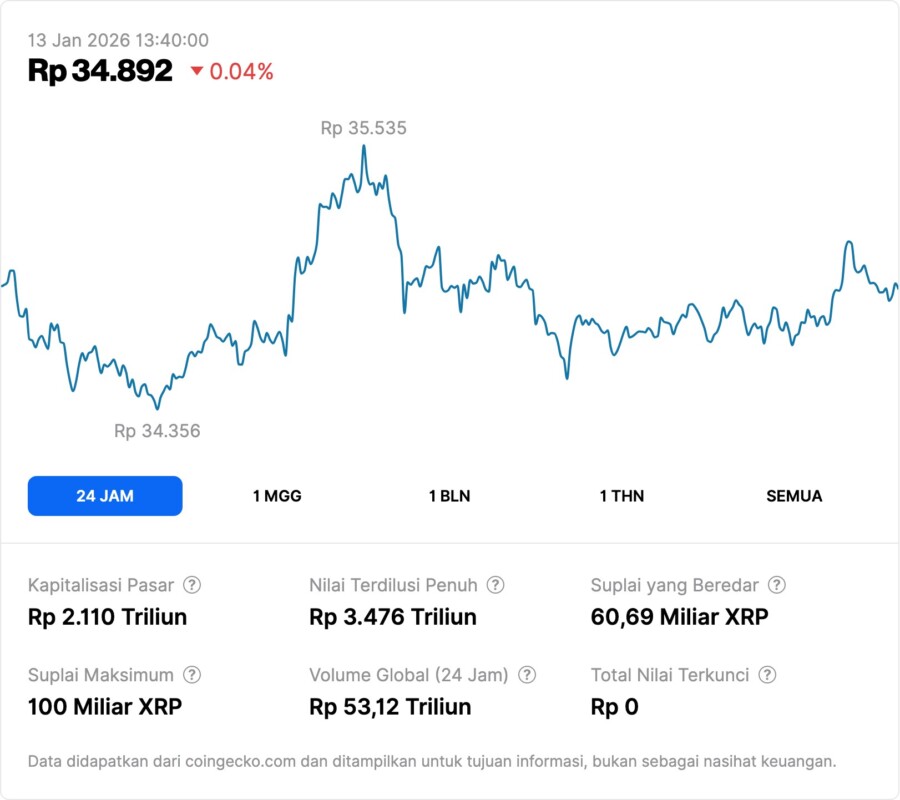

7 Factors Behind XRP’s Strong Performance and Potential to Continue in 2026

Jakarta, Pintu News – XRP has performed relatively strongly in early 2026 compared to major cryptocurrencies such as Bitcoin and Ethereum , supported by a combination of structural factors underlying market momentum. This performance reflects not only short-term trends, but also a set of fundamental conditions that could extend XRP’s relative advantage throughout the year.

1. Increased Regulatory Clarity

One of the key drivers of XRP’s momentum is the increasing regulatory clarity in large markets such as the United States. This clarity reduces the legal uncertainty that has hitherto overshadowed the asset and allows large institutions to more confidently place their capital. With more defined regulations, XRP is seen as more viable as an institutional crypto asset class than ever before.

This has also triggered a shift in perception among traditional investors, where legal risk is now more quantifiable and potential capital flows into XRP-related products have a stronger foundation.

Also Read: Shocking Prediction: XRP Poised for a Surge Post Last Drop!

2. Continuous Institutional Fund Flow

Institutional fund flows through products such as XRP-based ETFs have been a significant catalyst in the token’s performance. Since their debut, such ETF products recorded substantial capital inflows in the early 2026 period, reflecting broader institutional investor interest.

The consistency of these flows is what sets XRP apart from other cryptocurrencies that experience fluctuations in net capital flows, supporting relative price stability and demonstrating strong institutional demand.

3. Shrinking Supply on the Exchange

On-chain data shows that a significant amount of XRP is starting to flow out of crypto exchanges, reducing the number of tokens available for free trading. This reduction in active supply is often interpreted as a reduction in potential selling pressure, a condition that could create a more supportive price environment if demand continues to exist.

The shrinking supply on the exchange also suggests that long-term holders are likely to maintain their holdings, an indicator of confidence that usually favors a more stable price structure.

4. Relatively Bullish Market Sentiment

The overall sentiment towards XRP remains relatively positive. Social sentiment indicators and other on-chain metrics show that interest in XRP comes not only from short speculation, but also from medium-term conviction among market participants.

This bullish sentiment is important as it could trigger further accumulation by retail and institutional investors, broadening the demand base beyond mere technical or temporary catalysts.

5. Diversification in a Crypto Portfolio

XRP’s strong relative performance in early 2026 is also reflected in its position as one of the main altcoins chosen in crypto portfolio diversification strategies. When some assets go sideways or experience high volatility, XRP is seen as offering a different risk-reward profile due to its structural backing.

As crypto markets mature, diversification across multiple assets is becoming an increasingly common approach for large investors, which could extend the period of demand for XRP.

6. Relative Momentum Compared to Other Large Assets

XRP’s outperformance of some major assets such as BTC and ETH in early 2026 has come under scrutiny. The reasons include different capital flow patterns as well as technical dynamics that favored XRP’s relative rise in the early phase of the year.

This relative momentum is not just a short-term phenomenon as it is supported by a combination of fundamental catalysts that are different from other alternative assets.

7. Wider Integration and Adoption

In addition to the above factors, technical integration measures and strategic partnerships involving the Ripple network and the use of XRP in various cross-border payment applications also reflect the potential utility of this token beyond mere price speculation.

Wider use often has a positive impact on long-term value perceptions and helps support demand at fundamental levels.

Conclusion

Momentum built by a combination of regulatory clarity, sustained institutional flows, and supply and sentiment indicators makes XRP one of the strongest performing cryptocurrencies in early 2026. This creates the potential for a continuation of this positive performance, especially if fundamental catalysts remain supportive of price developments.

Also Read: US Dollar Predicted to Plummet in Early 2026 Before Reversing Direction

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

Bitcoin.com News. 3 Forces Behind XRP Outperformance Could Extend Into 2026. Accessed January 13, 2026.