Microsoft Stock: Key Reasons to Keep an Eye on It Before 2026

Jakarta, Pintu News – As reported by Finbold, the long-term trading history of Microsoft (NASDAQ: MSFT) shares shows a recurring seasonal pattern, which could be an interesting opportunity for investors ahead of January 2026.

Seasonal Patterns in Microsoft Stock Show Opportunities

Based on performance data over the past 38 years, Microsoft stock has consistently performed positively in January. This trend comes as MSFT stock has gained nearly 14% since the beginning of the year, and closed at $484 on December 9.

Read also: Wall Street Analyst Raises Apple Stock Price Target to $350

Furthermore, nearly four decades of seasonal data shows that Microsoft stock has averaged a 4.3% return every January, with 66% of those periods recording positive results, according to analysis from charting platform TrendSpider released on December 10.

Interestingly, January was recorded as the month with the best combination of frequency and magnitude of hikes, even surpassing other strong months such as March, April, and October.

The data also showed a spike in Microsoft’s average share price change in January, indicating yield consistency and stronger momentum.

MSFT Stock Fundamentals: Long-Term Strength Ahead of 2026

Microsoft stock’s positive seasonal pattern becomes even more relevant as we approach 2026, with the company’s leadership in AI, cloud services, and corporate software continuing to drive long-term revenue growth.

If market conditions remain stable, this seasonal pattern could be a good entry point for investors before the start of the year. On the other hand, the American tech giant is also backed by strong fundamentals that could support a continuation of the upward trend in its share price.

For example, in its latest quarterly report, Microsoft recorded revenues of $76.4 billion, up 18% year-on-year, with net income of $27.2 billion and diluted EPS (earnings per share) of $3.65, a 24% increase over the previous year. This growth was largely driven by the AI and cloud services segments.

These achievements are also in line with major product and infrastructure updates. At Ignite 2025, Microsoft unveiled new Copilot features and AI “agent” tools across the Microsoft 365 and Azure ecosystems, further strengthening the monetization potential of AI in both software and cloud consumption.

Read also: 3 popular US stocks highlighted by crypto analyst Ali Martinez

In addition, Microsoft is also pouring billions of dollars in investments to increase AI and cloud capacity globally, including the development of large-scale data centers in India, Canada, and other regions scheduled to be active between 2025 and 2026.

With these facilities operational, Microsoft will be better equipped to handle larger AI and cloud workloads, support increased demand for Azure, and strengthen its long-term revenue visibility.

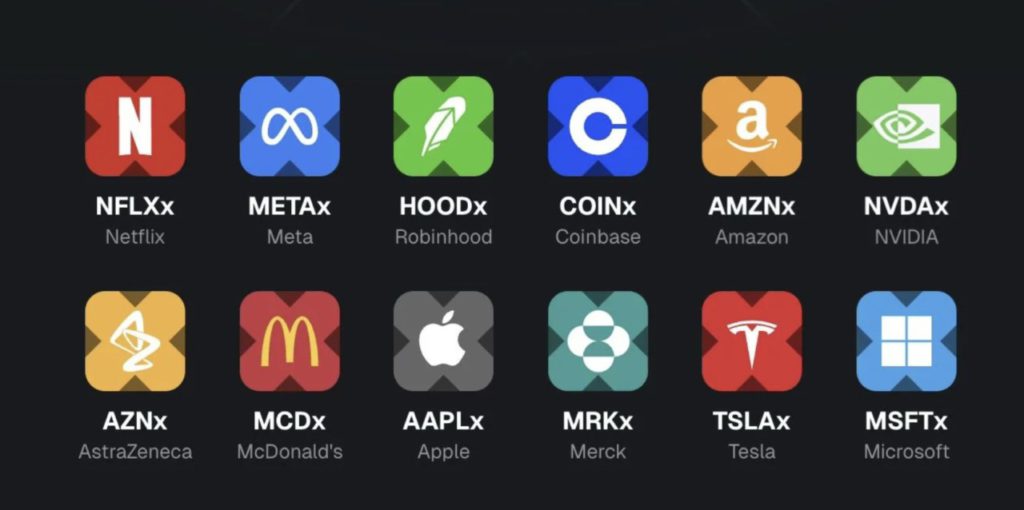

Trading US Stock Tokens on the Door

Imagine being able to buy shares of big companies like Tesla , Apple , and Amazon in token form for just a few thousand dollars. The good news is that you can now buy/sell tokenized US stocks from xStocks and Ondo at Pintu.

By leveraging blockchain technology, you can now enjoy a faster settlement process for tokenized US stocks, more affordable start-up capital, and a more global investment experience.

Trade on the Door Now!

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Finbold. Why You Need to Buy Microsoft Stock Before January 2026. Accessed on December 12, 2025