5 Important Facts about the Trending Halving Bittensor (TAO) in the Crypto World

Jakarta, Pintu News – The Bittensor halving event has become a hot topic of discussion in the cryptocurrency ecosystem due to its unique mechanism and its impact on the AI network and the project’s tokenomics.

According to a report by AltcoinBuzz, this halving differs from Bitcoin in that it involves a computational AI-driven change in incentives within the network, rather than a simple reduction in supply. This information has come to the attention of market participants and analysts as it concerns the dynamics of token issuance and competition within the Bittensor network.

1. What is TAO Halving and Why is it Monitored

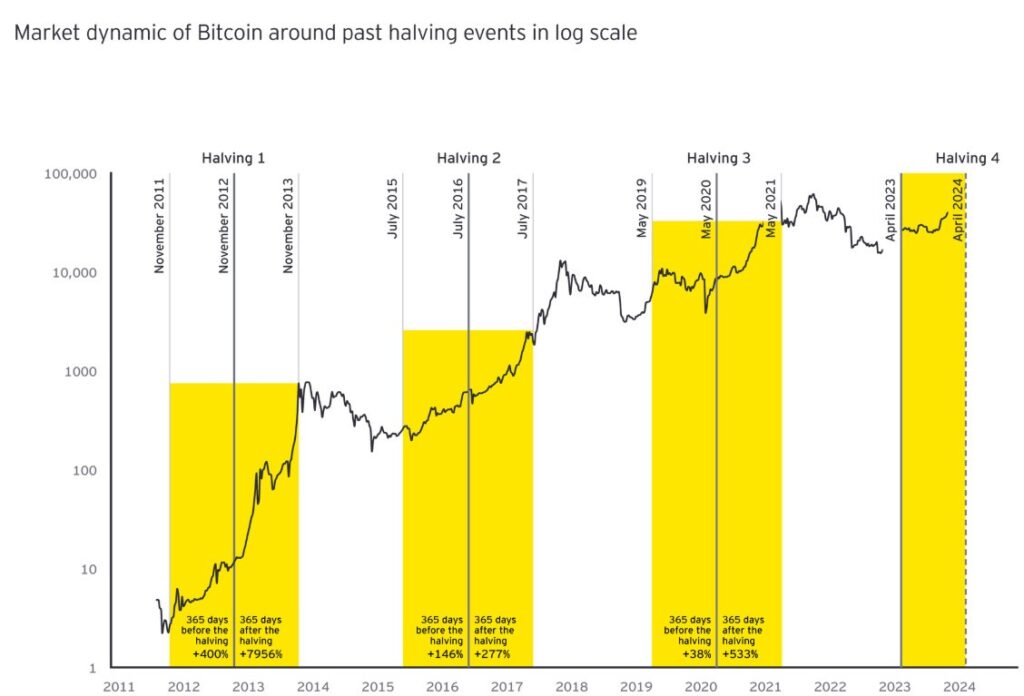

The TAO Halving is a Bittensor block reward reduction event that occurs when the token supply reaches half of the maximum total of 21 million TAO, at 10.5 million TAO. This mechanism cuts daily issuance from 7,200 TAO to around 3,600 TAO, similar to Bitcoin’s deflation principle but triggered by supply instead of blocks. This info is taken from the halving protocol documentation and trackers monitored by the crypto community.

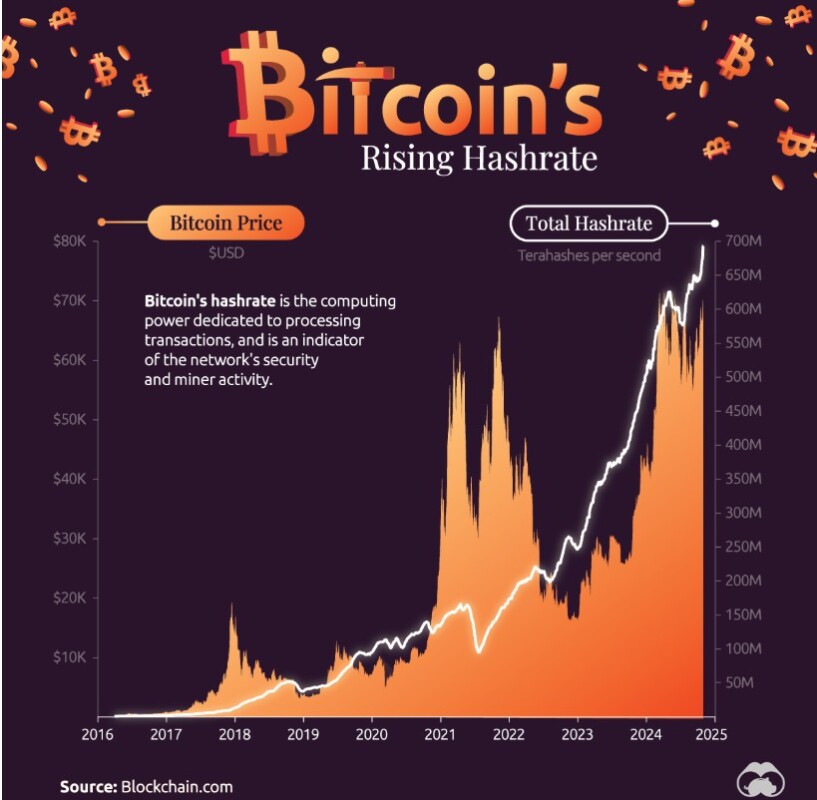

Moreover, in contrast to Bitcoin, on the Bittensor network rewards are not only paid to miners based on hash power, but based on AI computational contribution and the quality of output produced. This approach means that halving not only reduces the supply of new tokens but also suppresses the incentive structure in the ecosystem.

Also Read: Ethereum Headed to $5,000: Investment Opportunities Ahead of 2026!

2. Unusual Halving Mechanism

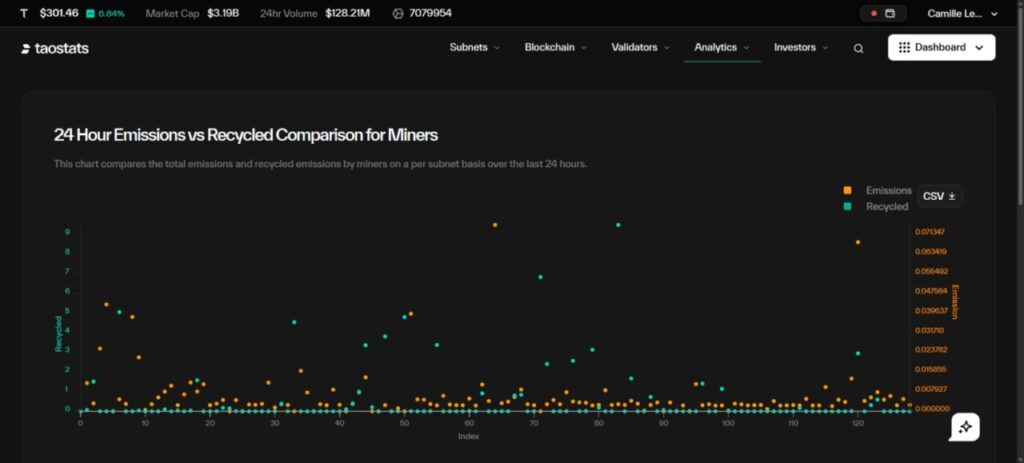

Bittensor’s halving mechanism is such that TAO token emission is reduced automatically when a certain supply is reached, rather than on a specific block in a fixed calendar. This means that the exact date of halving can shift with network dynamics and token usage activity. This information is based on data from the TAO halving tracker that follows real-time emissions.

The halving also impacts the internal dynamics of the network as a decrease in the number of new TAOs entering the market will increase competition between subnets and miners for fewer rewards. The concept is taken from AltcoinBuzz’s analysis comparing the tokenomics structure with Bitcoin halving.

3. Impact on Network Incentives and Competition

After the halving, network contributors such as miners, validators, and subnet operators will compete more fiercely due to fewer new TAO streams. According to AltcoinBuzz, this illustrates that the quality of AI output is becoming more important than just high quantity participation for the sake of rewards.

This phenomenon makes Bittensor attractive to the crypto community who want to understand the differences of a more dynamic token economy model. This new incentive structure allows the network to adapt and suppress unproductive activities while encouraging high-performing nodes.

4. Halving and Projection Event Times

Based on various community-monitored estimates, the TAO halving is expected to occur around mid-December 2025, with some trackers noting dates around December 10-15. Since the halving is triggered by supply, the exact date depends on how quickly supply is reached and the dynamics of token recycling on the network.

This event was widely discussed as it marked an important transition into a more mature phase of the network. Grayscale and several institutional parties are known to have produced reports on the halving, earning it widespread attention among investors and developers in the crypto space.

5. Potential Effects on TAO Supply and Values

With TAO’s daily emission reduced from 7,200 to 3,600, there will be less new supply entering the market, which in tokenomics theory can affect the selling pressure of reward distribution. This is similar to Bitcoin’s deflationary principle, but in the context of Bittensor, the impact is also felt on the operational functions of the AI network.

It is important to note that while halving may suppress supply, the price effect on TAO is not automatic and depends on market demand and network dynamics. This information is provided for community discussion and crypto analysts to place these events in an educational framework, not as a price prediction.

Also Read: Bitcoin Stuck Below $94,000: When Will Price Recovery Happen?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

What is halving in the context of Bittensor (TAO)?

TAO Halving is an event where block rewards for TAO tokens are halved when supply reaches a certain target, reducing the number of new tokens generated.

When did the first halving of TAO occur?

Based on estimated halving tracker data, the first halving is expected to occur around mid-December 2025 when supply reaches 10.5 million TAO.

How is TAO halving different from Bitcoin (BTC) halving?

TAO halvings are triggered by the achieved supply and affect the incentives and competition of the AI network, whereas Bitcoin halvings are block-driven and focus on decreasing supply without changing the functioning of the network.

Who is affected by the TAO halving?

Miners, validators, and operator subnets on the Bittensor network will be affected due to fewer new TAO rewards after the halving.

Does this halving guarantee an increase in TAO price?

There are no guarantees; halving reduces supply, but the effect on prices depends on market demand and other network factors.

Reference

- Camille Lemmens/AltcoinBuzz. The Bittensor TAO Halving is Here! Accessed December 16, 2025