3 Crypto Liquidated Today (12/18), 153,131 Traders Affected?

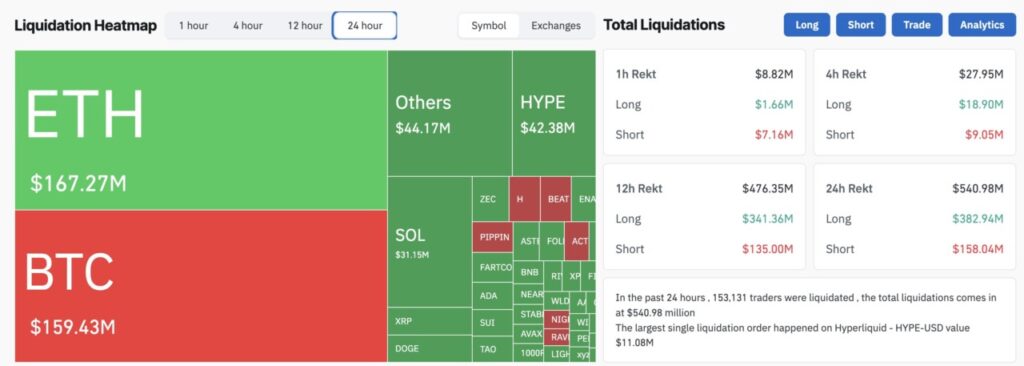

Jakarta, Pintu News – The crypto derivatives market recorded a significant surge in liquidations in the last 24 hours as of December 18. Based on liquidation heatmap data, the total liquidation exceeded USD 540.98 million with more than 153 thousand traders affected. The market pressure was dominated by the liquidation of long positions, reflecting a price correction that went against the expectations of the majority of market participants.

Ethereum (ETH) Leads Liquidation

Ethereum recorded the highest liquidation value totaling approximately USD 167.27 million. The dominance of ETH liquidations indicates the high exposure of traders to leveraged positions, especially on the long side. This indicates that ETH price movements contrary to market expectations triggered a wave of forced closings in a short period of time.

Bitcoin (BTC) Pressured by Market Volatility

Bitcoin followed in second place with total liquidations of approximately USD 159.43 million. BTC liquidations were dominated by long positions, in line with aggregate data showing the majority of traders anticipated a price increase. The price’s inability to hold key levels led to many positions being liquidated simultaneously.

Also read: 3 Bitcoin Price Predictions in 2026 According to Bitwise

Solana (SOL) Enters the Top Three

Solana recorded liquidations of approximately USD 31.15 million in the last 24 hours. Despite its smaller value compared to ETH and BTC, SOL still stands out as one of the assets with high derivatives activity. This liquidation reflects the high speculative interest in SOL, especially amid rapid market fluctuations.

Conclusion

Overall, the total liquidation in 24 hours reached USD 540.98 million. Liquidation of long positions dominated with a value of approximately USD 382.94 million, while short positions reached approximately USD 158.04 million.

On a shorter timeframe, 12-hour liquidation was recorded at USD 476.35 million, indicating that the majority of the pressure occurred in the last half of the trading day. The largest single liquidation was recorded on the HYPE-USD pair on Hyperliquid with a value of approximately USD 11.08 million, signaling a concentration of risk on large leveraged positions.

FAQ

What is liquidation in crypto trading?

Liquidation is the forced closing of a leveraged position when there is insufficient margin due to price movements.

Why are more long positions liquidated?

Since the majority of traders bet on price increases, any price correction triggers mass liquidation.

Does liquidation signal a bearish trend?

Not always, but it often reflects short-term corrections or high volatility.

Does liquidation impact the spot price?

Yes, large liquidations can accelerate price movements due to automatic selling pressure.

How to avoid liquidation?

By setting leverage conservatively, using stop losses, and strict risk management.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coinglass

- Featured Image: Generated by AI