JasmyCoin Surges 12%: Will the upward trend continue?

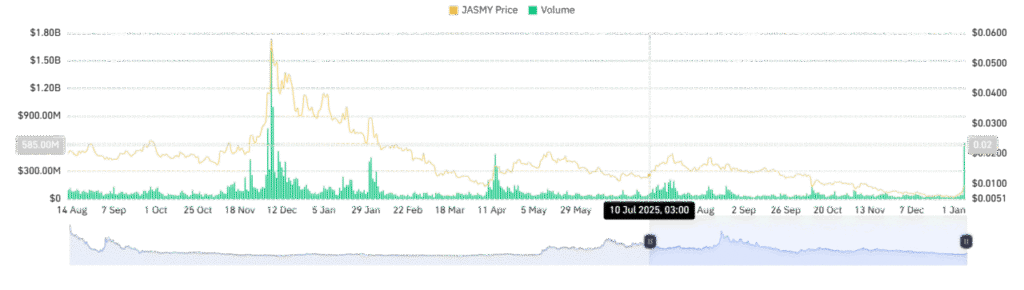

Jakarta, Pintu News – JasmyCoin recently reached a two-month peak, with significant gains driven by high demand in the Futures market. After experiencing a decline during the fourth quarter of 2025, the coin showed strong bullish momentum in early 2026.

For the seventh consecutive day, JasmyCoin recorded a significant increase, and managed to break through the long-standing upper limit barrier, with a 35.14% increase from $0.0074 to $0.01.

Causes of the JasmyCoin Spike

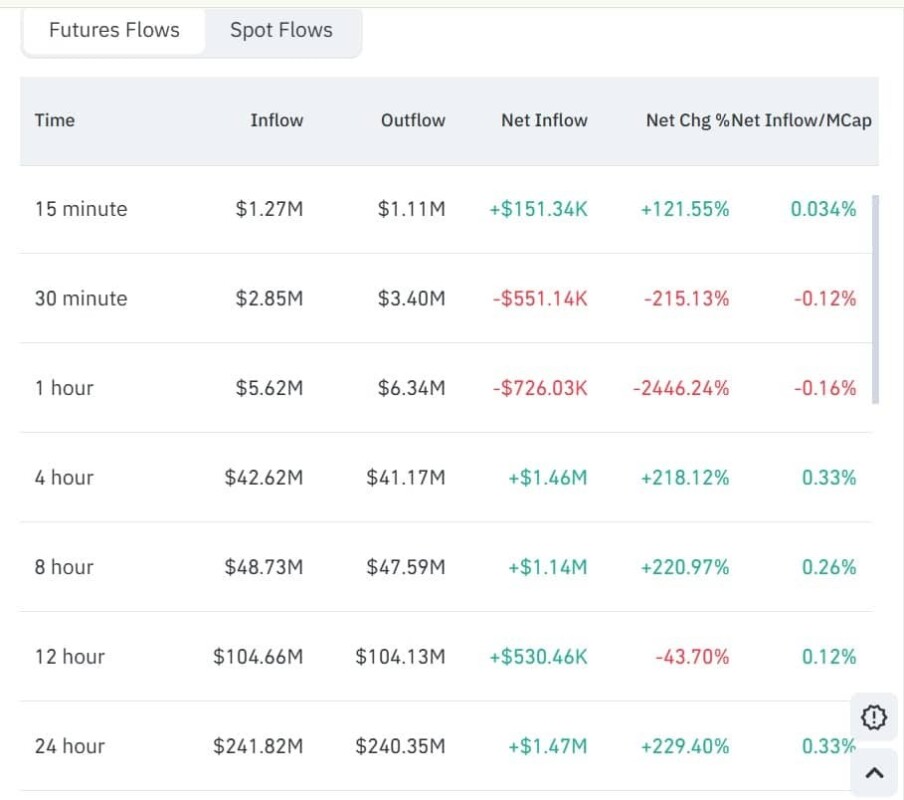

JasmyCoin’s price surge was fueled by increased activity in the Futures market. According to data from CoinGlass, derivatives volume surged by 1,134% to reach an annual peak of $769 million. Meanwhile, Open Interest, or the number of unclosed contracts, rose by 87% to reach a four-month peak of $46 million.

The simultaneous increase in OI and volume signaled greater participation in Futures, both for long and short positions. A significant capital surge occurred in the Futures market, with inflows reaching $247.4 million compared to outflows of $245.4 million. This indicates an increase in capital being used for leverage, hedging, and market direction bets by traders.

Also Read: 5 Conditions for the Crypto Market to Hit an All-Time High in 2026, Here’s What Needs to Happen!

Profit Realization Increases

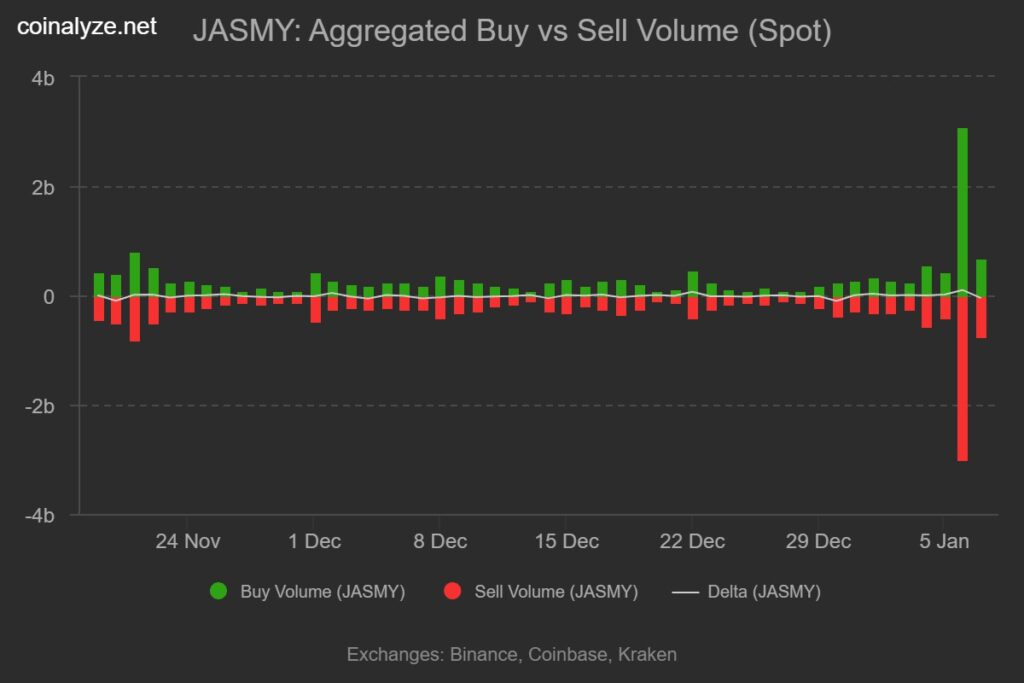

Along with the sharp price increase, investors who had previously incurred losses rushed to the spot market to realize profits. Data from Coinalyze shows that on January 6, buying volumes increased sharply. However, on January 7, there was a shift in market behavior with an increase in selling volume that reached 742 million, surpassing buying volume of 697 million.

As a result, JasmyCoin recorded a negative Buy Sell Delta of -45 million, signaling aggressive spot selling. This suggests that many investors chose to take advantage of the recent price increase.

Possible Sustainability or Just a Bubble?

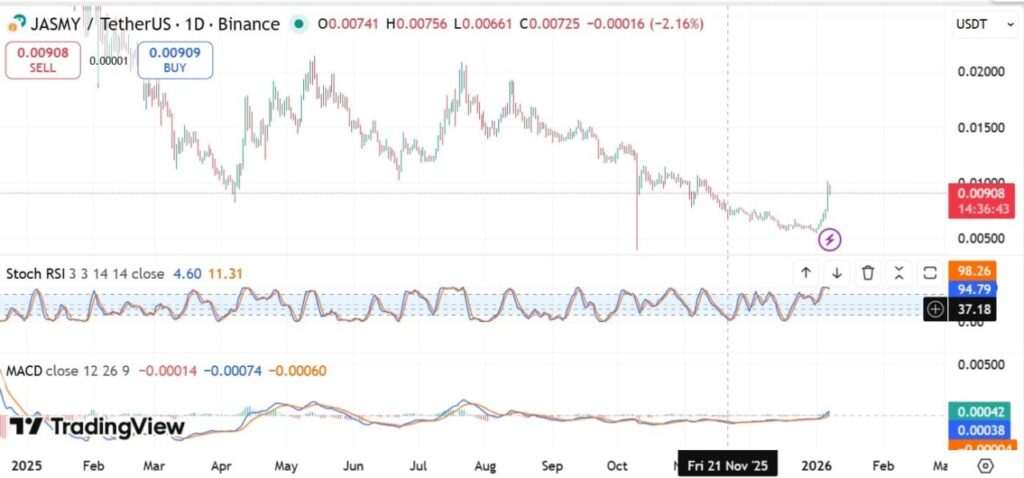

Although JasmyCoin showed large capital flows and a significant breakout, the Stochastic RSI indicator reached 100 and then dropped to 93, making a bearish crossover. This indicated weakness, as sellers started taking profits. Although the upward momentum is still high, the risk of a pullback remains, especially with the increased activity of sellers.

Current market conditions show a fierce battle between bulls and bears for control of the market. The next move will largely depend on the dominance of either party. If demand in the Futures market remains strong, JasmyCoin may continue its rise, break back to $0.01, and potentially reach $0.011. However, if profit takers dominate, the coin may experience downward pressure and drop to $0.0086.

Conclusion

With the ever-changing market dynamics, JasmyCoin shows potential for further growth or decline. Investors and traders should continue to monitor market indicators and volumes to make informed decisions in the face of price fluctuations.

Also Read: The Pattern Repeats? Ripple (XRP) is Ready to Surge Like 2017!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects

this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Jasmycoin surges 12%, breaks its range; can this rise continue?. Accessed on January 9, 2026