price matter?

Bitcoin (BTC) is the first and most well-known cryptocurrency, often considered a barometer for the crypto market as a whole. The price of Bitcoin is important because it influences market sentiment and the value of other crypto assets.

How has Filecoin (FIL) performed compared to Bitcoin (BTC) in the last month?

In the past month, Filecoin (FIL) rose about 37.6%, while Bitcoin (BTC) declined. This shows a negative correlation between FIL and BTC in that period.

What is a bear market and how does it impact crypto investing?

A bear market is a period where asset prices, including crypto, tend to fall significantly and sustainably. The impact on crypto investments is a decrease in portfolio value and increased uncertainty in the market.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with various advanced trading tools

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bear Market Coins: Top Picks for 2025. Accessed on November 21, 2025