Falling ETH Treasury Demand Hinders Price Recovery to $4,000? Here are the Facts!

Jakarta, Pintu News – Ethereum’s 80% plunge in treasury demand and strong resistance in the $3,100 to $3,200 range are the main obstacles in Ether’s price recovery towards $4,000.

Drastic Drop in Ethereum Treasury Demand

Recently, Ethereum experienced a significant drop in demand from corporate treasury entities that previously collected ETH as part of the “Digital Asset Treasury” (DAT) trend. Data from Bitwise shows that in November, DAT companies purchased only 370,000 ETH, a drastic 81% drop from its August peak of 1.97 million ETH.

This decline raises serious concerns about the sustainability and interest of corporate investment in Ethereum. Not only does this decline reflect a decline in corporate interest, but it could also be an indicator of a change in investment strategy within the wider crypto ecosystem. Market analysts are concerned that this could impact the liquidity and price stability of ETH in the future.

Also Read: Ripple CEO’s Shocking Prediction: Bitcoin Will Break $180,000!

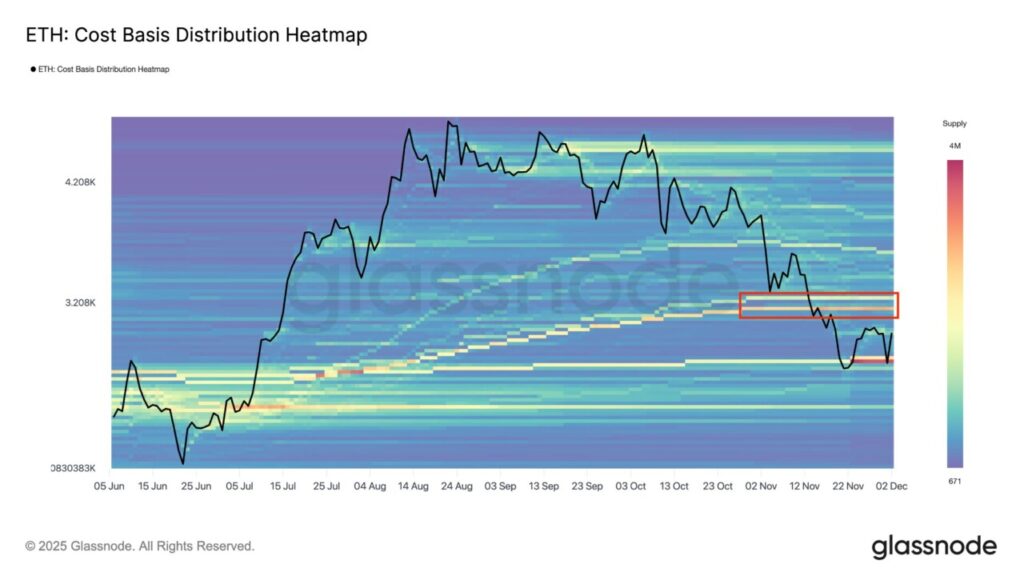

Strong Resistance Above $3,200

ETH’s recent price recovery managed to break through a key support area around $3,080, where the 50 and 100 weekly moving averages seem to converge. According to data from Cointelegraph Markets Pro and TradingView, if this level can be maintained, then there is potential to see further price gains.

Michael van de Poppe, founder of MN Capital, stated in a post on X that if this support holds, “we’re excited to see the upside.” However, there is strong resistance in the range of $3,100 to $3,200 that must be broken to ensure continued price recovery. If ETH manages to break this resistance, it would be a strong bullish signal for investors and traders.

ETH Descending Wedge Breakout Target

On the daily chart, the ETH/USD pair is showing signs of breaking above the upper trendline of the descending wedge pattern at $3,000. A daily close above this level would confirm the breakout and pave the way for a rise in ETH prices towards the wedge target of $4,150. This signals a potential upside of 36% from the current price. P

A falling wedge is often considered a bullish signal in technical analysis, and a successful breakout from this pattern usually indicates a change in momentum that could take prices to higher levels.

Conclusion

Although there are several challenges faced by Ethereum, including declining treasury demand and strong price resistance, technical indicators point to the potential for price recovery. Success in breaking resistance and maintaining key support will be key to seeing Ethereum return to the $4,000 price.

Also Read: Decisive Week: XRP Braces for a Huge December 2025 Surge!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

Q1: What is the percentage drop in Ethereum treasury demand recently?

A1: Ethereum treasury demand has plummeted by 80%.

Q2: What is the “Digital Asset Treasury” (DAT) trend?

A2: The Digital Asset Treasury (DAT) trend refers to the accumulation of digital assets such as Ethereum by corporate entities for their treasury or financial reserve purposes.

Q3: What level of strong resistance is Ethereum facing?

A3: Ethereum faces strong resistance in the price range of $3,100 to $3,200.

Q4: What is the price target of the descending wedge pattern seen on the ETH/USD chart?

A4: The price target of the descending wedge pattern on the ETH/USD chart is $4,150.

Q5: What impact has the decline in treasury demand had on the price of Ethereum?

A5: A decrease in treasury demand could negatively impact the liquidity and price stability of Ethereum, possibly affecting future price recovery.

Reference

- Cointelegraph. Ethereum Treasury Demand Collapses, Will It Delay ETH Recovery?. Accessed on December 4, 2025