3 Cryptos that Liquidated Today (12/29) Ahead of January 2026

Jakarta, Pintu News – The crypto market experienced significant pressure on December 29, 2025, ahead of the turn of the year and early January 2026. Derivatives liquidation data in the last 24 hours shows a surge in positions that were forced to close due to unfavorable price movements.

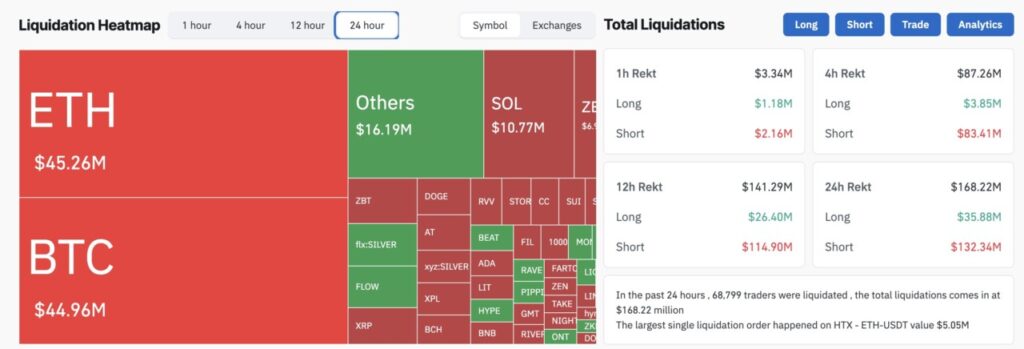

The total daily liquidation was quite large, reflecting the high volatility of the cryptocurrency market. This confirms that the transition phase to the beginning of the new year is still overshadowed by risk-off sentiment and traders’ position adjustments.

Ethereum (ETH) Leads Daily Liquidation

Ethereum has become the crypto asset with the largest liquidation value in the last 24 hours. The total liquidated positions on ETH amounted to around US$45.26 million, equivalent to approximately IDR 759 billion. This figure shows ETH’s dominance in derivatives trading activity and the asset’s high leverage exposure. This pressure largely came from short positions that failed to anticipate short-term price movements.

Also read: Gold Jewelry Price Today, Monday, December 29, 2025

The high liquidation rate on Ethereum reflects ETH’s role as the main barometer of the cryptocurrency market after Bitcoin. ETH price movements often trigger a chain reaction in other altcoins. When volatility increases, traders with thin margins are the most vulnerable. This situation reiterates the importance of risk management in derivatives-based crypto trading.

Bitcoin (BTC) Follows with Major Liquidation

Bitcoin is right behind Ethereum with a total daily liquidation of US$44.96 million or around Rp754 billion. This value shows that market pressure is not only on altcoins, but also on the largest cryptocurrency assets by market capitalization.

BTC liquidations were dominated by short positions, in line with aggregate data showing the majority of losses coming from that direction. This indicates a price movement against short-term bearish expectations.

As the benchmark asset of the crypto market, Bitcoin’s movements have a systemic impact. When BTC experiences sharp spikes or drops, liquidation often increases simultaneously across multiple exchanges. As January 2026 approaches, this reflects a market that is still searching for a new equilibrium. Macro uncertainties and year-end profit-taking contribute to volatility.

Solana (SOL) Completes the Top Three Liquidations

Solana took third place with a liquidation value of US$10.77 million. Although smaller than Ethereum and Bitcoin, this figure is still significant in the context of the altcoin market. SOL’s liquidation reflects the high level of speculative activity on a network known for its speed and low transaction fees. SOL’s price volatility makes it attractive, but also risky for leveraged traders.

Read also: Price of 1 Pi Network (PI) in Indonesia Today (29/12/25)

The pressure on Solana shows that altcoins with active ecosystems are not immune to market corrections. Rapid price movements often trigger successive liquidations in a short period of time. For the cryptocurrency market as a whole, this signals that sentiment is still fragile. Investors and traders should watch the liquidation dynamics as an indicator of short-term pressure.

Crypto Market Liquidation Overview

In aggregate, the total crypto market liquidation in the last 24 hours reached around US$168.22 million or the equivalent of Rp2.82 trillion. Of this amount, short positions accounted for the largest portion, indicating that many traders misread the direction of market movements. Tens of thousands of traders were liquidated during this period. This data illustrates the high risk of derivatives trading amid year-end volatility.

Liquidation spikes often signal the clearing of excess leverage in the cryptocurrency market. After this phase, the market usually enters a period of consolidation or the establishment of a new trend. As January 2026 approaches, market participants will be watching to see if this pressure continues or if it opens up opportunities for recovery. Daily liquidation is one of the important indicators in reading the future direction of the crypto market.

Conclusion

Large liquidations on Ethereum, Bitcoin, and Solana on December 29, 2025 confirmed that volatility still dominates the crypto market ahead of the start of the new year. The pressure on leveraged positions demonstrates the high uncertainty and sensitivity of the market to short-term price movements. For cryptocurrency investors and traders, this is a reminder of the importance of risk management discipline. Going into January 2026, liquidation dynamics will remain a key factor in determining the next direction of the market.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coinglass Liquidation Map

- Featured Image: Generated by AI