Will Zcash Price Dip or Continue Its Climb Toward $600?

Jakarta, Pintu News – The price of Zcash rose about 15% over the weekend, approaching the next key resistance level. This rise has sparked speculation as to whether the next rally is already taking shape or if there will be a short-term correction first.

Two momentum indicators as well as recent moves from whales suggest that a temporary dip is possible before Zcash attempts to break through resistance.

Momentum Signal Indicates Potential Cooling Before Breakout

On the 12-hour chart, Zcash formed a lower high between November 16 and 27, while the RSI (Relative Strength Index) indicator showed a slight increase. The RSI measures the strength of momentum, and this difference in direction is called a hidden bearish divergence-atechnical signal that often appears before a short-term correction.

Read also: 3 Altcoins with Strong Catalysts This Week, Potential to Soar or Plummet?

This means that even if buyers manage to push the momentum up, sellers are still able to keep the price from breaking a certain level. This suggests that demand is not yet strong enough to confirm the continuation of the uptrend.

The second signal came from the Money Flow Index (MFI), which measures the strength of fund flows from buying activity by retail investors. Between December 12 and 28, ZEC prices rose, but the MFI declined-indicating that buyers continued to chase prices higher, but demand did not strengthen.

Currently, the MFI is starting to rise again, but it needs to break the 65 level to confirm that momentum is really returning.

However, signals from these charts are only valid if they are supported by on-chain data. And indeed, the latest ownership data points in the same direction: a more cautious approach from large investors.

On-chain data shows whales start to reduce exposure

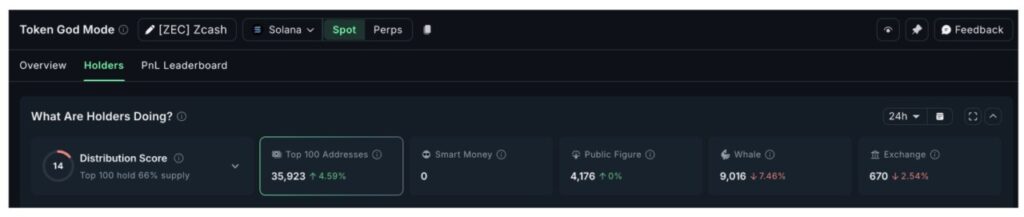

The activity of large Zcash holders on the Solana network is showing significant movement. In the last 24 hours (28/12), the whale’s balance has decreased by 7.46%.

With ZEC’s current price at around $518, this drop indicates that some whales may have started taking profits or waiting for buying opportunities at lower levels. However, on the other hand, the 100 largest addresses(mega whales) increased their holdings by 4.59% – suggesting that long-term sentiment remains positive.

This combination reflects a reasonable pullback scenario, rather than signaling a breakdown or major trend reversal. Profit-taking by some whales, along with accumulation by large players, suggests a cautious stance in the short-term but remains confident in ZEC’s long-term prospects.

Read also: Bitcoin Holds Steady at $87,000 as Analysts Point to Key Price Levels

$527 is the main trigger for Zcash’s next rally

As of December 28, Zcash was trading at around $518. The next key level is at $527 – and a 12-hour candle close above this point would be confirmation of the strength of the uptrend.

If that happens, upside room could open up to $633, about 22% higher than the current price. If momentum is maintained above $633, the next target with high conviction is $737.

The correction map is also clearly visible. The first support is around $435. If this level fails to hold, the price could drop towards $370. If $370 is also broken, volatility could potentially increase further, especially if the overall market weakens.

With market liquidity still thin towards the end of the year, both buyers and sellers need clear technical confirmation before taking positions.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Zcash Price Analysis: Rally or Pullback Risks. Accessed on December 29, 2025