7 XRP vs BNB Facts: Tight Competition for Top-3 Market-Watched Crypto Positions

Jakarta, Pintu News – The battle between XRP and BNB for the position of the third largest cryptocurrency asset has become a buzzword after data showed that the market capitalization of the two tokens is now so tightly packed, with a difference of only about $1.35 billion (around Rp22.6 trillion), that even small movements can change the rankings quickly.

This information was widely monitored by the market community as it showed a new competitive dynamic beyond the dominance of Bitcoin and Ethereum .

1. Intense Competition Between XRP and BNB

BNB and XRP are now in a tight race for the third largest non-stablecoin crypto asset by market capitalization. The market cap difference between the two is only about $1.35 billion, a number small enough to be lost in just one normal trading session, so the chance of a ranking flip is significant.

This race is giving rise to a renewed focus in the crypto community on who is really leading the market cycle besides Bitcoin and Ethereum. BNB currently maintains a higher capitalization, but XRP continues to catch up in daily trading volume.

This trend shows that market dominance is no longer just about large capitalization, but also about daily trading dynamics and community activity.

Also Read: 5 Important Facts about the Trending Halving Bittensor (TAO) in the Crypto World

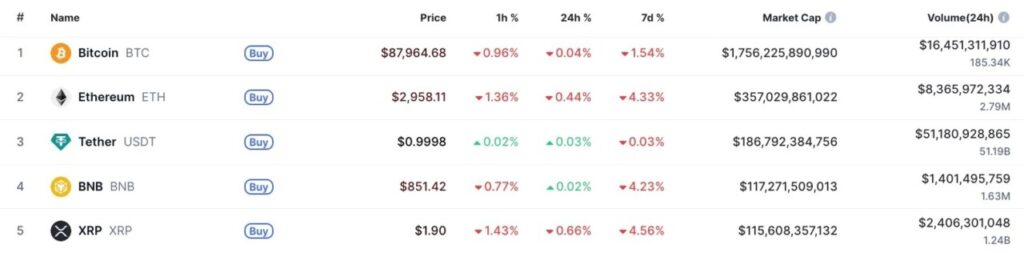

2. Capitalization and Trading Volume Data

BNB is estimated to have a capitalization of around $117.71 billion, while XRP is at around $116.36 billion, a figure that shows a very slight difference between the two crypto assets.

XRP’s 24-hour trading volume reached approximately $2.41 billion, while BNB recorded a volume of approximately $1.4 billion, signaling XRP’s more intense market activity despite its capitalization still being slightly below that of BNB.

In the past week, the price declines of both tokens have also been relatively balanced (BNB around -4.08% and XRP around -4.04%), reflecting that this competition is more about market positioning than a one-way trend.

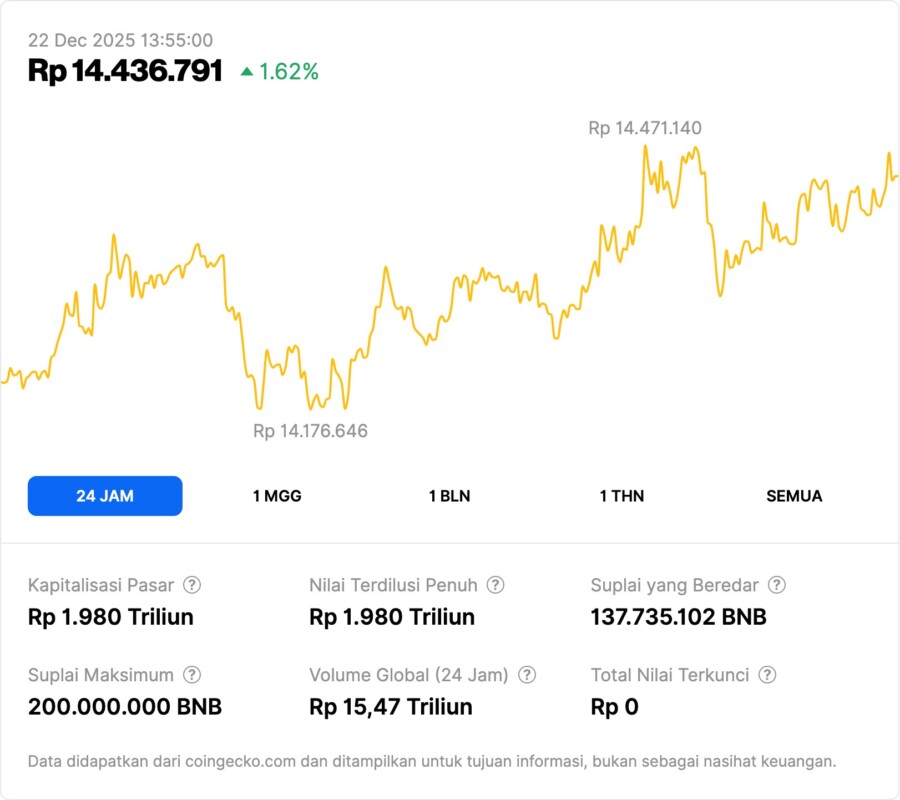

3. 2025 Performance Overview

Looking at the long-term picture, BNB has performed more strongly this year, with a gain of approximately +31.55% over 2025 to date, while XRP has been under pressure with a decline of approximately -12.81%.

This difference in performance shows that although the capitalization of the two is now almost equal, the fundamental trend in the medium term still favors BNB.

However, due to the small market cap difference and different trading volumes, XRP could catch back up to BNB with positive news or strong movement from the community.

4. BNB Ecosystem Factors

BNB enjoys strong support from the Binance ecosystem, including transaction flow on exchanges, usage on BNB Chain, as well as a consistent token burn narrative, which is a major factor in maintaining a higher capitalization position.

The BNB Chain ecosystem also strengthens demand for BNB through various incentive mechanisms, gas usage, and DeFi’s growing cross-app activity.

This is often considered a structural advantage that helps BNB stay ahead despite the competition from XRP.

5. Narrative Factors and XRP Adoption

In contrast, XRP is heavily monitored due to the narrative of payment adoption, regulatory wins, and news on institutional products that may influence market perception.

If XRP can generate credible positive news regarding global adoption or institutional support, it could provide the necessary boost to close the capitalization gap.

With such a small market cap gap, big news or strong sentiment alone is enough to change the ranking order of both within hours.

6. Position in the Global Crypto Ecosystem

This competition is not just a duel of capitalization figures but also reflects how large non-stablecoin cryptocurrencies compete for the attention of global investors.

As BNB gains strong support from Binance’s vast ecosystem and large on-chain integrations, XRP continues to be seen as a potential cross-border payment and utility asset if it reaches new adoption milestones.

This third position is often an indicator of the market’s perception of crypto asset diversification beyond the dominant ones such as Bitcoin and Ethereum.

7. What It Means for Crypto Market Players

This battle shows that small differences in market capitalization can result in large narrative shifts in a short period of time, especially when the global community of traders and investors are monitoring every move in price and volume.

The tight battle between BNB and XRP reflects how the cryptocurrency market is increasingly dynamic and not just dominated by the big two (BTC and ETH) alone, but also by different assets that continue to challenge non-stablecoin highs.

With such intense competition, the next market narrative such as technology adoption, regulatory news, or platform development could soon affect rankings significantly.

Also Read: Avalanche Price Prediction 2025-2030: Can AVAX Reach $100?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

Why are XRP and BNB called in a “tight race”?

Since the market capitalization of these two cryptos is very close (about $1.35 billion difference), even small market movements can change their ranking position.

What are the factors that support BNB’s position?

BNB gets support from the Binance ecosystem, the exchange’s transaction flow, usage on BNB Chain, as well as the ongoing narrative of token burning.

How can XRP close the gap with BNB?

In addition to relatively high trading volumes, positive news regarding the adoption of institutional payments or products could provide the necessary impetus to close the gap.

What does third place mean in the crypto market?

The third position of non-stablecoins shows the diversification of market value beyond Bitcoin and Ethereum, reflecting how other assets are attracting broad global investor interest.

Reference

- U.Today. XRP vs BNB Unexpectedly Becomes Tightest Race Crypto Has Right Now. Accessed December 21, 2025