4 Key Risks of Cardano (ADA) in December 2025 that Crypto Investors Should Monitor

Jakarta, Pintu News – Cardano is back in the spotlight due to its concerning monthly performance. Throughout November 2025, ADA recorded a price drop of more than 31%, making it one of the worst-performing major altcoins this month. Meanwhile, Bitcoin and Ethereum actually recovered slightly by around 6-8% each in the same period.

Although ADA has gained 1.9% in the last seven days, on-chain data and technical analysis still show that the selling pressure has not completely subsided. Here are four major risks that analysts are monitoring and the crypto community is discussing regarding Cardano’s prospects this December.

1. CMF Negative: Institutional Funds Weaken Sharply

The Chaikin Money Flow (CMF) technical indicator, which reflects the strength of large or institutional fund flows, has shown significant weakness since November 24, 2025. Based on TradingView data quoted by BeInCrypto, although the price of ADA had risen, CMF actually formed a lower high and fell below zero.

In the same period, according to BeInCrypto, the price of ADA fell by more than 36% – reflecting the strong correlation between fund flows and price movements. A negative CMF indicates that large investors are no longer accumulating and even tend to distribute.

Also Read: 7 Proper Ways to Save Money to Make Your Finances Safer

2. Spike in Spent Coin Activity: A Sign of Strong Selling Pressure

Data from Santiment shows that the volume of ADA moving between wallets (Spent Coin Age Bands) rose 23% in just one day – from 93.2 million to 114.6 million ADA. This spike is a signal that ADA owners are starting to release their tokens into the market.

This condition usually magnifies selling pressure due to the increased supply that is actively moving. According to historical data, whenever this metric spikes, ADA prices struggle to recover consistently, even when prices appear to stabilize temporarily.

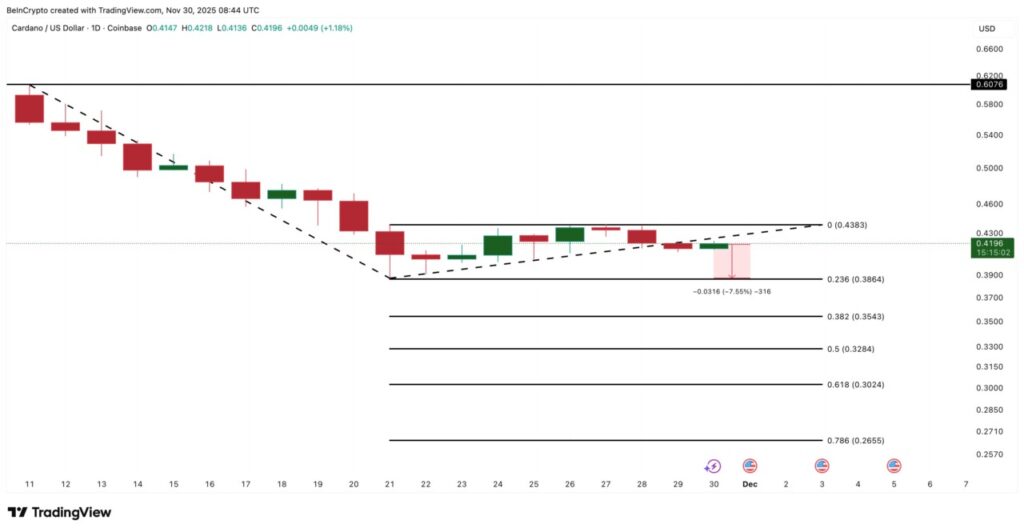

3. Critical Support and Resistance Levels that Determine the Next Direction

Currently, the price of Cardano (ADA) is around $0.419 or equivalent to Rp6,983 (at an exchange rate of $1 = Rp16,663). If the selling pressure continues, then the strong support is at $0.386 (IDR6,426). If this level is broken, the next targets are $0.354 (IDR5,902) and $0.302 (IDR5,032).

Conversely, to end the downtrend phase, ADA needs to break the important resistance at $0.438 (IDR7,298) with a full candle close. This should also be supported by the recovery of CMF to above zero and a decrease in spent coin activity.

4. Market Momentum Still Weak Despite Minor Uptick

Although ADA posted a weekly gain of 1.9%, analysts warn that this is not yet strong enough to be considered a trend reversal. This rise is more likely a short technical bounce in a still-active downtrend.

BeInCrypto emphasizes that as long as indicators such as CMF and spent coin volume do not show significant changes, the potential for further correction remains open. Therefore, it is important to monitor these important metrics in real-time before making investment decisions.

Also Read: When will the Gold Price Drop Drastically? This is the Full Explanation

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ: Cardano (ADA) December 2025 Risk

What was the main cause of Cardano (ADA) price drop in November?

The data showed a large drop in institutional fund flows (CMF) and a surge in spent coin activity, which reinforced the selling pressure.

Is there any chance of ADA price recovery in the near future?

Opportunities remain, but only if indicators such as CMF return to positive and spent coin activity decreases, which is currently not in sight.

Which ADA price levels are important to monitor?

Key support level: $0,386. If broken, potential drop to $0.354 and $0.302. For a reversal, resistance must break at $0.438.

What makes spent coin activity such an important indicator?

Because the volume of tokens moving signals whether long-term owners are selling. Spikes in this metric are often followed by price drops.

Reference:

- Ananda Banerjee / BeInCrypto. Cardano ADA Price Major Risk December 2025. Accessed December 1, 2025.