5 Shocking Facts About Strategy: 650,000 BTC worth ±$60 Billion!

Jakarta, Pintu News – Here are 5 surprising facts about Strategy, why is ‘too big to fail’ a myth?

1. Strategy has 650,000 BTC worth ±$60 Billion – but that’s no guarantee it’s safe

According to recent reports, Strategy is a company with huge Bitcoin reserves, holding around 650,000 coins worth about $60 billion, representing about 3.1% of the total BTC supply.

While these reserves are impressive, some observers caution that large size does not automatically guarantee a company’s survival. The history of large companies collapsing – despite being considered “too big to fail” – is proof that risks remain if management and financial conditions are weak.

Also Read: Ripple CEO’s Shocking Prediction: Bitcoin Will Break $180,000!

2. Significant Share Price Decline: MSTR Shares Down 30% in a Month

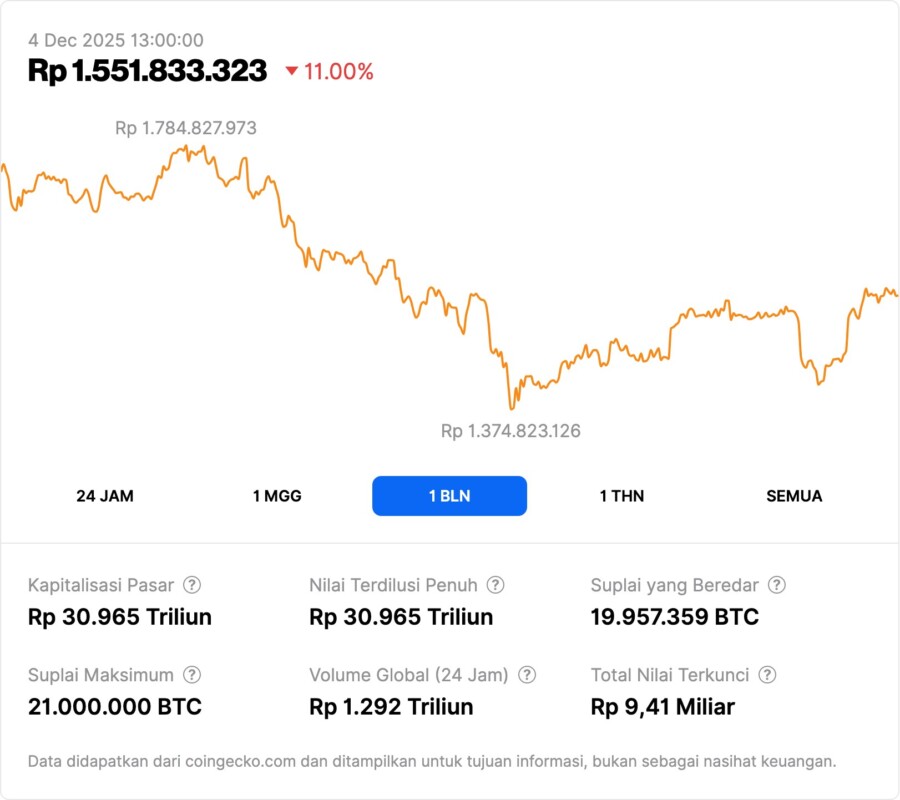

Over the past month, Strategy’s share price (code MSTR) has fallen by around 30%, to $185.88 – a decline that has coincided with a partial correction in the price of Bitcoin.

Historically, MSTR has fallen about 65% from its highest peak in November 2024, suggesting that the previous price rally is no longer sustainable. This decline shows that even companies with large reserves can be highly vulnerable to fluctuations in the global cryptocurrency market.

3. Liquidity Risk and Market Pressure: Even Big Companies Can Collapse

According to a corporate lawyer in the on-chain infrastructure sector, public companies – even if they are large – still have the potential to “completely collapse”, as was the case with large companies in the past.

Historical examples of companies such as banks and large corporations collapsing prove that the “too big to fail” label does not guarantee viability. In the context of crypto and digital assets, market pressures, leverage, and price volatility make liquidity risk an important metric that must be closely monitored.

4. Potential BTC Disengagement: First Sell Strategy Could Happen If Market Pressure Pushes

Concerns increased after Strategy’s founder acknowledged the possibility of the company having to sell some BTC to balance its finances – something that was previously thought not to happen.

The admission shows that, for large companies like Strategy, large reserves alone are not enough if market conditions force asset disposals. This makes the “too big to fail” argument even more vulnerable as liquidity situations and market values can change drastically.

5. Public Status and Bail-out Expectations May Be Misleading – But Not a Real Guarantee

Some believe that because Strategy is a large public company, intervention or rescue is possible if the company is on the brink – as has been the case with previous large institutions.

But independent observers warn that recognition of the risks and financial history suggest bailouts are rare, and shareholders could still lose out if the company collapses.

The notion that large sizes are automatically safe can give a false sense of comfort – so metrics like liquidity, leverage, and crypto market dependency need to be constantly monitored.

Also Read: Decisive Week: XRP Braces for a Huge December 2025 Surge!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

Is the Strategy really “immune to failure”?

It doesn’t. Despite holding large reserves of BTC, some observers say that public companies can collapse if financial management and liquidity are poor.

Why did MSTR’s shares fall so sharply despite its large Bitcoin reserves?

Bitcoin price corrections as well as broad market conditions can put pressure on stock valuations, so large reserves do not guarantee stock price stability.

Is there any indication that Strategy has sold some of its Bitcoin?

Strategy’s founder once stated that asset disposals could happen if needed – suggesting that a sell-off is not out of the question.

Why does a company’s public status not guarantee a bailout?

Because the history of large companies shows that even public companies can fail without a bailout, especially when facing debt burdens, poor liquidity, or market pressures.

What metrics should be monitored to assess the stability of large crypto companies?

Liquidity, debt structure, dependence on the price of digital assets such as BTC, and transparency of financial statements are important metrics.

Reference

- Ryan S. Gladwin / Decrypt. Is Bitcoin Treasury Giant Strategy ‘Too Big To Fail’? Accessed December 4, 2025.