Crypto Whales in Action: Huge Investment in Ethereum Reaches $425 Million!

Jakarta, Pintu News – Ethereum has again broken through the $3,150 level after a period of high volatility, showing a rare sign of strength in an uncertain market. Although there are differences of opinion among analysts about the next direction of the market, several prominent whales have increased their investments in Ethereum, showing positive expectations for the asset’s future.

Top Whale Invests heavily in Ethereum

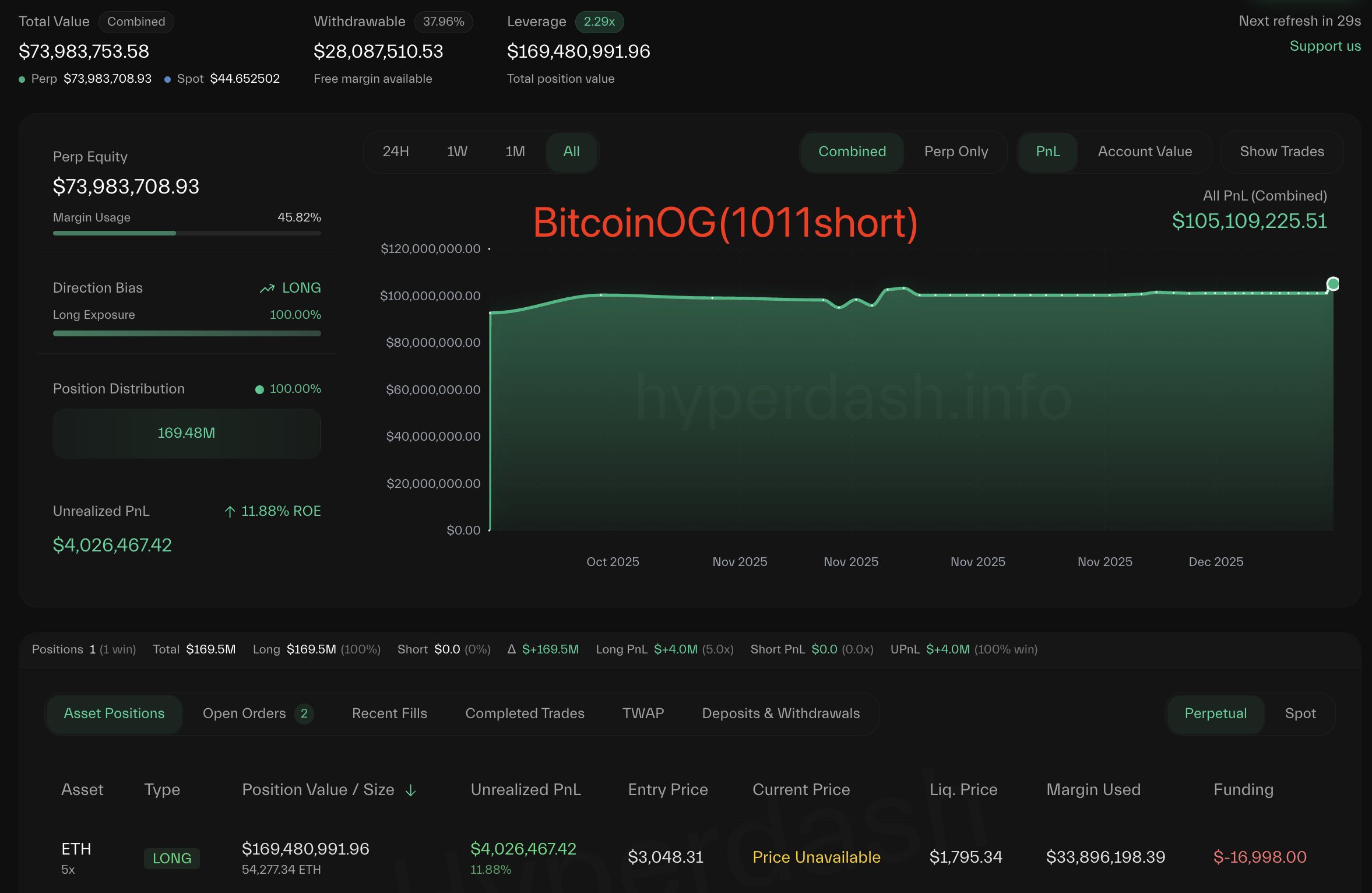

Data from Hyperdash shared by Lookonchain shows that some of the most successful and influential whales in the crypto market are aggressively accumulating Ethereum. This is a strong indication that they are confident of future price increases. BitcoinOG, a trader known for successfully short selling during the market crash on October 10, now owns 54,277 ETH worth approximately $169.48 million.

His success in profiting $105 million from the position has increased his credibility as a bullish investor. Another whale to watch out for is Anti-CZ, who is known for taking positions opposite of Changpeng Zhao, the founder of Binance.

With a total profit of $58.8 million, he currently owns 62,156 ETH worth $194 million. His trading activity is often an early indicator of market direction, which adds weight to this shift to bullish exposure. In addition, the whale pension-usdt.eth address, which has been consistently profitable, is now long 20,000 ETH worth $62.5 million.

Also Read: Sneak Peek at 3 Crypto Events This Week that Could Affect Prices!

Weekly Structure Shows Signs of Stabilization

Ethereum’s weekly chart shows the market’s attempt to recover its position after a sharp decline from the $4,500 range. The recovery of the $3,150 level is an important development, as this level is in line with the previous weekly support from mid-2024 and is just above the 50-week moving average, which often acts as a trend-defining zone.

Although ETH briefly dropped below this area during the massive sell-off in November, buyers stepped in aggressively, resulting in a strong weekly wick that signaled demand at lower levels. However, ETH is still below the key resistance level.

The 20-week and 100-week moving averages are above the current price and converging, creating a potential rejection zone unless momentum strengthens. Currently, ETH is trading in a transitional structure: it is no longer declining aggressively, but it also hasn’t shown a confirmed bullish reversal on higher time frames.

Ethereum Investment Prospects and Risks

If ETH can maintain consecutive weekly closes above the $3,200-$3,300 range, the chart will open up opportunities to retest the $3,600-$3,800 range. However, failure to hold $3,150 could risk heading towards $2,800 support.

Trading volume also supports this interpretation, where selling volume has reduced compared to the capitulation phase, while the latest green candles show moderate yet steady buying interest-suggesting accumulation rather than full-on risky behavior.

Conclusion

Given the whale activity and current market structure, investors and market watchers should remain alert to the evolving dynamics. Despite the uncertainty, signs of stabilization and major investments from key players could be early indicators of a larger bull cycle that may stretch into 2026.

Also Read: Leading Investor Ditches Bitcoin in Favor of All-In on Ripple (XRP), Here’s Why!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Smart Whales Align: Top Performers Go All-In on Ethereum Long Positions with Over $425M in Exposure. Accessed on December 10, 2025