Bitcoin’s Big Sell by Long-Term Holders Indicates Cycle Fatigue

Jakarta, Pintu News – Bitcoin has struggled to break the $90,000 level since last week and is now trying to stabilize after selling pressure continues to shape market sentiment. From the peak of the latest cycle, Bitcoin’s price plummeted, leaving bullish traders on the defensive. Analysts who a few weeks ago were still optimistic are now starting to change their tune, with many predicting the beginning of a bear market.

Role of the Long-Term Holder

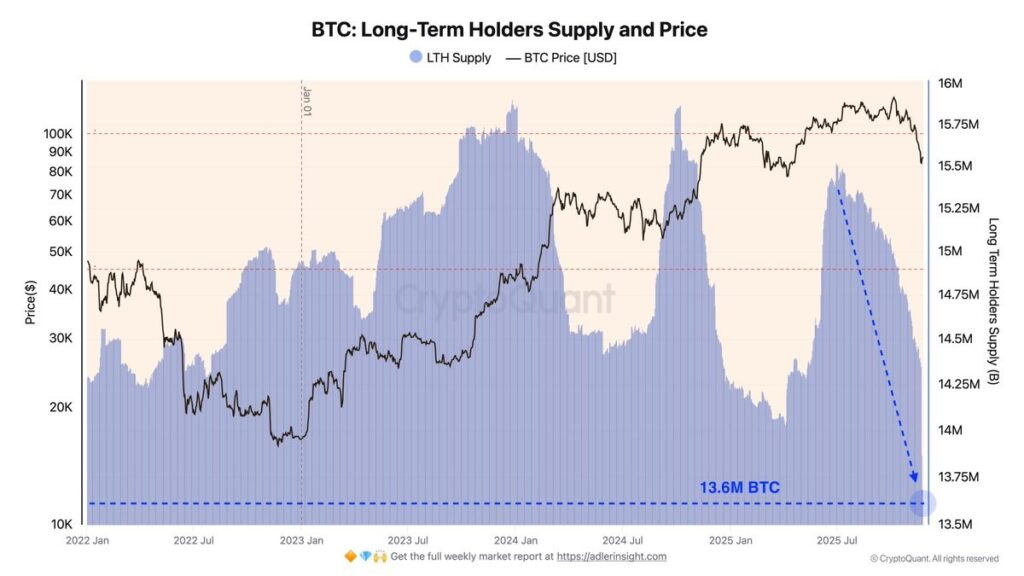

Axel Adler, a prominent analyst, reported that Long-Term Holders (LTH) have done the most selling this cycle, reducing their holdings by 1.57 million BTC during the quarter. This decline occurred as the price approached $80,000, a phase often associated with exhaustion and late-cycle peaks. Adler emphasized that the massive selling by LTHs has pushed supply levels back to an early 2023 low.

Also Read: JPMorgan Predicts Oil Price Fall to $30 by 2027

Sales Impact on Market

In the past two weeks (November 11-25), LTH has sold 803,399 BTC, which represents a decrease of 5.54% and an average of 53,560 BTC per day. This significant drop in supply has only occurred during major inflection periods in Bitcoin’s history. Adler compared the current situation to previous periods when Bitcoin experienced sharp price drops, suggesting that this phase may be an early indication of a weaker market.

Bitcoin Stabilization Efforts

Bitcoin’s price action on the daily chart shows a market struggling to regain its footing after a sharp drop from the $120K region to a new low near $80K. The price is currently hovering around $86,800, trying to bounce back, but the broader trend is still clearly bearish.

The price is below the 50-day, 100-day, and 200-day moving averages, all of which indicate continued downward momentum. The increased volume during the sell-off suggests forced liquidation and capitulation-driven selling, rather than orderly distribution.

Conclusion

With the current market conditions, the main focus for the bulls is whether Bitcoin can build a base above the $85K region to avoid the next wave of selling pressure. If this level does not hold, there could be a further drop towards $78K and potentially $72K.

Also Read: True XRP Holders Keep Calm Amid Weak Markets, Here’s the Outlook for December 2025!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

Q1: What caused the recent Bitcoin price drop?

A1: Bitcoin’s recent price drop was caused by massive selling by long-term holders, who reduced their holdings by 1.57 million BTC, pushing the price towards $80,000.

Q2: How much Bitcoin was sold by long-term holders in the last two weeks?

A2: Long-term holders have sold 803,399 BTC in the past two weeks, which represents a decrease of 5.54% of their total holdings.

Q3: What impact will these sales have on Bitcoin supply?

A3: These sales have pushed Bitcoin’s supply level back to an early 2023 low, with a current total supply of 13.6 million BTC.

Q4: Does the current Bitcoin price trend indicate further downside potential?

A4: Yes, the current Bitcoin price trend is still bearish with the price being below the 50-day, 100-day, and 200-day moving averages, indicating further downside potential.

Q5: What could happen if Bitcoin cannot sustain levels above $85K?

A5: If Bitcoin is unable to sustain levels above $85K, there could be a further decline towards $78K and potentially $72K.

Reference

- NewsBTC. Major Bitcoin LTH Sell-Off Signals Cycle Exhaustion as Supply Drops to 13.6M BTC. Accessed on November 28, 2025