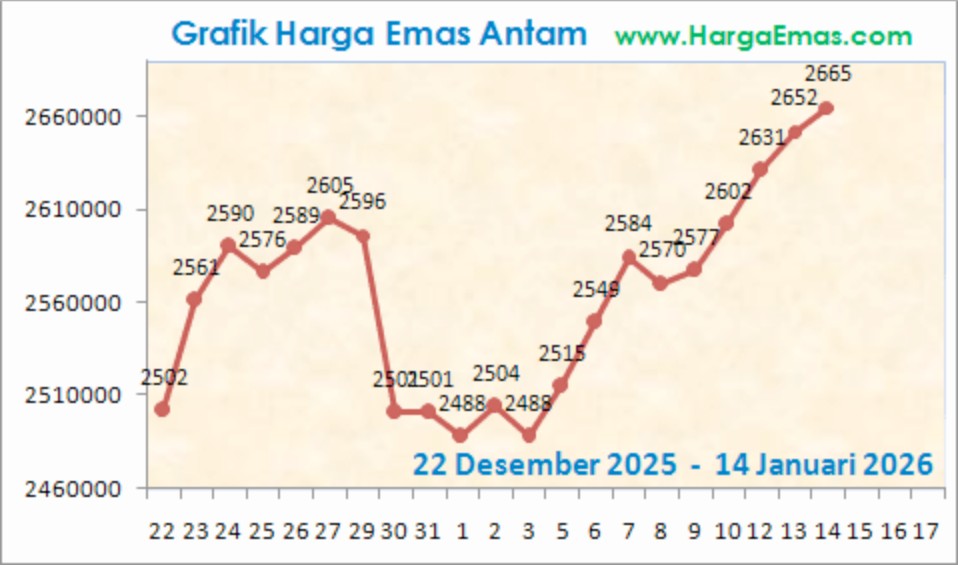

Antam Gold Price Chart Today January 14, 2026: Up IDR 11 thousand, Touching a New High Area

Jakarta, Pintu News – Antam’s gold price is back in the spotlight after today’s movement chart shows a consistent upward trend, in line with the strengthening world gold prices and the stable rupiah exchange rate against the US dollar. Based on the latest data, the price of Antam gold bars recorded a new high in recent weeks, strengthening gold’s position as a hedge asset amid global market dynamics.

1. Antam Gold Prices Strengthen in Early Trading

Today’s Antam gold price chart shows a significant increase compared to the previous day. As of January 14, 2026, Antam’s gold price was recorded at around IDR 2,665,000 per gram, up from the previous level of around IDR 2,652,000 per gram. This increase reflects the market’s positive sentiment towards precious metals.

The strengthening of Antam’s gold price is in line with the movement of global spot gold which is at USD 4,624.10 per troy ounce. If converted at an exchange rate of 1 USD = IDR 16,708, the world gold price is equivalent to around IDR 77.25 million per troy ounce. This condition provides strong support for domestic gold prices.

Also Read: 6 Robert Kiyosaki Prediction Facts: Silver to US$100 and New All-Time High in 2026?

2. Daily Chart Shows Gradual Uptrend

From a technical perspective, the intraday chart shows a gradual upward pattern from the morning session to noon. The price briefly moved in the consolidation area before finally continuing to strengthen to the daily high zone. This pattern indicates a steady buying interest in the gold market.

The uptrend seen on the daily chart also signals that selling pressure is relatively limited. Investors tend to hold gold as a safe asset, especially amid global uncertainty. This situation makes Antam’s gold price relatively maintained despite short-term fluctuations.

3. Effect of World Gold Price on Antam

The increase in Antam’s gold price is inseparable from the surge in world gold prices which still remain at a high level. Concerns about the stability of global monetary policy encourage demand for safe haven assets such as gold. This condition also affects the price of physical gold in the country.

An upward movement in global gold prices is usually immediately reflected in Antam gold prices due to the daily price adjustment mechanism. As long as global gold prices remain strong, there is limited room for correction in Antam gold prices. This is an important factor that investors pay attention to.

4. Rupiah Stability Curbs Price Volatility

The relatively stable USD/IDR exchange rate at around IDR16,879 helped maintain Antam’s gold price movement. When the rupiah does not experience a sharp weakening, the increase in domestic gold prices is more influenced by global factors. This situation makes the gold price chart look more controlled.

Exchange rate stability also reduces the risk of extreme price spikes. For retail investors, this provides room to observe price movements more calmly without the pressure of excessive volatility.

5. Comparison with Digital and Crypto Assets

Interestingly, the strengthening of gold comes at a time when some crypto assets and cryptocurrencies are experiencing more volatile movements. Gold reaffirmed its position as a traditional hedge asset that is relatively stable compared to digital assets. This creates a clear contrast between the physical gold and crypto markets.

For investors who have exposure to both crypto and gold, this highlights the importance of diversification. Gold often acts as a portfolio balancer when digital assets experience sharp fluctuations.

6. Short Term Charts Point to New Resistance

In the short term, the Antam gold price chart shows the potential for testing a new resistance area above IDR 2.67 million per gram. If this level is successfully penetrated, further upward opportunities are still open. However, investors also need to be aware of the potential for technical corrections after consecutive increases.

Further price movements will largely depend on the direction of world gold and global macro sentiment. As long as these factors remain favorable, the trend of Antam gold has the potential to stay positive.

7. Implications for Gold Investors

Today’s Antam gold price chart illustrates that gold is still in an uptrend phase. Long-term investors tend to see this condition as a signal of stability, not short-term speculation. A gradual and disciplined approach remains a relevant strategy.

Amidst the volatility of crypto assets and cryptocurrencies, Antam gold again shows its defensive character. Understanding the daily price chart can help investors make more measured decisions.

Also Read: Monero Hits Record High, Investors Leave Zcash!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- HargaEmas.com. Antam Gold Price Chart and World Spot Gold. Accessed January 14, 2026.