3 key factors that could potentially push Bitcoin to break $100,000

Jakarta, Pintu News – Bitcoin is again showing a positive trend with five key factors supporting its potential rise to $100,000. Recent institutional analysis, onchain monitoring, and market structure show favorable changes. This comes after a difficult phase that saw Bitcoin over-sold and a decline in retail participation.

US Demand and Favorable Season Strengthen Bitcoin

One factor is the result of a new research note from BTIG, which was cited by prominent journalist, Walter Bloomberg. According to the firm, technical setups became over-sold due to Bitcoin’s recent price drop. The firm also pointed out that Bitcoin usually reaches its seasonal bottom on November 26.

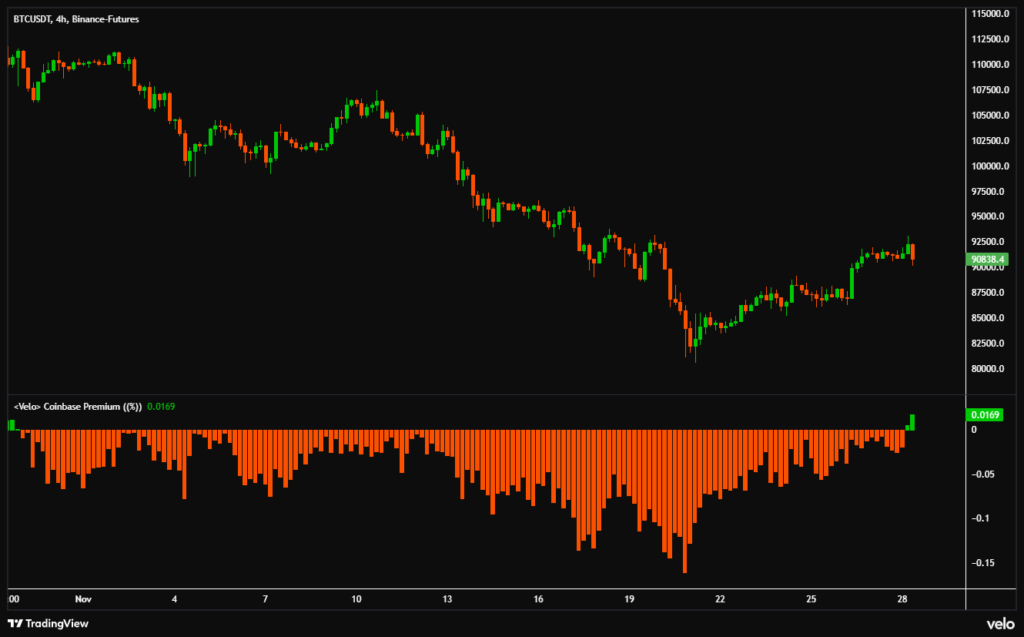

Each cycle repeats this pattern and generally results in a strong recovery later in the year. This combination of forces could support a retest of $100,000 if momentum continues. The Coinbase Premium Index is showing positive after nearly eighty days in negative territory.

A positive premium means buyers in the United States pay slightly more than global markets. Large institutional players like BlackRock have accumulated millions in Bitcoin and Ethereum lately. This trend usually emerges when domestic traders increase their accumulation during the initial recovery phase.

Bull Cycle Still Early as Buying Pressure Rises

The third factor comes from broader cyclical positioning. A dataset shared by Master of Crypto shows that only one of the thirty bull market peak indicators has appeared. According to him, the retail hype is not strong and altcoins have not reached their extreme stages.

Also read: 10 Crypto AI Agents that Have the Potential to Rise in 2026

The flow of Bitcoin and Ethereum is generally positive and stable. This suggests that there is still a further period in the bullish cycle. Also, there is no significant selling pressure as indicated by the lack of overheating, creating room for more upside movement.

Improving Market Structure Supports Bitcoin’s Positive Outlook

The final factor is the broader recovery in market structure. Selling pressure eased and demand returned in several key regions. Seasonal trends, improved flows and renewed institutional interest reinforced this shift.

A well-known example of institutional buying is the plan by Metaplanet to buy additional Bitcoin. The combination of increased demand, good liquidity, better cyclical placement, and conducive seasonality puts Bitcoin price in a position to rise. When these conditions are met, it is highly likely that the price of BTC will increase towards $100,000 in the near future.

Conclusion

With the supportive factors firming up again, Bitcoin is showing potential to appeal not only to institutional investors but also to retail market participants. The combination of strong demand, sufficient liquidity, and an improving market structure is a clear indication that we may see Bitcoin reach new price records in the near future.

FAQ

What is Bitcoin (BTC)?

Bitcoin (BTC) is a digital currency or cryptocurrency created in 2009, using peer-to-peer technology to facilitate instant payments.

Why can the price of Bitcoin (BTC) reach $100,000?

Bitcoin (BTC) price has the potential to reach $100,000 due to factors such as strong demand in the US, oversold market conditions, and improved market structure.

Who is influencing the current Bitcoin (BTC) price trend?

Large institutions like BlackRock and analysts from BTIG are some of the key players influencing the current Bitcoin (BTC) price trend with their investments and analysis.

What is the Coinbase Premium Index and how does it affect the price of Bitcoin (BTC)?

The Coinbase Premium Index measures the difference in Bitcoin (BTC) price on Coinbase compared to global markets. A positive index indicates higher demand in the US, which can push prices up.

When does Bitcoin (BTC) usually hit a seasonal bottom?

Based on historical patterns, Bitcoin (BTC) usually hits a seasonal bottom around November 26, which is often followed by a price recovery later in the year.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coingape. Top 5 Factors for Bitcoin Price to Hit $100,000 Soon. Accessed on December 1, 2025

- Featured Image: Generated by AI