Bitcoin Holds Steady at $92,000 as Whale Accumulation Ramps Up

Jakarta, Pintu News – The latest on-chain data reveals a stark difference between the behavior of whales and retail investors during Bitcoin’s latest correction, indicating that the “smart money” may be preparing for the next big move.

While BTC’s price drop from its peak of $126,000 has retail traders on edge, large holders have been seen buying aggressively-a pattern historically associated with the beginning of a trend reversal.

Then, how will the Bitcoin price move today?

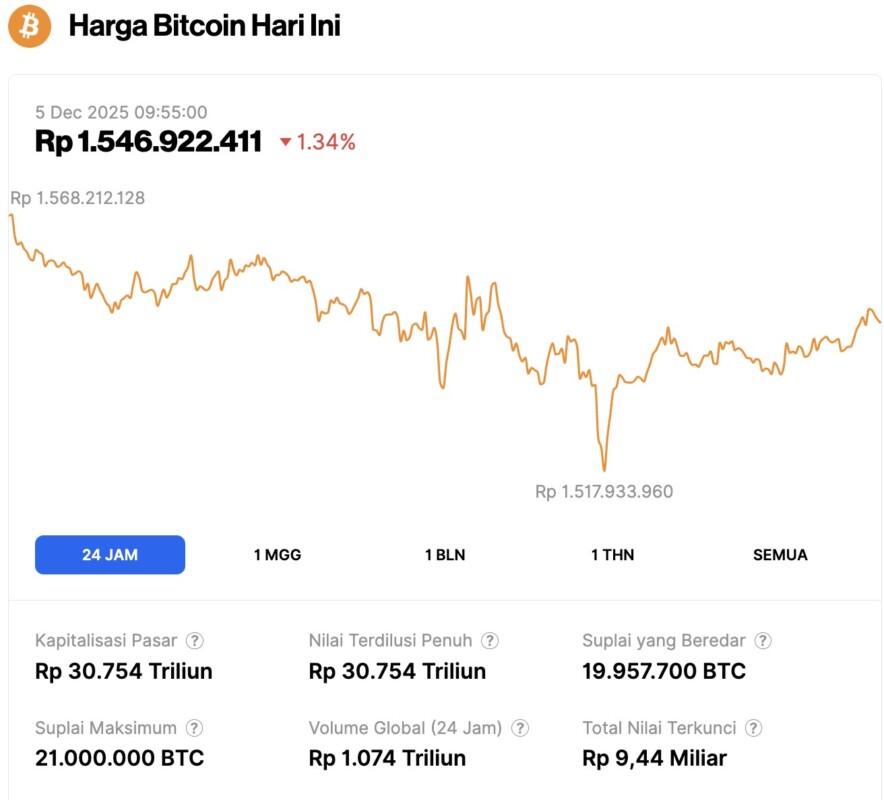

Bitcoin Price Drops 1.34% in 24 Hours

On December 5, 2025, Bitcoin was trading at $92,556, equivalent to IDR 1,546,922,411, marking a 1.34% decline over the past 24 hours. During this time, BTC dipped to a low of IDR 1,517,933,960 and reached a high of IDR 1,568,212,128.

At the time of writing, Bitcoin’s market capitalization is approximately IDR 30,754 trillion, while 24-hour trading volume has dropped by 21%, down to IDR 1,074 trillion.

Read a;sp: NEAR Foundation Launches AI Cloud and Private Chat for 100 Million Users!

Whale Accumulation Surges to Highest Level in Years

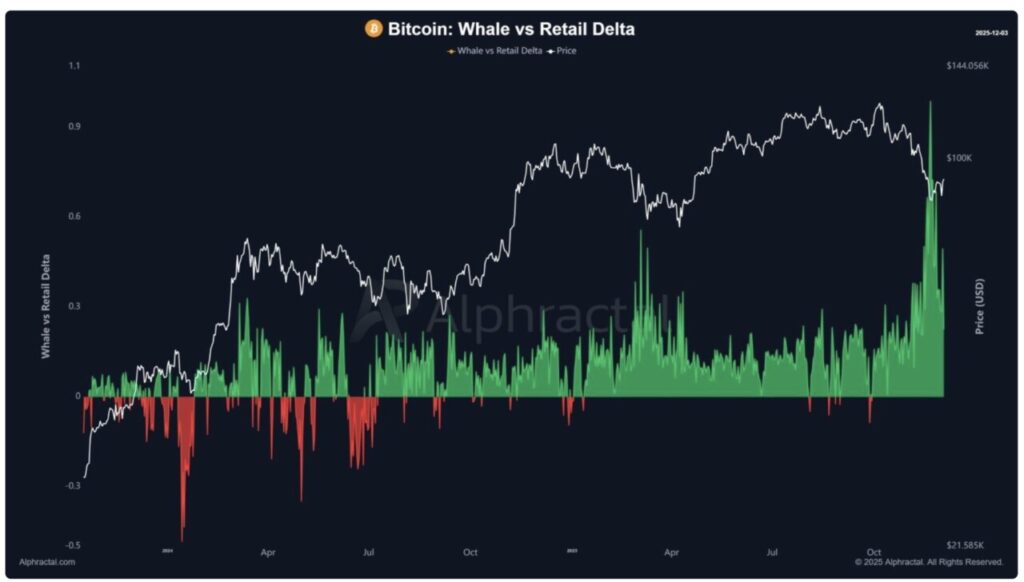

A recent chart of Whale vs. Retail Delta from Alphatractal shows the most significant spike in whale accumulation in almost two years.

While retailers were selling out of fear due to Bitcoin’s price drop towards the $100,000 range, whales started accumulating assets in a big way-absorbing high amounts of liquidity.

This change in delta indicates that large holders anticipate potential price increases in the medium term, although short-term sentiment remains cautious.

Historically, aggressive accumulation patterns like this often precede major bullish trend continuations, including Bitcoin’s breakouts above the $40,000, $70,000, and $140,000 levels in previous cycles.

Meanwhile, retail traders-who were previously very optimistic when BTC was above $130,000-turned defensive after the recent sell-off. The chart shows a decline in retail participation and weakening buying pressure during the correction-versus the situation when retail tried to “buy at the bottom.”

This difference in behavior often marks a moment of mispricing, where a fear-induced sell-off opens up opportunities for big players to accumulate.

Will this trigger a BTC price rally to new highs?

Since hitting a temporary low around $80,500, BTC prices have started to show signs of recovery. Buying pressure is slowly trying to overcome the lingering bearish influence.

Although the pace of recovery is still relatively slow, BTC is currently trading in a bullish pattern. Therefore, the price of BTC is expected to consolidate near the resistance area until there is a large enough surge in buying volume to break the level.

Read also: 3 Trending Crypto ChatGPT Trading Bot Picks

Short-term price movements show that BTC is on a recovery path, although the movement is still trapped in arising parallel channel pattern. As the price continues to test the upper limit of the channel, the chances of a breakout are quite high.

However, the MACD indicator shows the potential for a minor correction, given that the RSI is already at the upper threshold. As such, BTC prices are likely to remain in the upper zone of this channel, and if trading volumes increase, a breakout could be imminent.

Bitcoin Correction Seems More of an Opportunity than a Sign of Fatigue

Overall, recent on-chain trends suggest that Bitcoin’s recent price correction is not a sign of weakness, but rather a strategic opportunity. With whales accumulating at the highest level in almost two years and retail sentiment starting to ease, the market seems to be entering the early phase of recovery.

If this accumulation trend continues, Bitcoin price realistically has the potential to return to the $105,000-$108,000 range in the short term, with a medium-term target until the end of 2025 that could reach $115,000-$117,000 – assuming macro conditions remain favorable.

FAQ

What is a Bitcoin whale?

Bitcoin whale is a term used to describe investors or entities that own very large amounts of Bitcoin (BTC). They have a significant influence on price movements in the market.

Why is whale behavior important to the Bitcoin market?

Whale behavior is important because they can influence market dynamics with their massive accumulation or selling. Accumulation by whales is often considered a bullish indicator, while heavy selling can create selling pressure in the market.

What is the divergence between whales and retail investors?

Divergence between whales and retail investors occurs when these two groups act oppositely in the market. For example, when whales accumulate Bitcoin while retail investors sell, it could signal that whales see a potential price increase that retailers are not paying attention to.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpedia. Bitcoin Whales Quietly Buying the Dip, Is a $120k Rebound Coming? Accessed on December 5, 2025