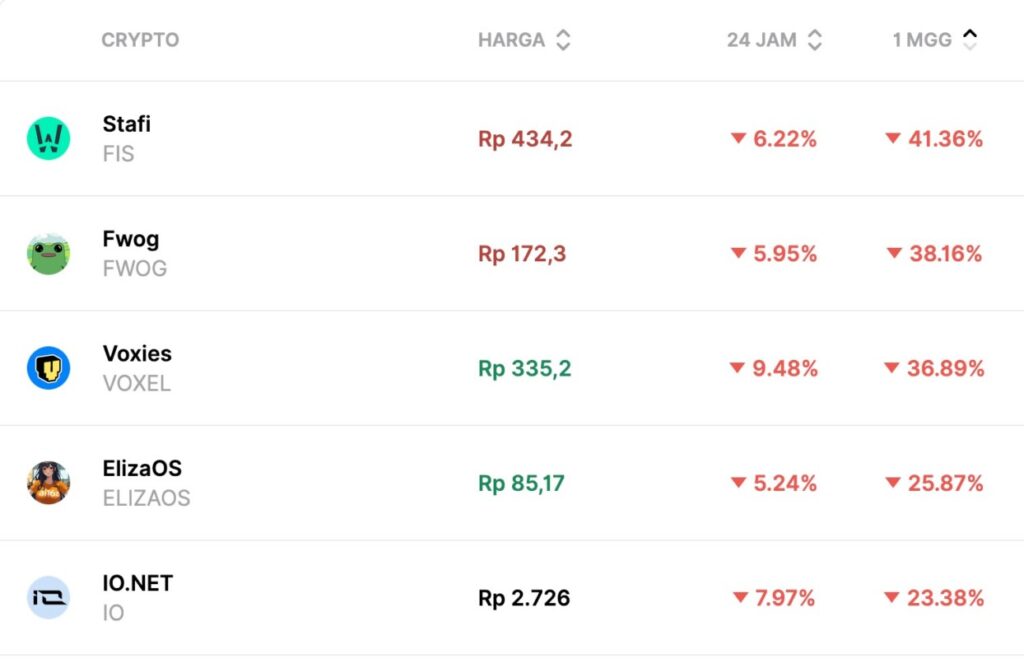

5 Crypto with the Biggest Drop in the First Week of December 2025

Jakarta, Pintu News – Entering the first week of December 2025, the crypto market has been volatile again. Several altcoins recorded sharp corrections due to risk-off sentiment, liquidity outflows, and decreased trading volumes.

Based on weekly price data on the Pintu app, here are the five crypto assets with the biggest declines in the past 1 week.

1. Stafi (FIS) – Down 41.36%

Stafi was the asset with the deepest correction this week after plummeting more than 41%. The token, which focuses on liquid staking, is still facing pressure due to declining investor interest in alternative staking products and limited positive catalysts.

- Price: IDR 434.2

- 24 hours: -6,22%

- 1 week: -41,36%

Also Read: Will Dogecoin (DOGE) be back in the hands of the bulls by early 2026?

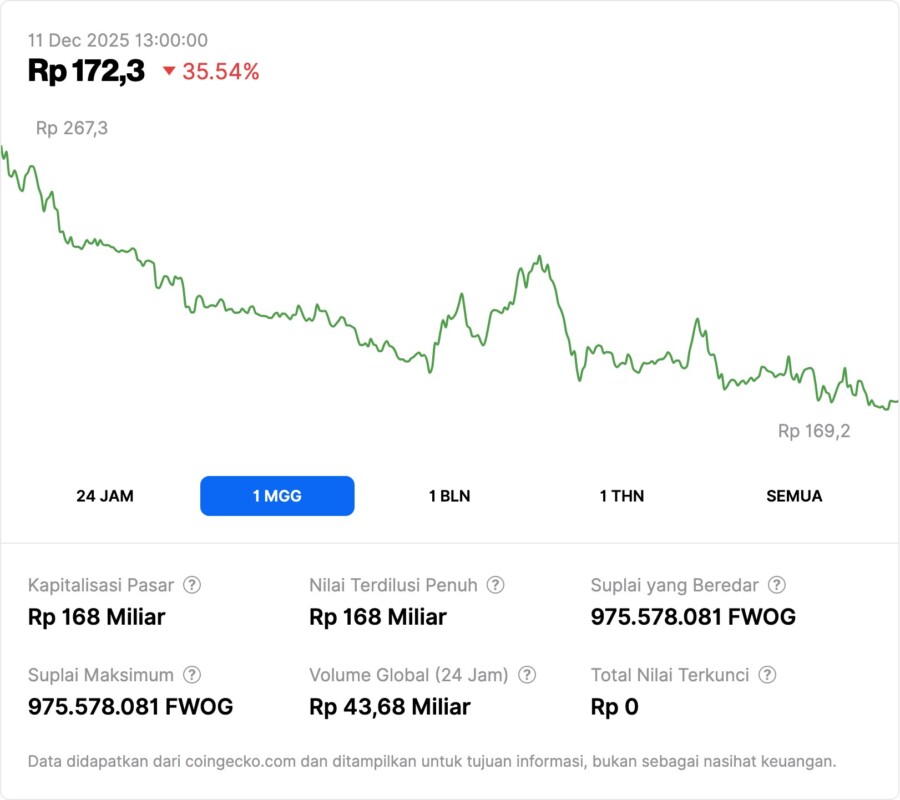

2. Fwog (FWOG) – Down 38.16%

FWOG, a community-based memecoin, recorded a sharp decline after a brief rally earlier. A drop in transaction volume and reduced trader interest saw the token weaken significantly.

- Price: IDR 172.3

- 24 hours: -5,95%

- 1 week: -38,16%

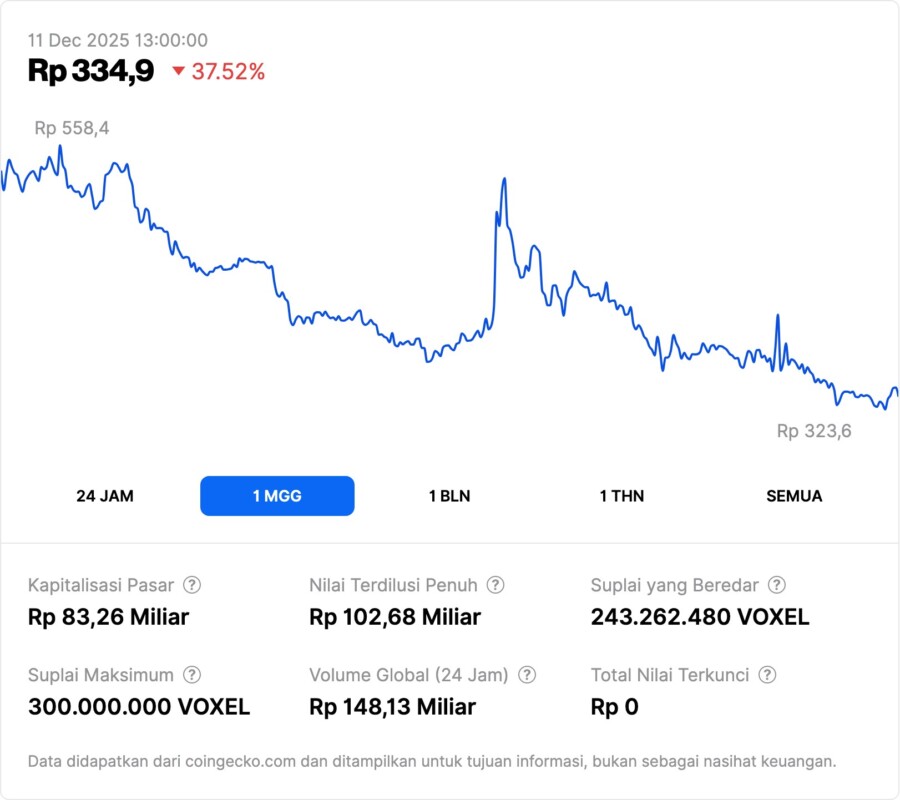

3. Voxies (VOXEL) – Down 36.89%

The Voxies game token came in third place with a drop of almost 37%. The lack of project updates and reduced sentiment on the GameFi sector continue to pressure VOXEL prices.

- Price: IDR 335.2

- 24 hours: -9,48%

- 1 week: -36,89%

4. ElizaOS (ELIZAOS) – Down 25.87%

ElizaOS, an AI-as-a-service based token, fell more than 25% due to market conditions that were less favorable to risky assets. This correction is still moderate compared to other tokens on the list.

- Price: IDR 85.17

- 24 hours: -5,24%

- 1 week: -25,87%

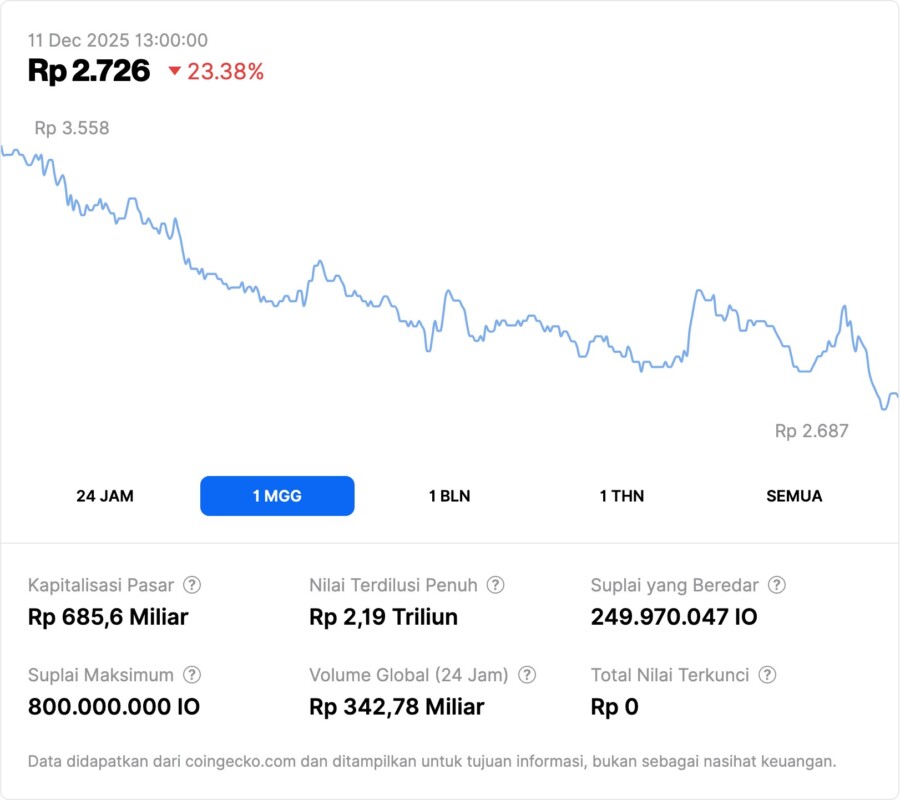

5. IO.NET (IO) – Down 23.38%

IO.NET is experiencing sustained selling pressure after a period of high volatility. Although the drop is the smallest on this list, the asset remains in a weekly corrective trend.

- Price: IDR 2,726

- 24 hours: -7,97%

- 1 week: -23,38%

Conclusion

The significant decline in the five assets shows that the first week of December 2025 is still dominated by bearish sentiment. Investors need to pay close attention to fundamentals, project developments, and macroeconomic conditions before making decisions. Sharp corrections often open up accumulation opportunities, but they still require careful risk evaluation.

FAQ

What was the main cause of the crypto correction in the first week of December 2025?

The correction was triggered by weak market sentiment, decreased liquidity, profit-taking, and the lack of positive catalysts from each project.

Does the weekly decline signal a long-term bearish trend?

Not always. Weekly drops can be temporary, especially in highly volatile crypto markets. However, it is still important to monitor long-term price trends and macro data.

Which are the high-risk assets on this list?

Stafi , Fwog , and Voxies have higher volatility due to lower capitalization and reliance on community sentiment.

Is a correction like this a buying opportunity?

It is possible, but it really depends on the investor’s risk analysis. Investors are advised to review the fundamentals, roadmap, and ecosystem activities of the asset.

How to monitor crypto prices in real-time?

Prices can be monitored through the Pintu app in the Market section, including price charts, percentage changes, and other data.

Reference

- Door. Crypto Price Data – Market Overview. Accessed today’s date.