Which Crypto will Shine in 2026: Bitcoin, Ethereum, or XRP?

Jakarta, Pintu News – The crypto market is approaching 2026 after a year characterized by sharp volatility, new record highs, profit-taking, and an apparent maturity phase.

Bitcoin is further cementing its role as an institutional reserve asset, while Ethereum and XRP are entering a corrective phase after previous strong trends characterized by uncertainty and rapid price fluctuations.

On the macro front, the US Federal Reserve began its first interest rate cut, labor market data showed early signs of cooling, and capital flows into digital assets became increasingly selective.

As a result, Bitcoin, Ethereum, and XRP are now near significant technical levels. The key question for 2026 is whether global liquidity will expand or stall-and whether that liquidity will flow decisively into cryptocurrencies.

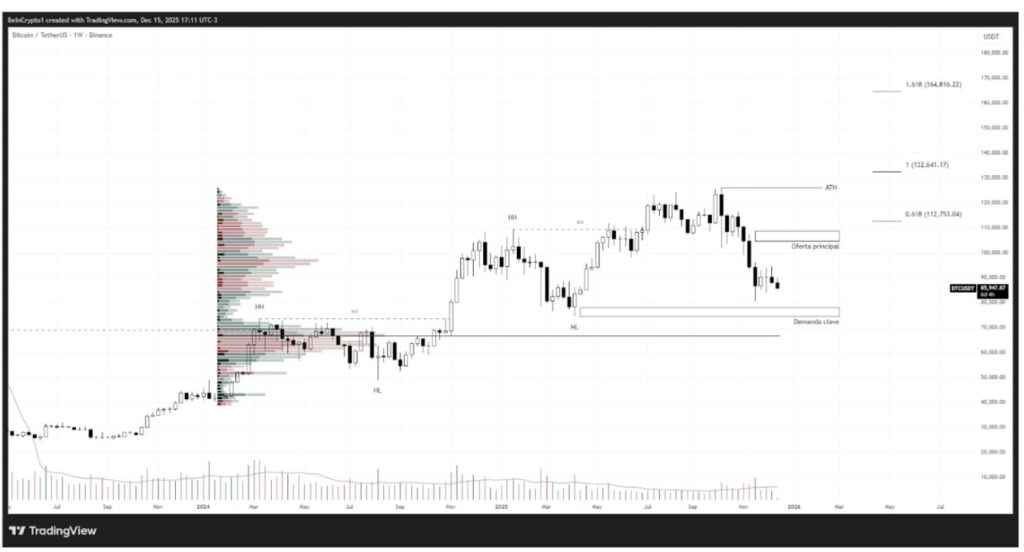

Bitcoin (BTC) Price Analysis and Predictions for 2026

Bitcoin reached a new record high above $126,000 in 2025, largely driven by continued institutional adoption. Companies and state entities continue to add BTC to their reserves.

Read also: Bitwise Chief Predicts Bitcoin Could Set New Records in 2026 and Break the 4-Year Cycle!

MicroStrategy accumulated around 660,645 BTC, while El Salvador increased its holdings to 7,502 BTC.

Meanwhile, spot Bitcoin ETFs continue to absorb supply, reinforcing Bitcoin’s role as a long-term macro asset. From a technical perspective, the broader bullish structure for Bitcoin is maintained despite losing the ascending channel that directed the price movement from March 2024 to November 2025.

After registering the latest ATH, BTC corrected to the key demand zone around $80,000. Resistance around $110,000 continues to limit attempts at price increases. Trading volumes have slowed down, a pattern usually associated with correction phases rather than trend reversals.

Bitcoin Bullish Scenario

A strong reaction from the accumulated demand zone around $75,000 could pave the way for a long-term move towards $150,000-$170,000.

A breakout above the $100,000-$115,000 resistance cluster would confirm the continuation of the trend, supported by renewed participation from retail and institutional investors.

BitcoinRange Scenario

If the upward momentum is limited, Bitcoin might spend most of 2026 trading between $70,000 and $110,000.

This would represent an extended accumulation phase within the broader cycle, characterized by volatile price movements and false breakouts while the market waits for a clearer monetary trigger.

Bitcoin Bearish Scenario

A decisive loss from the $75,000-$80,000 demand zone will open up the possibility of a deeper correction.

In this case, the $60,000-$40,000 zone could serve as a balancing zone without invalidating Bitcoin’s long-term macro structure.

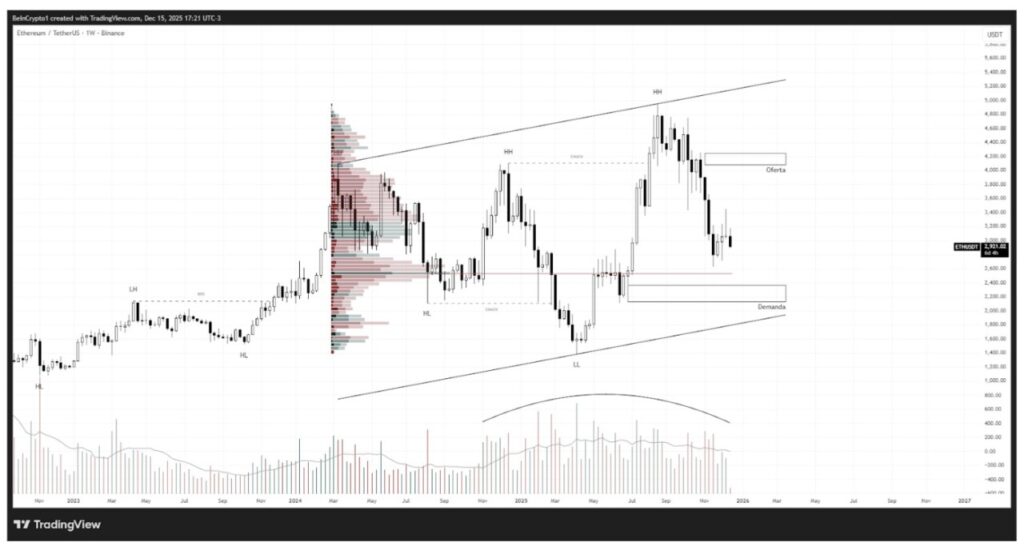

Ethereum (ETH) Price Analysis and Predictions for 2026

Ethereum had a momentous year in 2025, reaching new record highs around $4,955. Network upgrades like Pectra and Fusaka increased scalability and efficiency, while spot Ethereum ETFs started to gain attention. Staking activity and DeFi usage continue to support Ethereum’s fundamental value.

On the weekly chart, ETH remains within a broad long-term upward channel. After setting a new record high in August 2025, the price corrected towards a relatively weak demand zone around $2,900.

Although the long-term structure remains constructive, the momentum has slowed down compared to the previous expansion phase. The short- and medium-term structure remains bearish.

Ethereum Bullish Scenario

A sustained recovery could allow Ethereum to target $5,700 and possibly $6,100, based on historical cycle extensions.

A clean break above the channel resistance near $5,200 would solidify Ethereum’s position as the leading asset in 2026.

Read also: Ethereum Price Rises to $2,900 Today: Signs of ETH Rebound Starting to Emerge?

EthereumConsolidation Scenario

If demand remains moderate, ETH could consolidate between $4,300 and $2,200. This range would signal a balance between buyers and sellers, making 2026 a transition year rather than a breakout phase.

EthereumBearish Scenario

A drop below the channel’s support would open Ethereum up for a deeper move towards $2,250-$1,600, an area that corresponds to historical demand levels crucial for maintaining the long-term structure.

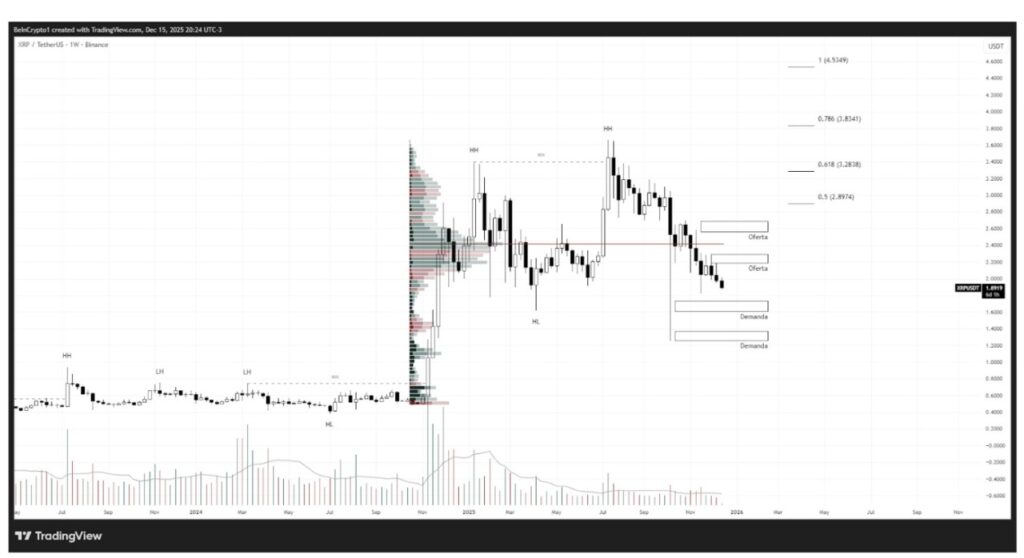

XRP Price Analysis and Predictions for 2026

Ripple ended 2025 with a significant increase in regulatory clarity after a favorable settlement of its legal dispute with the SEC. This outcome revived institutional interest and reopened discussions regarding an XRP ETF product, enhancing its position within traditional financial markets.

Large-scale institutional adoption could trigger a surge in demand capable of pushing XRP to new record highs.

Technically, XRP is in a corrective phase after a strong rally that peaked at around $3.60 in mid-year. The price has since retreated into key demand zones, while some areas of supply continue to limit the short-term rebound. This behavior is in line with the broader trend regression phase.

XRP Bullish Scenario

If 2026 proves favorable for Ripple’s institutional adoption, XRP could continue its move towards $3.83-$4.53. To achieve this, the price will have to reclaim the $2.40 level and sustain buying volumes, supported by positive regulatory developments.

XRPRange Scenario

If uncertainty remains, XRP may trade sideways between $3.00 and $1.60. While this reflects doubts regarding adoption by the banking sector, it would also indicate a healthy consolidation phase ahead of the next cycle.

XRPBearish Scenario

A drop below key support could send XRP towards $1.20-$0.90. Such a move would indicate the loss of critical levels, including the $1.60 psychological mark, as well as a decline in speculative interest.

Read also: Peter Brandt’s Prediction: XRP Price Could Fall Below $1 Due to Double Top Pattern

Will 2026 be a Year to Remember or a New Foundation?

Price projections for 2026 show a market that is on the verge of equilibrium. Bitcoin continues to show the most structural resilience, while Ethereum and XRP remain more dependent on specific triggers.

Upside potential exists, but requires clear technical confirmation and fundamental follow-through.

One trend is undeniable: the crypto market is transitioning into a more mature phase. Both bulls and bears are now more manageable, with volatility more compressed than in previous cycles.

The pace of the renewed bull run will depend on a more supportive macro environment, deeper institutional adoption, and consistent regulatory clarity.

If those forces align, 2026 might be remembered not as a stagnant year, but as the foundation for the next wave of record highs.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin, Ethereum, XRP Price Prediction 2026. Accessed on December 19, 2025