7 XRP Crypto Facts: Weekly Inflows Rise 34% as US Investors Pull Out

Jakarta, Pintu News – This week cryptocurrency-based investment products showed large total net outflows, while XRP recorded a notable surge ininflows according to the latest CoinShares data.

Reports show that XRP was the only major asset to record positive inflows of about $62.9 million, up about 34% over the previous week, even as other funds experienced large withdrawals. This information is summarized based on CoinShares data as well as related market reports published by U.Today.

1. XRP Weekly Capital Inflows Increase by 34%

According to CoinShares data, XRP-based investment products recorded approximately $62.9 million in capital inflows in the week under review, up from approximately $46.9 million in the previous week – an increase of nearly 34%. This performance made XRP the asset with the largest inflows among crypto investment products in the period.

This increase in capital inflows comes amidst the context of a market experiencing large outflows overall, so XRP’s positive record stands in contrast to the broad market trend of weakness.

Also Read: 7 XRP vs BNB Facts: Tight Competition for Top-3 Market-Watched Crypto Positions

2. Broader Crypto Market Context This Week

Overall, the crypto investment market recorded a net capital outflow of about $952 million in the week under review. Bitcoin and Ethereum experienced the lion’s share of such capital withdrawals, at around $460 million and $555.1 million in outflows, respectively. Market analysts attributed this trend to delays in relevant legislation as well as whale-selling concerns.

This kind of market condition shows that even though large capital is flowing out of the majority of cryptocurrency assets, there is a steady diversification of capital flowing into some specific products such as XRP.

3. Total Assets Under Management & Inflows of XRP ETFs

The data also showed strong performance for XRP spot ETF products in the United States. The XRP spot ETF recorded about $13.21 million in net inflows on December 19, pushing the ETF’s cumulative total inflows above $1.07 billion with total net assets at about $1.21 billion. Spot trading value volume on the day stood at around $58.90 million.

This figure provides additional context that capital inflows into XRP are not only coming from general investment products, but also from ETF products listed on the US market.

4. Monthly & Year-to-Date Inflows

As of this month to date, XRP continues to record total inflows of approximately $354.6 million. On a year-to-date (YTD) basis, total capital inflows are approximately $3.244 billion, and total assets under management in XRP products stand at approximately $2.946 billion.

This data shows consistency in capital inflows into XRP-based investment products throughout this year, in contrast to the capital outflows seen in many other crypto assets.

5. XRP Price Response to Capital Flows

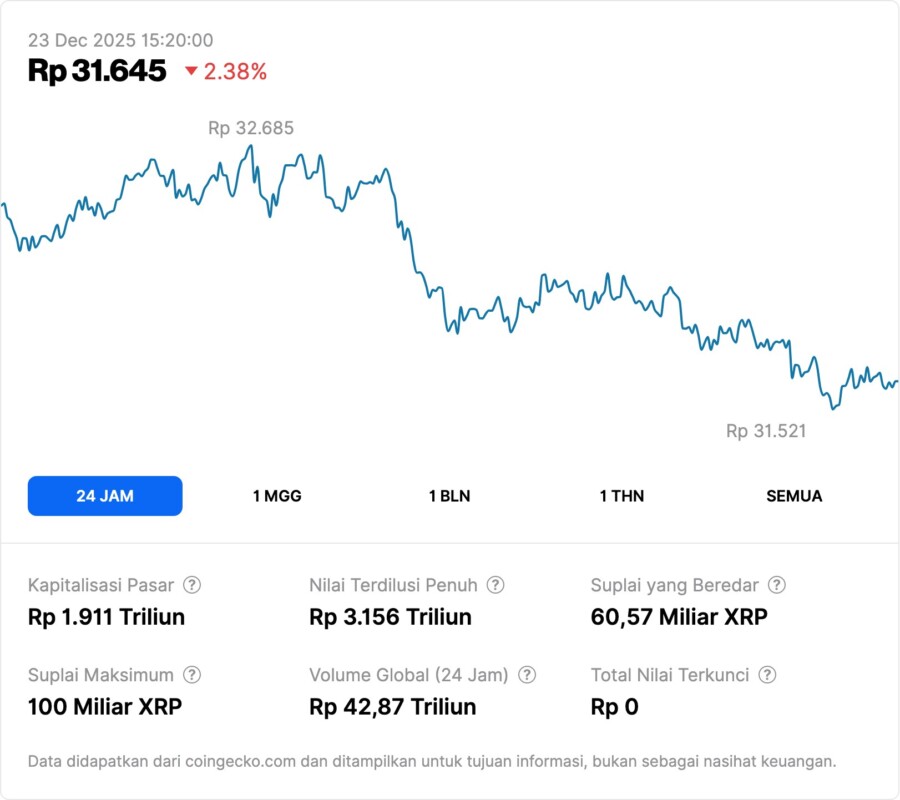

Despite this strong capital inflow, the price of XRP did not show a comparable sharp spike. In the early session of the report, the XRP price moved in a range of around $1.93 and printed an intraday high of around $1.9381 before moving relatively stable.

This modest price movement shows that while capital is flowing into investment products, spot price dynamics are still influenced by other factors such as broad market pressures and heavy selling activity at some price levels.

6. Capital Rotation Between Crypto Assets

This capital flow data reflects the phenomenon of capital rotation in the cryptocurrency market, where investors are moving allocations from major assets such as BTC and ETH to assets such as XRP that perform relatively better in capital flows. Such a trend could reflect investors’ preference towards diversifying exposure amidst market uncertainty.

This international capital rotation coincides with more cautious global markets, especially in most other digital asset assets that are under selling pressure.

7. Implications of US Investors Pulling Out

This report shows that while non-US investors continue to add exposure to XRP products, US domestic investors appear to be more cautious, reflecting investor behavior pending domestic regulatory clarity such as the provisions of the Clarity Act legislation. Increased capital inflows persisted despite regulatory pressures that slowed market momentum.

Such developments illustrate that global investors and domestic investors may have different responses to market dynamics, including unfinalized regulations, that affect capital flows.

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

What does it mean that XRP’s weekly inflows increased by 34%?

This means that XRP-based investment products attracted more capital in the week under review than the previous week, increasing from approximately $46.9 million to approximately $62.9 million.

How are the outflows in other crypto markets?

Overall, the cryptocurrency market recorded a net outflow of around $952 million in the same week, with Bitcoin and Ethereum experiencing the bulk of the capital withdrawal.

What does the XRP ETF contribute to capital inflows?

Spot XRP ETFs in the US recorded about $13.21 million net inflows on December 19, contributing to cumulative net inflows of over $1.07 billion since launch.

Does the price of XRP reflect these capital inflows?

The price of XRP was moving moderately around $1.93 when the report was made, suggesting that the capital inflow did not immediately translate into a significant price spike.

Why are US investors pulling out?

US investors seem to be cautious due to delays in legislation such as the Clarity Act, which affects capital allocation and puts pressure on other crypto investment products.

Reference:

Gamza Khanzadaev/U.Today. XRP Gets the Money:Weekly Inflows Jump 34% While US Investors Pull Back. Accessed December 22, 2025.