YouTube Now Lets US Creators Get Paid in PYUSD Stablecoin as Market Cap Surges to $3.9 Billion

Jakarta, Pintu News – YouTube now allows content creators in the US to receive payments in the form of PayPal’s PYUSD stablecoin. The move marks an important milestone in crypto adoption on the leading video platform.

The partnership between the Google owned platform and PayPal demonstrates the growing institutional confidence in stablecoin technology for everyday transactions.

YouTube Adds PYUSD as a Payment Option for Creators

Content creators in the United States can now choose to receive their YouTube earnings in the form of PYUSD, PayPal’s US dollar-backed stablecoin. May Zabaneh, head of PayPal’s crypto division, confirmed that this option is already available to users in the US, according to a report from Fortune. A Google spokesperson also confirmed this move.

Read also: 3 Cryptos that Analyst Ali Martinez Highlighted When Market Crashed

This feature is an extension of PayPal’s platform update in the third quarter of 2025, which allows recipients to receive payments in PYUSD. YouTube has also adopted this option.

The news has been welcomed by the community, who see this as a development that makes transactions easier and faster.

“Stablecoin payments on YouTube are crazy. It makes the creator economy feel much more global and seamless, especially for those outside the traditional banking system. Awesome,” commented one user.

This YouTube integration comes amid growing institutional adoption of PYUSD. Yesterday, State Street Investment Management and Galaxy Asset Management announced plans to launch the State Street Galaxy Onchain Liquidity Sweep Fund (SWEEP) in early 2026.

The investment fund will use PYUSD as the settlement currency for subscriptions and redemptions on an ongoing basis, marking an important step in the use of stablecoins in regulated financial products.

PYUSD Market Capitalization Sets New Record as Stablecoin Adoption Surges

The overall stablecoin market has experienced rapid growth in recent years. According to the IMF, cross-border flows involving USDT and USDC reached around $170 billion throughout 2025.

Read also: SEI 2026-2030 Price Prediction: Bullish Sei Signal Appears? Here’s the Analysis

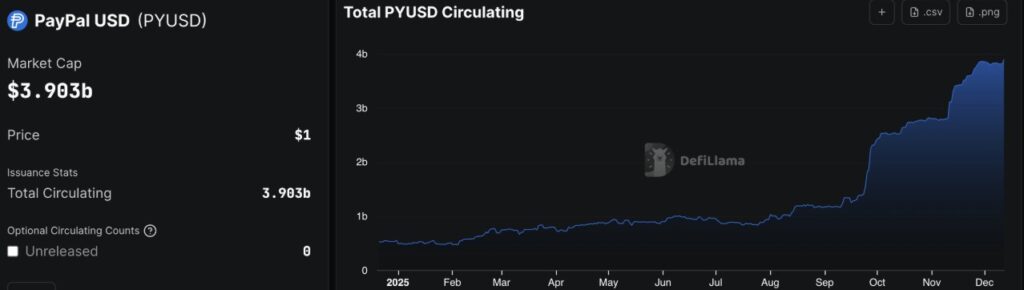

Amidst these trends, PYUSD also recorded significant expansion. Its market capitalization jumped from around $500 million in early January to a record high of around $3.9 billion in December.

Data from DeFiLlama shows that Ethereum is currently the main network for PYUSD, with circulation reaching $2.79 billion – up 36.6% in the past month.

Solana came in second place with $1.046 billion, an increase of 4.3% over the same period. Smaller amounts were also spread across the Flow, Berachain, Plume and Cardano networks, reflecting PayPal’s multi-chain strategy for these stablecoins.

The combination of PYUSD’s integration on YouTube, the surge in market capitalization, and the launch of institutional products show how PYUSD is further strengthening its position in the world of digital finance.

This trend indicates that stablecoins are no longer just a niche interest in the crypto world, but are starting to transform into important financial tools backed by big brands and trusted institutions.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. YouTube Enables PYUSD Stablecoin Payments for US Creators as Market Cap Hits $3.9 Billion. Accessed on December 12, 2025

- Crypto News. YouTube Now Lets US Creators Get Paid in Stablecoins via PayPal. Accessed on December 12, 2025