Bitcoin Climbs to $92,000 as Analysts Anticipate Possible Holiday Rally

Jakarta, Pintu News – Bitcoin briefly traded at around $90,000 with a 2% drop on Dec. 9, raising short-term concerns. However, analysts suggest that BTC is quietly entering the early stages of a supply crunch, a condition that has historically often triggered massive price spikes.

Meanwhile, Bitcoin balances on exchanges are declining and long-term holders continue to accumulate. The market is now waiting to see if Bitcoin is able to capitalize on the tightening supply conditions ahead of the Christmas period.

Then, how will the Bitcoin price move today?

Bitcoin Price Up 2.32% in 24 Hours

On December 10, 2025, Bitcoin was trading at $92,412, equivalent to approximately IDR 1,542,168,679 — marking a 2.32% increase over the past 24 hours. During that period, BTC dipped to a low of IDR 1,503,660,790 and peaked at IDR 1,579,758,422.

At the time of writing, Bitcoin’s market capitalization is around IDR 30,823 trillion, while its 24-hour trading volume has jumped 23%, reaching IDR 936.63 trillion.

Read also: These 3 U.S. Stocks Just Caught Ali Martinez’s Attention — Here’s Why They Might Rally

Bitcoin reserves on exchanges hit historic lows

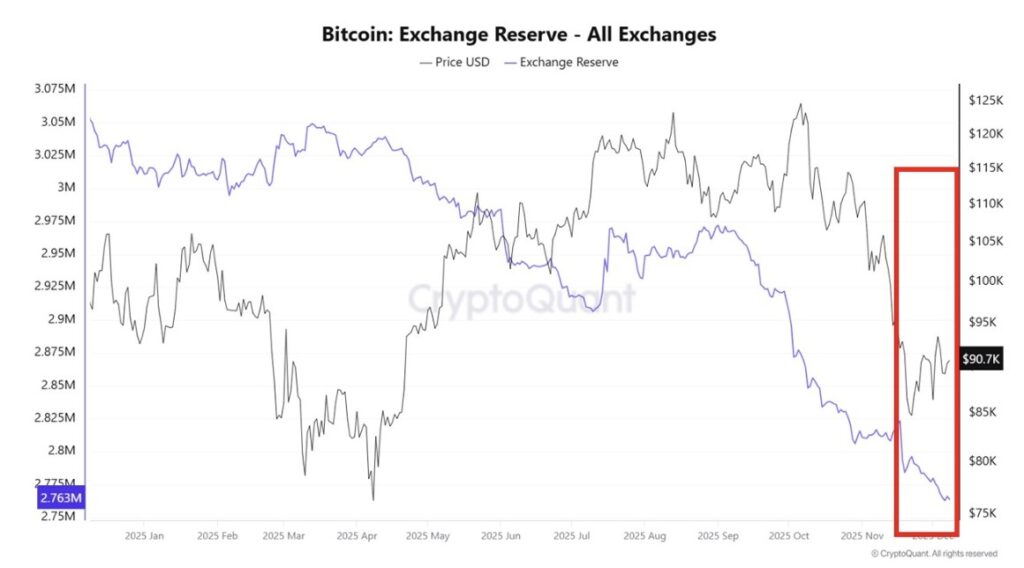

On-chain data from CryptoQuant shows that Bitcoin is now entering one of the lowest liquid supply phases in its history. Despite the price correction, centralized exchanges currently hold only around 2.76 million BTC.

This decline in reserves increased sharply throughout November and December, even as the price of Bitcoin continued to fall to its lowest level in months.

Traditionally, a price drop usually drives more Bitcoin onto exchanges as traders prepare to sell. However, the opposite is true this year.

Long-term holders and financial institutions have been withdrawing their Bitcoin to private storage wallets, reducing the amount of supply available for immediate sale. Analysts from CryptoQuant predict this pattern could develop into a full-fledged “supply shock” if this pace of withdrawals continues.

On the other hand, data from Santiment shows a major decline in the supply of Bitcoin on exchanges over the past year. Around 403,200 BTC was withdrawn from exchanges during the period, which equates to a 2.09% decrease in the total circulating supply held on trading platforms.

In the case of Bitcoin, the fewer coins available on exchanges means there is less chance of a sudden massive sell-off. Santiment said that while the price of Bitcoin is still hovering around $90,000, this decrease in supply reflects strong demand.

A year ago, the exchange held around 1.8 million BTC. But according to a graph from Santiment, that number has now dropped dramatically to around 1.2 million BTC.

Read also: Top 3 XRP Price Predictions for December 2025: Can it Break This Level?

Analysts Watch for Potential Spike in Bitcoin Price Ahead of Christmas

Analyst Michael van de Poppe shared a chart showing that Bitcoin is still maintaining a bullish movement structure.

He said that if buyers are able to maintain the current price range and prevent a deeper correction, the Bitcoin price has a chance to break the $100,000 level before Christmas.

Meanwhile, Bitcoin Vector added that macro liquidity conditions are now starting to favor Bitcoin. They noted that similar situations in the past with similar characteristics often led to massive rallies, making BTC a prime candidate for the next crypto to “explode” in price.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CoinSpeaker. Bitcoin Entering a Supply Shock? Analysts Eye Christmas Rally. Accessed on December 10, 2025