4 Reasons XRP Is Considered the Most Attractive Asset of the Year Over BTC and ETH

Jakarta, Pintu News – The crypto market opened 2026 with an unusual dynamic, with Ripple emerging as the best performing asset. In the first week of the year, XRP recorded significant gains and outperformed Bitcoin and Ethereum .

This performance even led CNBC to dub XRP as the new “darling cryptocurrency”. However, behind the price surge, there were a number of fundamental factors and sentiments that helped shape market movements.

XRP Price Performance Outperforms Bitcoin and Ethereum

Since January 1, 2026, the price of XRP has surged by around 25%, far outpacing Bitcoin’s rise of around 6% and Ethereum’s rise of around 10%. This difference in performance suggests a rotation of investor interest into crypto assets outside of the two major market players. XRP’s surge occurred amid relatively stable market conditions, making it stand out even more against other major assets.

This price increase has also sparked a new narrative among market participants. XRP is starting to be viewed as a “less dense” trade than Bitcoin and Ethereum. This opens up room for more aggressive price movements in the short term, although it comes with the risk of volatility.

Boost from XRP ETF and Capital Flows

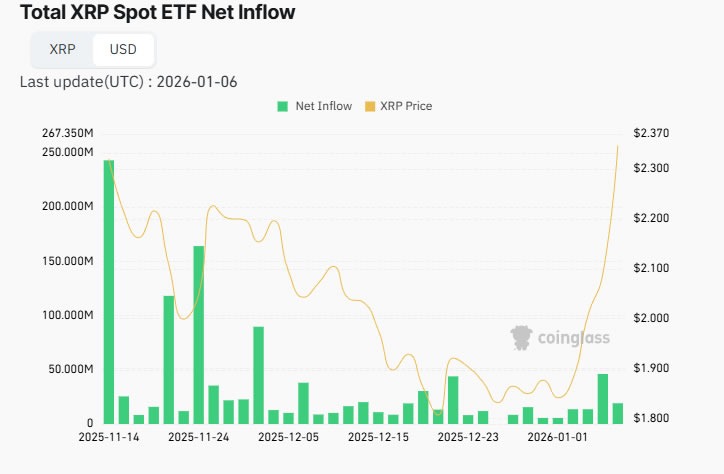

One of the main factors for XRP’s gains came from the momentum of exchange-traded funds (ETFs). Throughout the beginning of the year, spot XRP ETFs recorded inflows of nearly US$100 million, or around Rp1.68 trillion, without a single day of outflows. The total inflow of XRP ETFs has now reached around US$1.15 billion, equivalent to IDR19.32 trillion.

Also read: Ripple (XRP) Named Best Investment in 2026 According to CNBC

Interestingly, the fund flow pattern of XRP ETFs is different from Bitcoin and Ethereum ETFs. When prices were relatively weak in the fourth quarter of 2025, there was accumulation in XRP ETFs. This buy-the-dip strategy proved effective when XRP prices surged in early 2026, boosting short-term investor confidence.

Social Sentiment and Supportive On-Chain Data

Apart from ETFs, social sentiment has also played a big role in the strengthening of XRP. Artificial intelligence-based analysis shows that both public and “smart money” sentiment towards XRP is in the bullish zone. Positive narratives on social media often accelerate the flow of interest into a particular crypto asset.

On the on-chain side, XRP reserves on major exchanges are at their lowest level in two years. This usually indicates reduced selling pressure as fewer tokens are available for trading. XRP network activity has also increased significantly, with the number of transactions up more than 50% in the past two weeks, reflecting increasingly active network usage.

Ripple’s Expansion and the Risks That Remain

Beyond market factors, Ripple’s strategic moves also supported positive sentiment. The company is reportedly working with a number of major financial institutions in Japan to drive adoption of the XRP Ledger. In addition, Ripple also obtained conditional approval to establish a national custodian bank in the United States, strengthening its position in the cryptocurrency infrastructure.

Read also: Ripple postpones IPO plans despite raising $500 million, why?

However, analysts caution that sentiment- and ETF-based rallies are not always sustainable. ETF fund flows can reverse quickly, while on-chain metrics are also prone to change amid high volatility. Regulatory factors and global macroeconomic conditions remain external risks that could pressure XRP prices despite its strong early-year performance.

To conclude, XRP’s surge in early 2026 reflects a combination of institutional capital flows, market sentiment, and Ripple’s strategic moves. The performance advantage over Bitcoin and Ethereum suggests a change in investor preferences in the short term. However, the sustainability of this trend will still largely depend on the stability of fund flows, regulatory conditions, and overall crypto market dynamics.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Cointelegraph. 4 Reasons XRP Called Hottest Trade This Year. Accessed on January 11, 2026

- Featured Image: Generated by AI