Pi Network Price Rises 4% Today — Is Pi Coin Outpacing Bitcoin’s Gains?

Jakarta, Pintu News – Pi Network’s price on a weekly timeframe still recorded a 6.1% gain – outperforming most other crypto assets. In fact, so far this month Pi Coin has risen by around 15%, while Bitcoin has fallen by almost 20%.

This shows a strong negative correlation between Pi and the crypto market in general, which is one of the reasons why Pi Coin is still able to print green candles despite weak market conditions.

However, Pi Coin’s price movement is currently stuck in a narrow range between $0.24 to $0.22 since November 17. The chart shows a tight range of around 4-5%, which could be the next decisive point of direction – whether Pi Coin will break upwards or downwards, depending on how some technical signals shape up in the near future.

Pi Network Price Rises 4.7% in 24 Hours

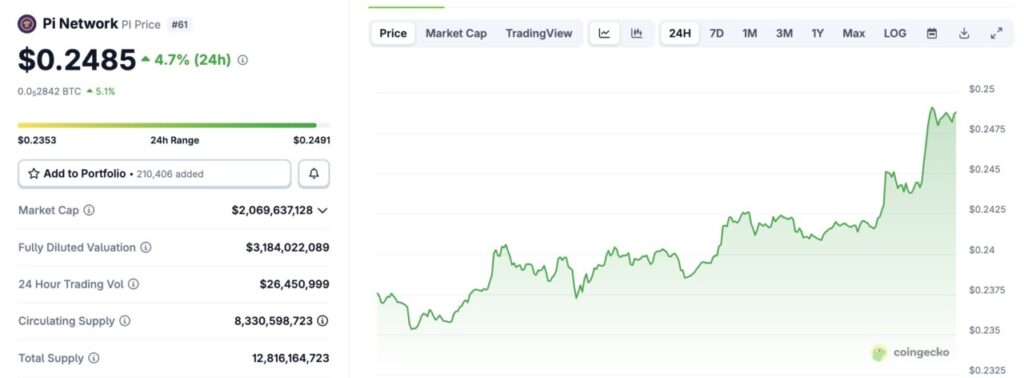

On November 26, 2025, the price of Pi Network was recorded at $0.2485, an increase of 4.7% in 24 hours. If converted into the current rupiah ($1 = IDR 16,650), then 1 Pi Network is IDR 4,137. During this period, the PI price moved in the range of $0.2353 to $0.2491, close to the current daily high.

Read also: Pi Network Price Pattern Hints at Big Rally as Leading Whale Reaches 381 Million Tokens

With a market capitalization of $2,069,637,128, Pi Network occupies a solid position among major crypto projects. Trading activity is also quite active, with transaction volume in 24 hours reaching $26,450,999, signaling consistent market interest in this asset.

Support from Large Holders Still Underpins Price Bounce

Pi Coin currently has one strong positive signal: big wallets continue to support the price movement.

Between November 19 and 24, prices formed lower highs, while the Chaikin Money Flow (CMF) indicator recorded higher highs. CMF measures the flow of funds in and out of the market, particularly from large players. This bullish divergence pattern suggests that accumulation is still ongoing despite the slowdown in price.

In addition, the CMF is still holding above the trend line and is above the zero level. As long as the indicator remains above the line, the support from large wallets is still strong and the opportunity for a price bounce remains open.

For now, this is the only clear bullish signal on Pi Coin’s price movement.

Weak Retail Strength, and Lack of Volume Support?

Retail buyers don’t seem to have shown the same enthusiasm as large holders.

Between November 21 and 24, Pi Coin’s price formed a higher low, but the Money Flow Index (MFI) recorded a lower low. The MFI measures the strength of buying when prices fall by combining price and volume data. This bearish divergence indicates weakening buying interest from retail investors.

Volume data also confirms the risk.

The On-Balance Volume (OBV) indicator is still below the main trend line, at around -1.97 billion. OBV is used to see if there is new volume coming into the market. As long as it has not broken the trend line, Pi Coin is considered not to have enough volume participation to support a strong breakout.

In fact, if the OBV drops through the currently supporting uptrend line, the volume support could weaken further.

Read also: Dogecoin Price Reached $0.15 Level Today: How High Can DOGE Go?

In summary, while large wallets are still providing support, retail buying power is still weak. Volume is currently neutral and will likely be the next determinant of Pi Coin’s price direction.

Pi Coin price: Between 4% Breakout or 5% Breakdown

Pi Coin is in a crucial zone with the potential for sharp movements in the near term – it could go up or down in a narrow range.

For this recovery to turn into a real rally, Pi Coin needs to break the $0.24 level. The rise towards this level requires a move of about 4.38%, and if volume strengthens, the door is open towards the next target at $0.26 to $0.29.

However, a bearish scenario is also approaching. If the price drops below $0.22, the support at $0.21 will be exposed. A drop below $0.22 would reflect a correction of 5.49% and align with the bearish divergence signal from the MFI as well as the still neutral OBV indicator.

Currently, Pi Coin is at a close equidistant point between the two possibilities:

- CMF still maintains the potential for a bounce and could push the price up 4%.

- MFI and OBV still exert downward pressure, opening up a 5% correction risk.

A net breakout above $0.24 will confirm the strength of the market. Conversely, a net decline below $0.22 would signal the weakness of the current structure.

In short, Pi Coin’s price range could break soon – and the next direction will be determined by volume and who controls momentum.

FAQ

What is Pi Coin (PI)?

Pi Coin (PI) is one of the digital currencies or cryptocurrencies that is currently being noticed for its growth potential.

What is Chaikin Money Flow (CMF)?

Chaikin Money Flow (CMF) is an indicator that measures the flow of money to and from a stock or asset over a period of time, often used to identify buying or selling pressure.

Why is volume important in cryptocurrency trading?

Trading volume indicates the total number of cryptocurrency units traded in a given period and is often used to measure the strength or weakness of price movements.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Pi Coin Price Breakout 4.5 Percent Range. Accessed on November 26, 2025