6 Facts from CryptoQuant CEO about Bitcoin (BTC) in the Spotlight!

Jakarta, Pintu News – The cryptocurrency market has been buzzing since CryptoQuant CEO Ki Young Ju’s recent statement that a number of on-chain metrics indicate that Bitcoin could potentially enter a bearish phase – unless there is a large flow of liquidity, especially from spot ETFs, coming back into the market.

This has led to the analysis of the top cryptocurrencies coming back into focus as an important metric in assessing broad market conditions.

1. Bitcoin On-Chain Indicator Dominated by Bearish Signals

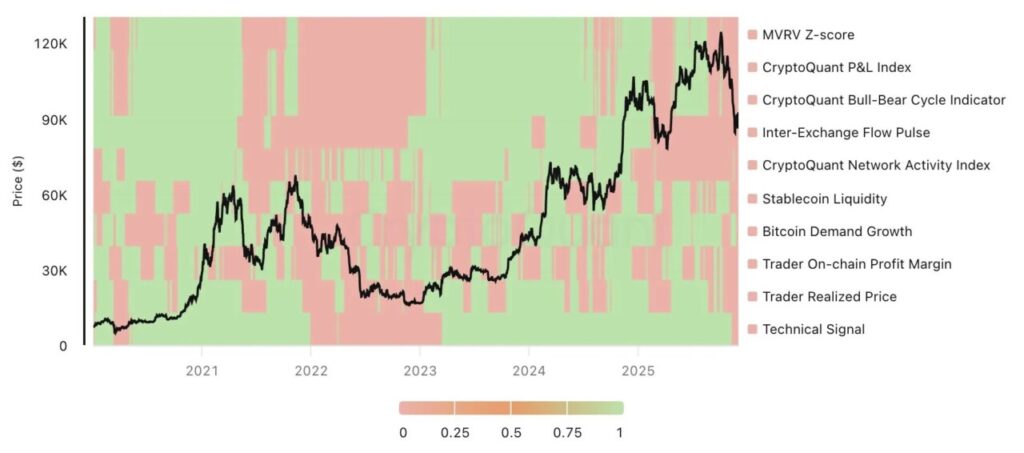

According to CryptoQuant, the majority of on-chain indicators – such as MVRV Z-score, P&L Index, Bull-Bear Cycle Indicator, and stablecoin liquidity – are currently showing red in the composite heatmap between 2021-2025.

This suggests that the selling pressure and trader activity reflects the potential for large market ups and downs. As a result, Ki Young Ju warns that without a large influx of liquidity (e.g. through institutional flows), the market could fall into a bearish cycle.

Also Read: 5 Shocking Facts About Strategy: 650,000 BTC worth ±$60 Billion!

2. Recovery Depends on Capital Flows from Spot ETFs

Ju emphasized that the key to keeping Bitcoin from falling further is macro liquidity flows – especially through spot ETFs that can channel institutional capital into the crypto market.

If institutions return to buying through ETFs, this could ‘revive’ demand for BTC, shifting the chart from red to green. Without it, the risk of a bear market remains high according to recent on-chain analysis.

3. Less Extreme Decline Than 2022, If No Mass Capitulation

Ju mentioned that although current conditions reflect a decline from the highest peak, a worst-case scenario such as a 65% plunge as in 2022 is considered less likely – as long as large entities such as MicroStrategy (which holds 650,000 BTC) do not sell heavily.

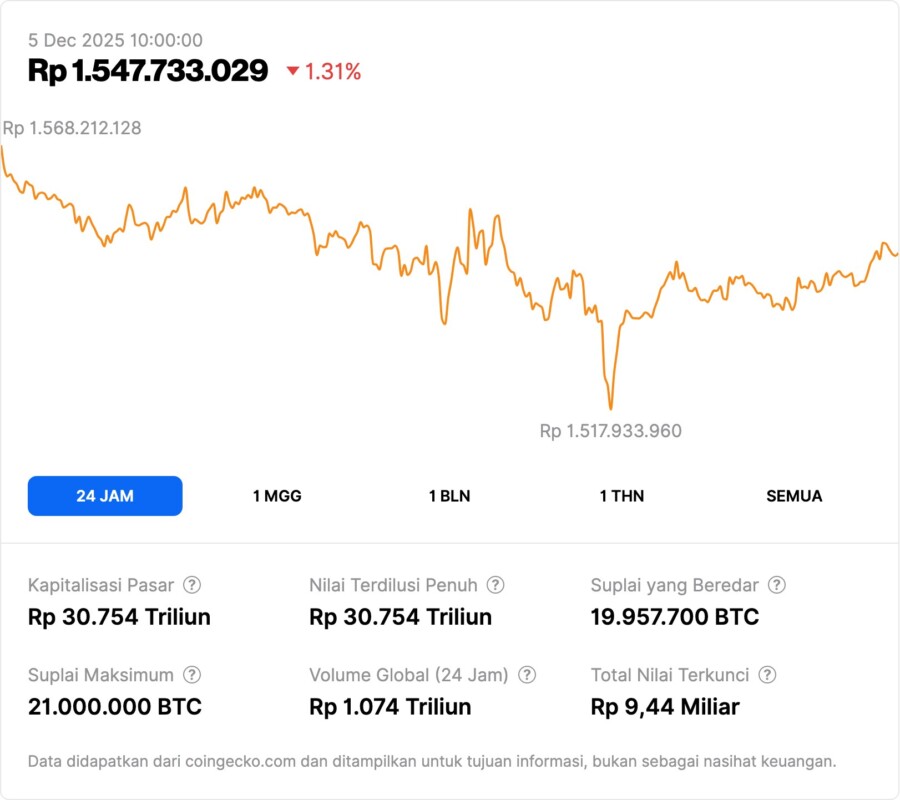

Currently, BTC is reported to be at around -25% of its all-time high , so even if the market is bearish, it could be that the decline is limited and the market moves in a consolidation range.

4. New Treasury & Liquidity Strategies by Large BTC Holders

According to a report cited by CryptoQuant, MicroStrategy has built up a liquidity reserve of US$1.44 billion to deal with possible price drops – meaning the company is no longer relying solely on BTC, but is also holding dollars as a buffer.

This “dual-reserve” model is designed to prevent forced selling pressure if the price drops too far. This is a signal that large entities are preparing for a long-term setback in the crypto market.

5. Need for Flexibility: Scenario Analysis > Definitive Prediction

Ju stated that in the current environment, “reactive is more important than predictive.” This means that market participants and crypto investors need to monitor on-chain data, liquidity flows, and global macro conditions before deciding on a strategy.

This approach encourages scenario-based analysis: the market could be sideways, slightly rebounding, or bearish – depending on whether large liquidity comes back in. This makes Bitcoin (BTC) and other cryptocurrencies assets that are closely monitored by both institutional and retail investors.

6. Why Bitcoin is still in the spotlight amid market uncertainty

While many indicators highlight risk, the structure of the crypto market is more mature: liquidity through ETFs, reserves by large institutions, and widely available on-chain data. According to Ju, this keeps Bitcoin in the spotlight compared to other cryptocurrencies – as the main asset with the largest capitalization.

In that context, Bitcoin and other crypto assets are again a hot topic of discussion in the global investor community, because price fluctuations and liquidity can occur suddenly.

Also Read: Decisive Week: XRP Braces for a Huge December 2025 Surge!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

What are the main indicators that Bitcoin could enter a bear market?

The majority of on-chain indicators such as MVRV Z-score, stablecoin liquidity, and inter-exchange flow are showing bearish signals, according to CryptoQuant.

Why are spot ETF flows considered key to avoiding bear markets?

Because institutional liquidity through ETFs can inject huge demand into the market, thereby stabilizing prices and reducing selling pressure.

How big of a drop is considered possible for Bitcoin right now?

According to the analysis, the decline could be limited – far from the 65% scenario like 2022 – and may only be in a consolidation range if there is no major capitulation.

What is MicroStrategy’s current BTC-related strategy?

MicroStrategy has established US$1.44 billion in liquidity reserves as a buffer and implemented a dual-reserve treasury model to mitigate the risk of forced sales if prices fall.

Is now the time to panic or sell Bitcoin?

According to CryptoQuant’s analysis, it is currently more suitable to monitor on-chain data and macro conditions – as opposed to making drastic decisions based on sentiment.

Reference

- NewsBTC. Bitcoin Signals Bear Market: One Thing Could Flip It, Says CryptoQuant CEO. Accessed December 05, 2025