5 Popular Platforms Traders Use to Track Crypto Whale Activity

Jakarta, Pintu News – Crypto wallets with large token balances continue to influence price movements on various blockchains. Traders often refer to these wallets as “whales”. Transactions made by whales can indicate accumulation activity, distribution, or specific asset placement strategies.

It is for this reason that many market participants utilize crypto whale tracking tools to monitor wallet activity and analyze capital flows. So, what are the platforms that can monitor whale crypto movements?

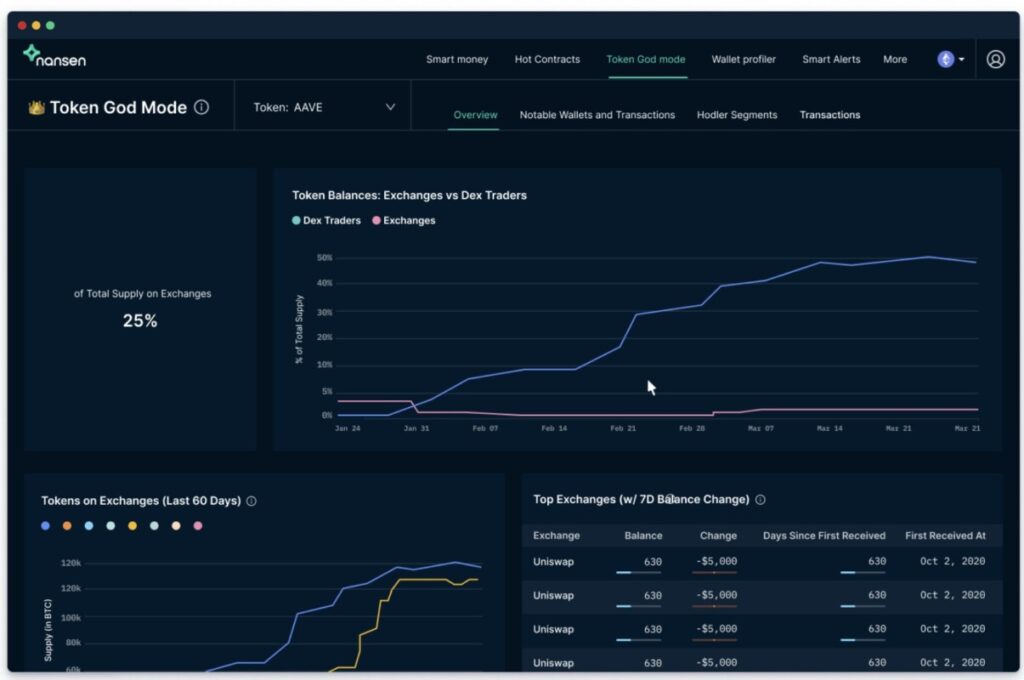

Nansen – Good for Inflow Monitoring, Token Outflow, and NFT Tracking

Nansen.ai monitors whale activity across major EVM-compatible blockchains. The platform’s focus is on overall capital movements, not just individual transactions. The Nansen Spotlight feature displays assets with the highestinflows andoutflows, helping traders quickly identify trending tokens.

Read also: Silver Price Prediction 2026-2030, How will it fare in the next 5 years?

Users can switch to the token dashboard to analyze inflow and outflow data as bullish (positive) or bearish (negative) signals. This approach allows users to prioritize research without having to check wallets one by one.

Nansen’s main strengths include:

- Real-time tracking of inflows and outflows

- Smart money labeling and wallet tagging

- NFT market and portfolio analysis

- More than 500 million addresses have been labeled

Nansen provides a free version with limited features, while paid plans start at $69 per month.

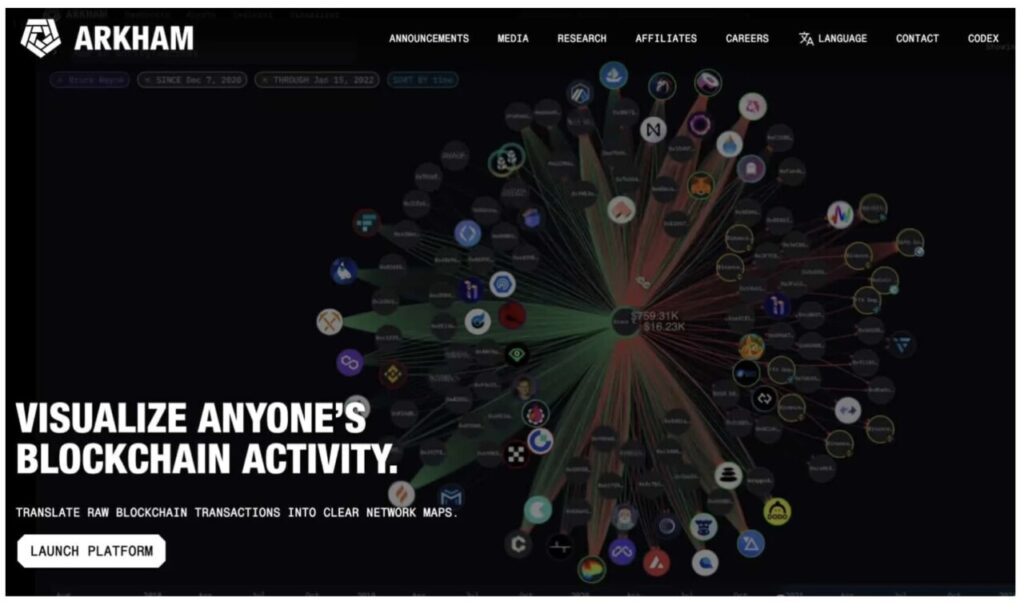

Arkham Intelligence – Good for Customizable Alert Dashboard

Arkham Intelligence focuses on transparency and customization of alerts. Users can view details of wallet holdings, transaction history, and interactions with exchanges across 18 supported blockchain networks. Its dashboard system allows users to create customized views based on tokens,chains, or wallet groups.

The alert feature is a major advantage. Users can monitor large BTC or ETH movements, deposits to exchanges, or the behavior of certain wallets-all without having to pay a subscription fee.

Arkham’s standout feature:

- Free and customizable wallet alerts

- Detailed tracking of wallet and exchange interactions

- User-created dashboard

Arkham also runs the Intel Exchange powered by the ARKM token, allowing users to trade blockchain intelligence data.

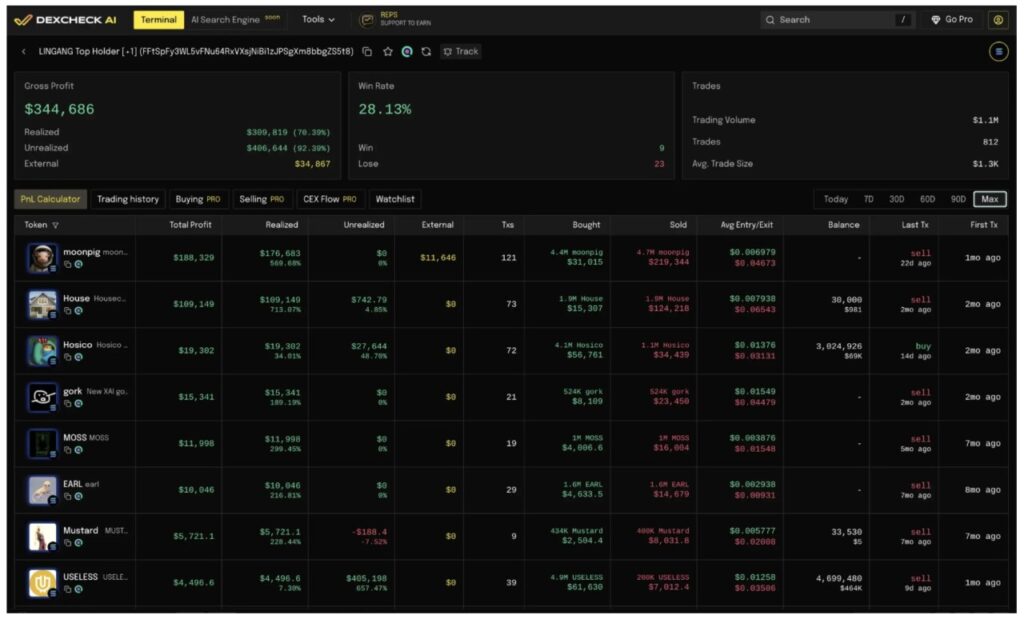

DexCheck – Good for Traders on Decentralized Exchanges (DEX)

DexCheck prioritizes activity on decentralized exchanges. The platform monitors large trades on DEX in real-time and displays large buy/sell whales as they occur. Traders can directly observe market behavior from on-chain transactions.

The wallet analytics feature allows users to reviewprofit & loss, trading history, and win ratio. Telegram bots extend this functionality with instant alerts.

DexCheck’s flagship tool:

- Live monitoring of whale trading on DEX

- Profit and loss analytics and wallet performance metrics

- Telegram bot for real-time monitoring

DexCheck’s premium access is granted through staking or burning DCK tokens, with prices starting from the equivalent of $99 per month.

Read also: Pudgy Penguins and Manchester City Partnership: Can PENGU’s Price Soar?

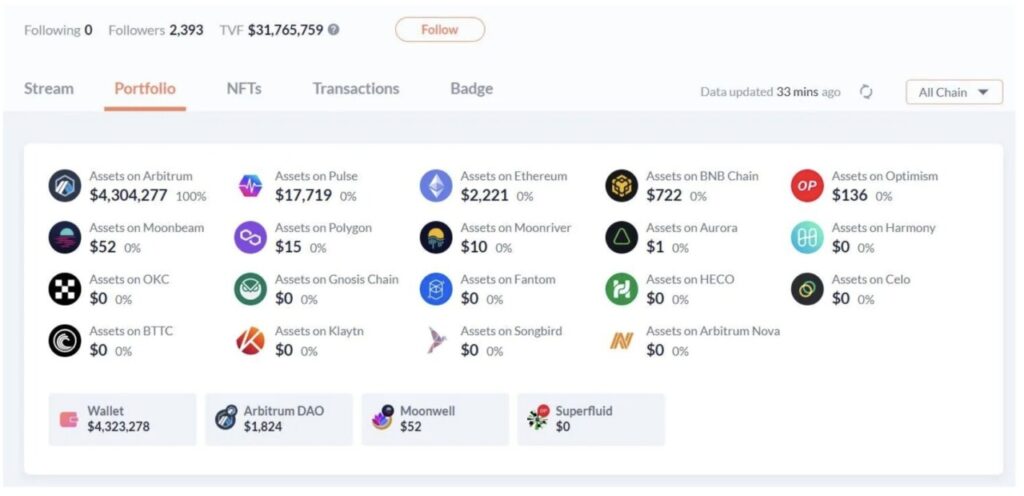

Debank – Good for Social Posts and New Token Detection

Debank serves as a portfolio tracker as well as a whale activity monitoring tool. The platform supports various EVM networks and quickly integrates new tokens and protocols.

Users can view wallet holdings, exposure to protocols, and transaction history in a clear and easy-to-understand view.

Debank also features a social feed where verified high-value wallet owners share their views and strategies. This transparency helps traders not only understand what the whales are doing, but also the reasons behind their actions.

Debank’s top features:

- Detailed view of wallet holdings and exposure to the protocol

- Fast detection of new tokens

- Social feed from a verified whale account

Debank Pro plans start at $15 per month.

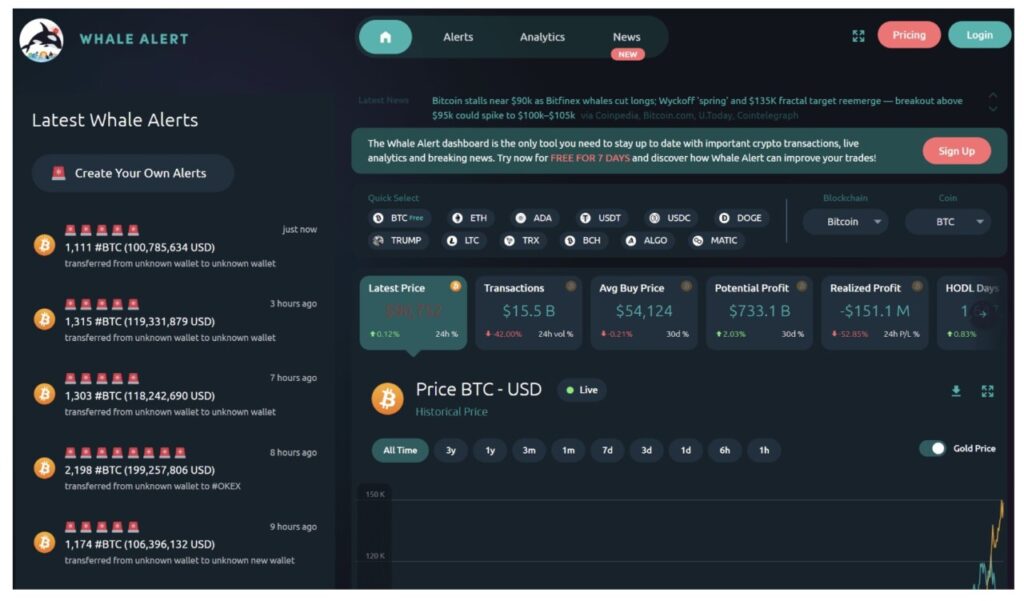

Whale Alert – Good for Simple Large Deal Alerts

Whale Alert monitors large transactions on various major blockchains and disseminates them publicly. The service sends alerts via the X platform (formerly Twitter) and provides API access for real-time data delivery.

Many traders use Whale Alert to observe large transfers between wallets and exchanges.

Free alerts may experience a slight delay, while paid plans offer instant notifications and more in-depth analytics.

The main feature of Whale Alert:

- Major transaction alerts across major networks

- API access for automated systems

- Historical transaction data

Prices start at $29.95 per month for alert access, with advanced plans aimed at institutional users.

How Do Traders Use Whale Tracker?

Traders utilize whale trackers for various purposes. They monitor accumulation trends, observe inflows to exchanges, as well as track wallet behavior during periods of market volatility.

Some traders even use multiple tools at once-since each platform highlights different signals, relying on just one data source can be suboptimal.

Tracking whale activity does not guarantee the ability to time the market correctly. However, it does provide important context. Understanding where big capital is headed can help make smarter decisions in the fast-paced crypto market.

As transparency on the blockchain increases, whale tracking tools continue to evolve. The tools reviewed above show how traders observe the behavior of smart money in both centralized and decentralized ecosystems.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpaper. Best Crypto Whale Trackers. Accessed on January 23, 2026