4 Reasons Why Solana (SOL) Catches the Attention of Crypto Traders in Late 2025

Jakarta, Pintu News – The crypto market is buzzing again after a recent report showed a rebound in crypto treasury stocks and a surge in presales of new tokens that are getting a lot of attention. According to a report on BlockchainReporter, this market recovery has made SOL price predictions a hot topic again.

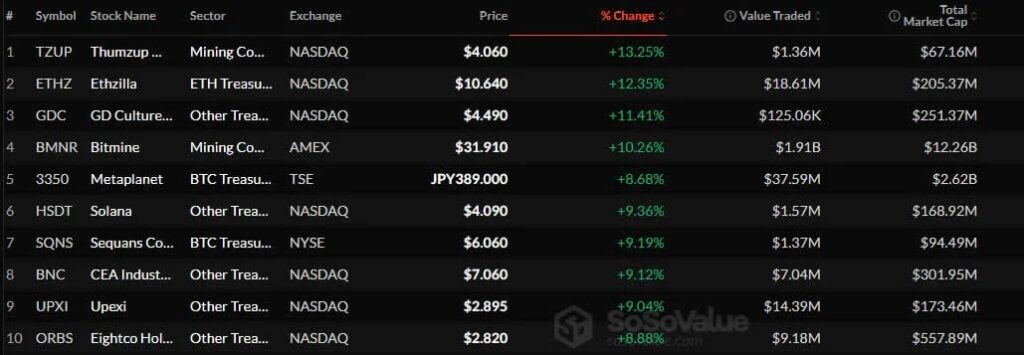

1. Treasury Crypto Rebound Triggers Bullish Sentiment on SOLs

Data shows that digital asset treasury stocks rebounded in early December, after a period of decline. The rise was led by Ether-based companies, but some Solana-focused entities also recorded gains – a signal that market interest in SOLs is returning.

This movement is considered an important metric as it shows that institutions are starting to add allocations to large crypto assets like SOL. As a result of this, SOL price predictions are starting to be viewed with optimism again, making it one of the top cryptos being monitored by traders and analysts.

Also Read: 5 Shocking Facts About Strategy: 650,000 BTC worth ±$60 Billion!

2. Money Inflow into ETP and SOL Monitored to be Large

According to industry reports, crypto Exchange-Traded Products (ETPs) attracted inflows worth around US$1.07 billion after a sharp decline. One such asset that was flooded with capital was SOL – receiving nearly US$500 million of inflows in the November period, making it a major highlight.

These large capital flows are considered an indicator that many investors are re-picking crypto assets with high liquidity and capitalization. In this context, SOL was touted as the leading asset chosen for its combination of liquidity, network adoption, and growth potential if market conditions improve.

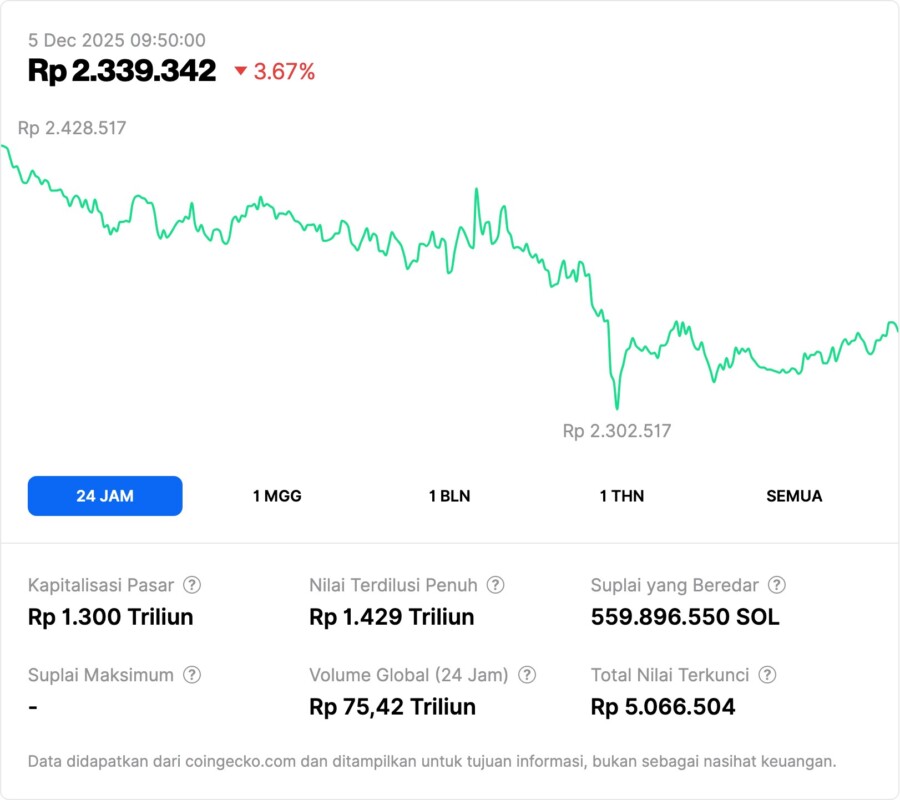

3. SOL Price Prediction is Back in the News

Many analysts are of the view that the rebound and new capital flows have put SOL price predictions back on the radar. The bullish scheme indicates that if adoption continues to increase – for example through DeFi projects or infrastructure integration – prices could move into a higher range.

Optimistic scenarios predict SOL could skyrocket if liquidity and macro conditions are favorable, making it an attractive alternative to some other altcoins. However, analysts still note that global volatility and regulation could be risk factors in the short term.

4. Combination of technical and fundamental factors puts SOL in the spotlight

SOL was again chosen as the main crypto asset due to a combination of technical strengths (liquidity, large network, wide adoption) and fundamental factors (institutional capital direction, market rebound, macro market expectations).

For medium to long-term investors, this is considered an important comparator to traditional assets or other high-risk instruments. Talk of SOLs is back in the crypto community, especially when global markets are fluctuating.

FAQ

What’s causing SOL prices to get a lot of attention again right now?

Due to the rebound in crypto treasury stocks and the large influx of capital into ETPs, which increased institutional interest in Solana.

Is the current SOL price prediction optimistic?

Yes – many predictions position SOL in a bullish scenario if liquidity and adoption continue to increase, despite volatility risks and global factors.

Why is crypto ETP inflow important for SOL?

ETP inflows indicate institutional capital is returning to big cryptos like SOL, putting buying pressure and increasing market liquidity and confidence.

Reference:

- BlockchainReporter. Solana Price Prediction: Crypto Treasury Stocks Rebound and DeepSnitch AI Presale Climbs 70%. Accessed on December 05, 2025