Why Crypto is Down Today, January 19, 2026

Jakarta, Pintu News – The European Union has stated that it intends to take decisive action against the United States in response to new tariffs imposed by President Trump.

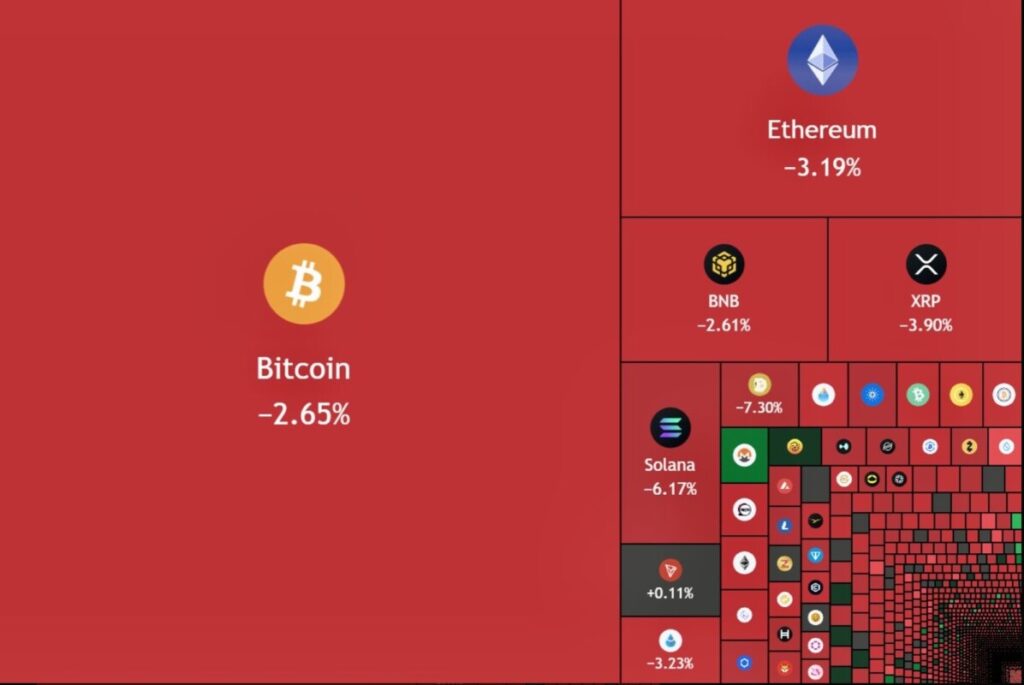

This led to a huge crash in the crypto market, which triggered massive liquidation.

Trump triggers another crypto market crash

The crypto market has suffered another setback due to continued trade tensions between the United States and the European Union. The price of Bitcoin suddenly plummeted in early trading hours on Monday, leading to the liquidation of more than $850 million.

Read also: Bitcoin (BTC) to Skyrocket in 2026? Here’s Arthur Hayes’ Shocking Prediction

This decline occurred while the US stock market was still closed due to a national holiday in the country. The price of Bitcoin fell sharply from around $95,000 to as low as $91,000. This erased the gains previously recorded in recent weeks, where BTC briefly reached $97,000.

Altcoins also took a hit following Bitcoin’s lead, causing the total crypto market capitalization to drop by around 3%. Since last Thursday, the market has lost more than $110 billion in total value.

The trigger was Donald Trump’s announcement that the US would impose a 10% tariff on goods from major countries in the European Union from February 1. He also threatened to raise the tariff to 25% from June 1 if no agreement was reached on the purchase of Greenland.

This move is clearly not well received by European countries who are now preparing to take retaliatory action. Meanwhile, the US government is still waiting for a Supreme Court decision regarding the legality of Trump’s tariff policy. This uncertainty has worsened the overall market sentiment.

EU prepares strong tariff response to President Trump

The crypto market’s fall has deepened after signals emerged from Europe regarding a counter plan to the threat of tariffs from the United States. According to a Reuters report, EU ambassadors reached an agreement on Sunday night to prevent Trump from implementing tariffs against member states.

Read also: 4 Crypto Highlighted by Analyst Ali Martinez Right Now, What’s Up?

EU leaders plan to discuss possible measures at an emergency meeting in Brussels on Thursday. One of the options being considered is a tariff package of 93 billion euros (about $107.7 billion) on imports from the US.

If approved, this policy could come into effect automatically on February 6 after a six-month suspension.

Another option being considered is the implementation of an “Anti-Coercion Instrument (ACI)” that could restrict access to banking services and narrow trade channels for the US.

Previously, investors had feared a crypto market crash when the US arrested the Venezuelan President, but the market held its ground.

Meanwhile, the eight countries targeted by the US tariffs have sent military personnel to Greenland to protect the region from American interference.

“Tariff threats undermine transatlantic relations and risk triggering a dangerous spiral of conflict,” said a joint statement from the countries.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Crypto Market Crash as EU Considers “Retaliatory Tariffs” Against the US. Accessed on January 19, 2026