Arthur Hayes Forecasts Monad (MON) to Soar After 55% Rise – Golden Opportunity or Danger Signal?

Jakarta, Pintu News – Former BitMEX CEO Arthur Hayes has now turned his attention to Monad , and signaled that the newly launched token may be gearing up for a big move.

His comments come just days after the launch of the Monad mainnet, which initially caused the token price to drop, but then spiked back up very sharply.

After a brief slump, MON reversed course drastically and has gained more than 55% in recent days, catching the market’s attention. However, Hayes’ involvement adds a new dimension to the story.

Several tokens that he publicly endorsed this year experienced significant short-term rallies, but then quickly lost momentum. This pattern has led some traders to consider Hayes’ endorsement as a local price peak signal, rather than an indicator of the beginning of an uptrend.

Now with MON in the spotlight and volatility on the rise, the question arises: is this token preparing to go even higher, or has this bounce started to lose steam?

Explanation of Crypto Monads

For those unfamiliar, Monad is a blockchain project that seeks to overcome the classic dilemma between decentralization and scalability. The network is designed to provide high performance without compromising security or its decentralized nature, thus opening up new potential in decentralized blockchain systems.

Read also: Zcash Surges, Reliance Global Shifts Investments from Bitcoin and Ethereum!

The project claims to be able to process 10,000 transactions per second, with block times of just 0.4 seconds, and transaction finality in 800 milliseconds. Not only that, the near-zero cost of gas makes the technology more affordable, overcoming one of the major barriers to widespread blockchain adoption.

Monad also supports full compatibility with the EVM (Ethereum Virtual Machine), allowing developers to directly utilize the mature Ethereum ecosystem, including existing tools, libraries, and applications.

Mainnet launch met with selling pressure and controversy

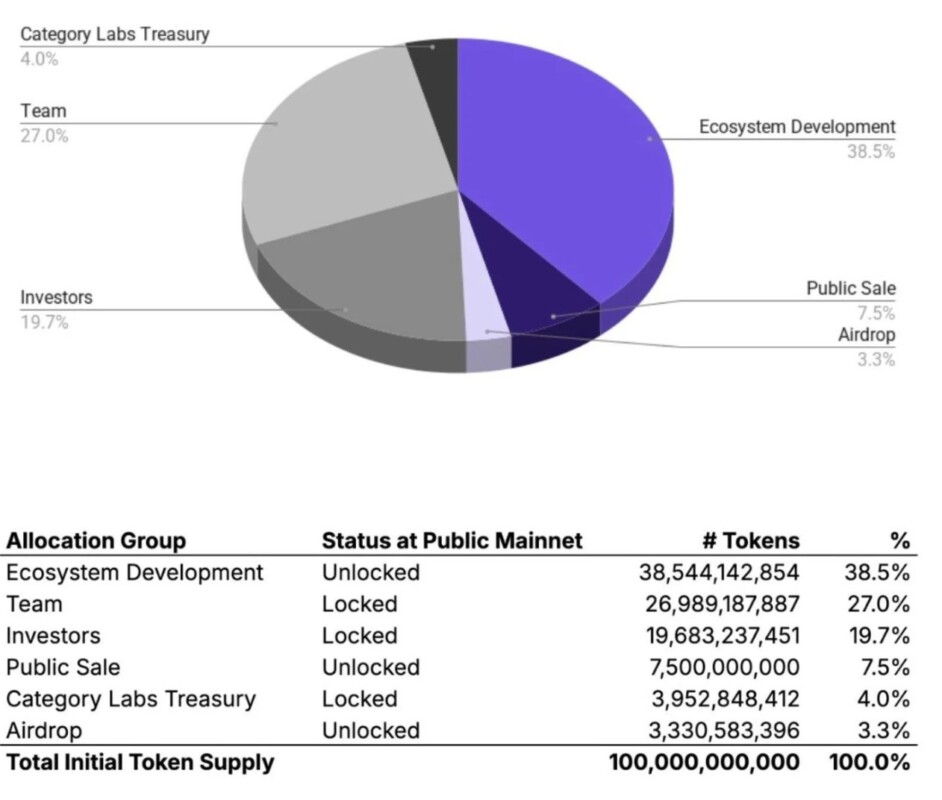

When the mainnet launched, Monad also held an airdrop. The project announced that the total supply of MON tokens was 100 billion units, with 10.8% of them already released and circulating in the market.

Of these, 7.5% of the tokens were released last week through a public sale on Coinbase’s token platform, priced at $0.025 per token. Earlier, the team revealed that the token sale saw 85,820 participants, with total funds raised reaching $269 million.

“The MON token sale has been completed. The sale even exceeded the target, mainly due to the surge of interest at the end of the period, as many predicted. However, for me, the most important number is 85,000 participants,” said Monad co-founder Keone Hon.

Meanwhile, the remaining 3.3% will be distributed via airdrop. However, not everyone is satisfied with the project’s token distribution structure (tokenomics).

Some community members on the X platform (formerly Twitter) voiced concerns that the allocation for the development team was too large when compared to industry standards.

“Monad has one of the most ‘predatory’ tokenomics. Allocation to the team stands at 27%, the highest in the industry. VCs got 20% for much less than retail investors. Ecosystem development sucks up 38.5%, similar to Plasma-and we know how that project ended,” said CoinMamba’s anonymous analyst.

Arthur Hayes’ Monad Prediction Raises Questions

Arthur Hayes has publicly admitted to buying MON tokens, and in a post on the X platform, he even predicted that the price of this altcoin could one day reach $10.

However, not everyone took this statement as a positive signal. Some traders see Hayes’ enthusiasm as an indication that the Monad price may be nearing its local top.

These doubts are not unwarranted. Hayes is known to have a track record of making highly optimistic predictions for a number of altcoins, but it is not uncommon for the price of the asset to drop shortly after – sometimes coinciding with him reducing his holdings.

Read also: Bitcoin Price Rises to $91,000 Today: Here’s BTC’s Technical Outlook!

For example, he promoted Ethena , Hyperliquid , and Ethereum , which attracted a lot of attention. But in some cases, he was later found to have sold some of these assets.

Because of this history, Hayes’ strong belief in MON has sparked a split in views in the market.

- Some investors see this as a signal that there is still great potential for price increases.

- However, others see this as a warning that the current rally may be overextended.

The market response in the next few days will determine which view proves to be correct.

MON Price Prediction

Since Monad has just launched, predicting its short-term price movements is speculative. Currently, MON tokens are still in the “price discovery” phase-a period where the market is trying to determine a fair valuation based on initial trading activity.

During this phase, prices are usually volatile as new participants enter, early investors start to take profits, and market shapers start to set initial price ranges.

Although market sentiment towards MON is still mixed, the 1-hour chart shows a fairly positive technical pattern in the short term. The token is currently moving in an ascending channel pattern. As long as MON is able to maintain this pattern, the price will likely remain stable around the $0.041 support zone.

If this structure holds, there is a strong chance for MON price to break the immediate resistance at $0.048. A breakout from the upper limit of the channel could open the way to the next price target at $0.064.

However, traders need to be aware of the risk of correction. If selling pressure increases or market sentiment turns bearish, this bullish channel pattern could break to the downside. If that happens, MON prices could potentially drop towards the support at $0.033, which would invalidate the bullish structure and indicate a deeper correction.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CCN. Arthur Hayes Predicts Bull Run for Monad (MON) After 55% Price Spike: Real Deal or Red Flag? Accessed on November 27, 2025