Dogecoin’s Price Slips — What Could Be Next for DOGE?

Jakarta, Pintu News – Dogecoin is now entering a consolidation phase after recording an impressive 23% rally in the past week. This price drop comes after a strong move that managed to bring the Dogecoin price out of a sideways movement pattern that occurred throughout December.

Interestingly, this has also reignited positive sentiment in the memecoin sector as a whole. Although the recent price correction creates short-term uncertainty, the current technical structure suggests that this move is corrective in nature and not an overall trend reversal.

With DOGE now stabilizing above the key support level, traders are watching to see if the buyers are able to hold a higher low and open up opportunities for a further breakout.

Will the DOGE price be able to hold above its immediate support level? Let’s find out.

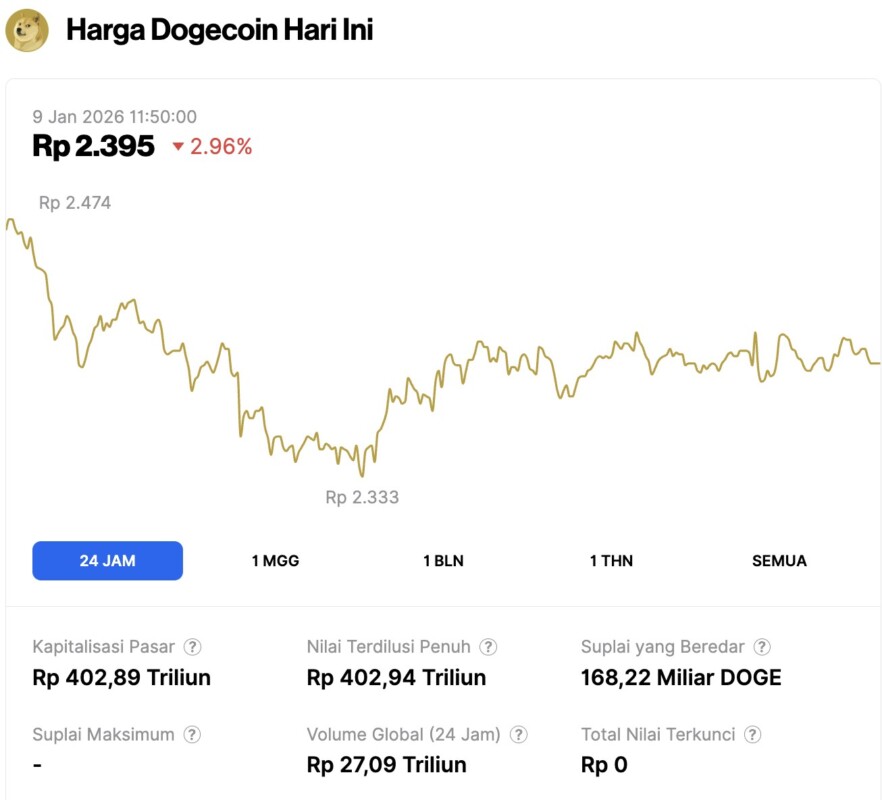

Dogecoin price drops 2.96% in 24 hours

On January 9, 2026, Dogecoin saw a 2.96% drop over the past 24 hours, trading at $0.1424, or approximately IDR 2,395. Throughout the day, DOGE’s price fluctuated between IDR 2,474 and IDR 2,333.

At the time of writing, Dogecoin’s market capitalization is estimated at around IDR 402.89 trillion, with a 24-hour trading volume of roughly IDR 27.09 trillion.

Read also: Dogecoin Breaks Key Resistance – Can DOGE Pass Three Sell Zones to Reach $0.20?

Profit Taking Slows Down Uptrend

The Chaikin Money Flow (CMF) gives a clear picture of the capital flows behind the DOGE price decline on the 4-hour chart.

Currently, the CMF indicator is in negative territory, around -0.16, which signals a short-term distribution phase. This figure reflects profit-taking by traders who are locking in profits, thus temporarily slowing down the upward momentum.

However, the price of DOGE is still well above its December low, which suggests that the overall accumulation structure has not broken down. From another technical perspective, the Moving Average Convergence Divergence (MACD) indicator also shows a similar cooling pattern.

The 26-day EMA line (orange) has crossed above the 12-day EMA (blue), and the histogram reversed to the red region. These changes signal a weakening of bullish momentum and reinforce the view that the Dogecoin price is undergoing a corrective phase.

However, this doesn’t necessarily indicate a complete trend reversal in a bearish direction. Under strong trending conditions, a drop like this is often a pause before the price resumes rising after momentum is restored.

Taking a closer look at Dogecoin’s price action, it took a dip after failing to hold above the $0.16 resistance zone. The rejection triggered a retracement to the $0.14 support area, which is now an important demand zone in the short term.

If this area is successfully defended, it would be a signal that buyers are still committed to keeping higher lows, as well as maintaining the overall bullish structure.

Dogecoin Buyers Still Hold a Slight Edge

On the daily chart (8/1), the Dogecoin price showed a reversal from the previous bullish trend, indicating the market is cooling down. However, technical indicators still show a slight bullish bias. One of them is the Directional Movement Index (DMI), which indicates that the buyers still have a slight advantage.

Read also: Ethereum Price Hovers at $3,100 Today: ETH Weekly Market Structure Shows Compression

As can be seen, the +DMI line is still above the -DMI line, which confirms the presence of buying pressure despite the price drop. However, the narrowing distance between the two lines signals a weakening momentum, not a complete trend reversal.

Meanwhile, the Average Directional Index (ADX) stands at 30.23, signaling that the trend is still quite strong although momentum is starting to wane. ADX readings above 25 indicate that the trend is still active, which means that the overall bullish structure on Dogecoin is maintained during this consolidation phase.

In addition, the Money Flow Index (MFI) is also still above the midline, indicating that capital inflows are still positive. With the MFI remaining above the 50 level, buying pressure is still more dominant than selling activity, and a reversal could happen in the near future if momentum indicators come back in line.

Where is DOGE Price headed next?

Based on the Fibonacci retracement levels as shown earlier, the price of DOGE is currently below the 0.236 Fib level, signaling difficulty in breaking the key resistance point at $0.16.

This level has served as a short-term ceiling, limiting the upside potential of the previous rally. If DOGE manages to break above $0.16 with confirmation of increased volume, then a path towards the next resistance at $0.19 could open up.

However, if the selling pressure continues and the price is pushed down, DOGE risks touching the support level at $0.11 – in which case it could invalidate the bullish momentum that has formed.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CCN. Dogecoin (DOGE) Price Pulls Back After Rally, Bigger Move Coming. Accessed on January 9, 2026