Ethereum Price Rises to $2,900 Today: Signs of ETH Rebound Starting to Emerge?

Jakarta, Pintu News – Ethereum price movements are giving mixed signals. After experiencing a correction of more than 3% in a day, ETH is showing signs of an early recovery, but the downside risks have not completely disappeared. The chart structure, momentum data, and on-chain fee levels all point to a narrow decision zone.

Currently, Ethereum is caught between a possible rebound and a deeper decline. The difference between the two outcomes is smaller than it seems. So, how will Ethereum price move today?

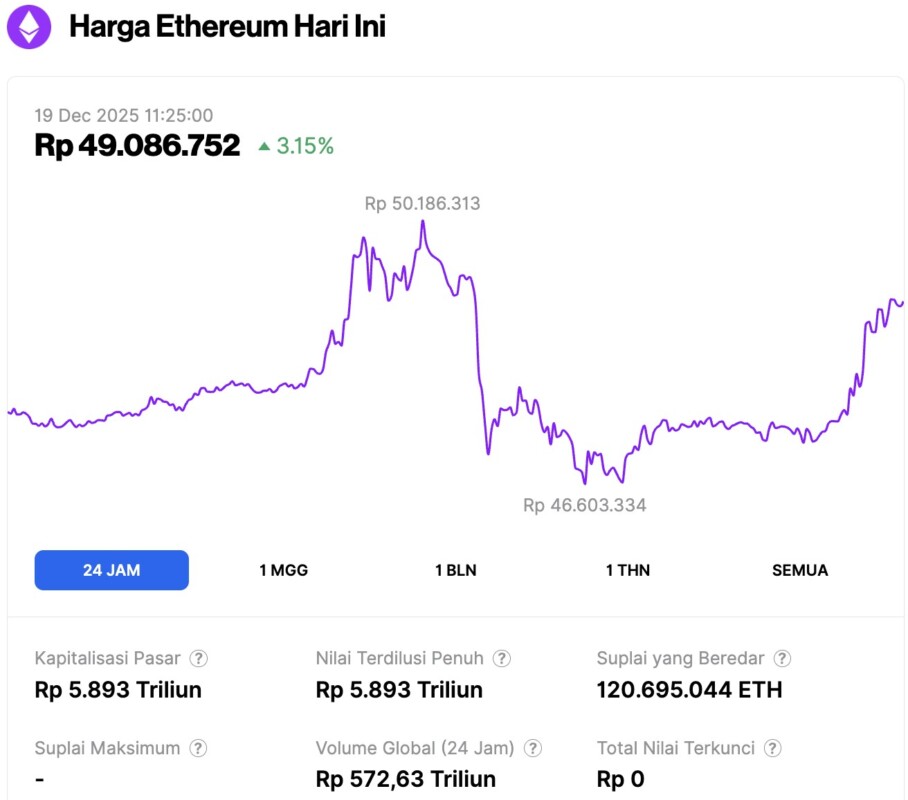

Ethereum Price Up 3.15% in 24 Hours

On December 19, 2025, the price of Ethereum was recorded at approximately $2,919, or IDR 49,086,752, marking a 3.15% increase over the last 24 hours. During this period, ETH reached a low of IDR 46,603,347 and a high of IDR 50,186,313.

As of now, Ethereum’s market capitalization is around IDR 5.893 trillion, with daily trading volume up by 25%, reaching IDR 572.63 trillion in the past 24 hours.

Read also: Bitcoin Price Stagnates at $85,000: Crypto Whale Purchases $4.6 Billion in BTC in Just One Week!

Rebound Signal Found Inside a Narrow Triangle

Ethereum is currently trading inside an increasingly narrowing triangle, a structure that reflects confusion between buyers and sellers. The price has consolidated towards the lower trendline, which is often the zone where selling pressure begins to ease.

Between December 1 and December 17, ETH printed a higher low in price. At the same time, the RSI (Relative Strength Index), a momentum measuring tool, printed a lower low. This created a hidden bullish divergence, which means the downward momentum started to weaken.

This setup doesn’t guarantee a rally, but it does suggest that the downward pressure may start to weaken as structural support, namely the lower trend line of the triangle, approaches. In simple terms, the sellers are starting to lose ground, but the buyers are yet to take control.

This makes the next move very sensitive to key levels.

Fee Base Data Shows Where Ethereum Price Rebound Could Stall

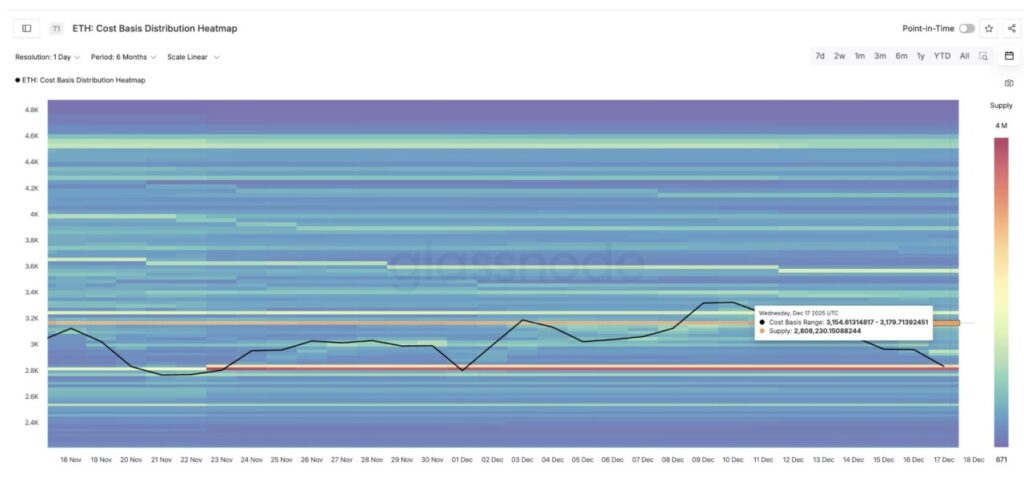

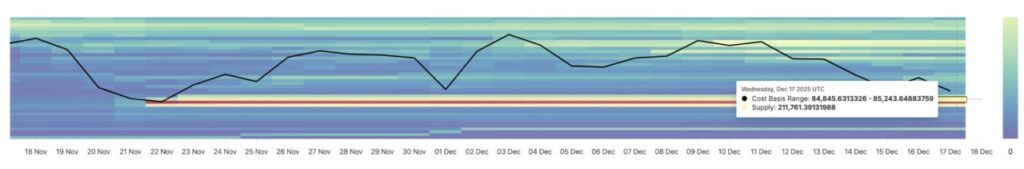

The on-chain fee base data helps explain why Ethereum’s price increase potential may be limited.

The strongest short-term resistance lies between $3,154 and $3,179, where about 2.8 million ETH accumulated. This is a heavy supply zone. When the price returns to this range, many holders break even and are likely to sell.

Read also: Solana Starts Quantum Proofing Update as Blockchain Industry Accelerates Security Measures

This is very much in line with the resistance on the chart at $3,149, which registers a potential upside of 11% from current levels. Even if Ethereum prices rebound, this zone is likely to attract selling pressure unless prices can close clearly above it. That’s why any rebound without a daily close above this area would still be considered a correction, not a trend change.

The downside picture is more fragile.

The most important support cluster lies between $2,801 and $2,823. This range has served as a key demand zone. A clean daily close below $2,801 (which is also visible on the price chart) would be a warning signal.

The move only registered a drop of about 1%, but it could open the door to $2,617, the next major support level on the chart.

This is what makes Ethereum’s current position dangerous. The upside potential could be stalled at around 11%, but the downside risk could start with a failure of just 1%.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Ethereum Price Nears Possible Breakdown – Yet A Bounce Hope Emerges. Accessed on December 19, 2025