Bitcoin Stalls Near $89,000 as Selling Pressure Jumps 61% in a Single Day

Jakarta, Pintu News -The price ofBitcoin is stagnating. BTC has traded flat in the past 24 hours and is down about 6% over the week. At first glance, there is no noticeable movement. But beneath the surface, there are four risk signals that are starting to align. A bearish chart pattern is starting to form.

Long-term holders started selling faster. Demand for ETFs recorded its weakest week since November. And buyers replacing sellers tend to be short-term and speculative.

Each of these signals may not be enough to shake the market. But taken together, they suggest that confidence in Bitcoin is starting to weaken at a sensitive level.

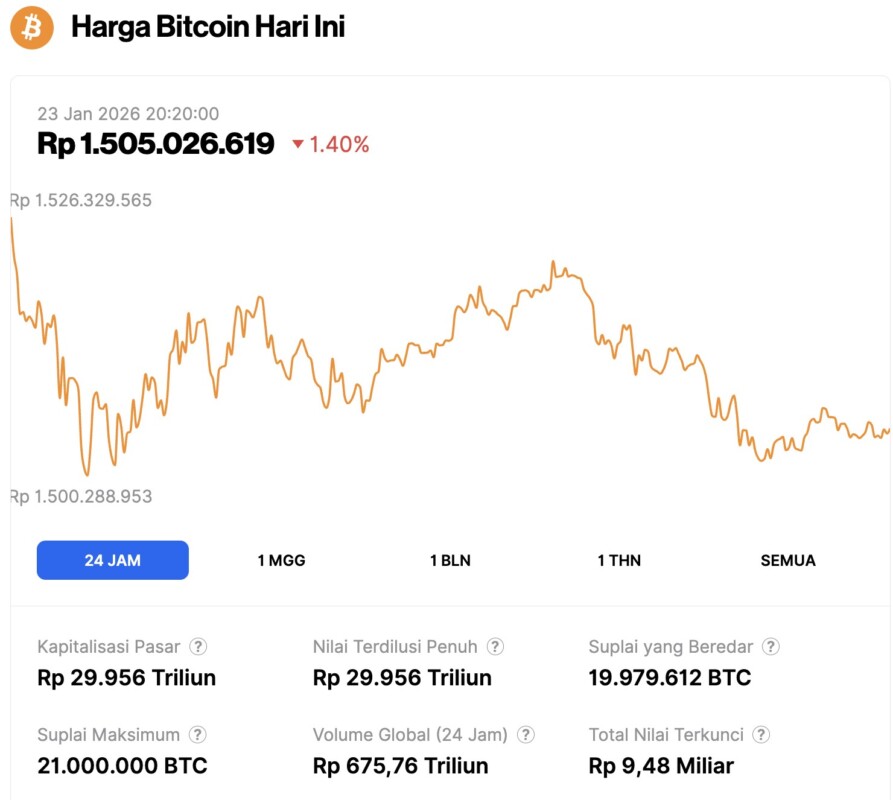

Bitcoin Price Drops 1.40% in 24 Hours

As of January 23, 2026, Bitcoin was trading at $89,240.57, equivalent to IDR 1,505,026,619 — down 1.40% over the past 24 hours. During that time, BTC dipped to a low of IDR 1,500,288,953 and reached a high of IDR 1,526,329,565.

At the time of writing, Bitcoin’s market capitalization stands at approximately IDR 29,956 trillion, while 24-hour trading volume has dropped by 26% to IDR 675.76 trillion.

Read also: Donald Trump Delivered 3 ‘Bullish’ Crypto Signals at Davos – Number 2 Shocked!

Bearish Chart Pattern Forms as Momentum Weakens

On the 12-hour chart, Bitcoin is forming a head-and-shoulders pattern. This pattern reflects weakening upside momentum, where each rally attempt ends up lower than the previous one. The neckline of this pattern is around $86,430.

If the price breaks the neckline, the measured movement indicates a downside potential of around 9-10%.

Momentum favors this risk. The 20-period exponential moving average (EMA) is starting to level off and is approaching the 50-period EMA. The EMA gives more weight to recent prices and helps indicate the direction of the trend. If there is a bearish crossover between the two EMAs, it will make it easier for sellers to push prices even lower.

This weakened structure becomes more worrisome when combined with the behavior of asset holders.

Long-term holders boost sales as confidence weakens

Long-term holders-that is, wallets that hold Bitcoin for more than a year-began to increase selling pressure.

On January 21, long-term holders were recorded selling around 75,950 BTC (outflow). But on January 22, the figure jumped to about 122,486 BTC. This is an increase of about 61% in just one day, indicating a sharp acceleration instead of a gradual distribution.

This selling was not caused by fear, but rather by reduced confidence in the potential for price increases. Long-term holders’ NUPL indicator, which measures unrealized gains or losses, fell to its lowest level in six months, although it is still within the confidence zone. This means that these holders are still in a position of profit.

In other words, the selling is voluntary. They are choosing to reduce their exposure, not because they are forced to. When high conviction holders start selling, it is important to pay attention to who is buying. This release of supply from long-term holders was also highlighted by experts on platform X.

Bitcoin ETF demand weakens as speculative buyers step in

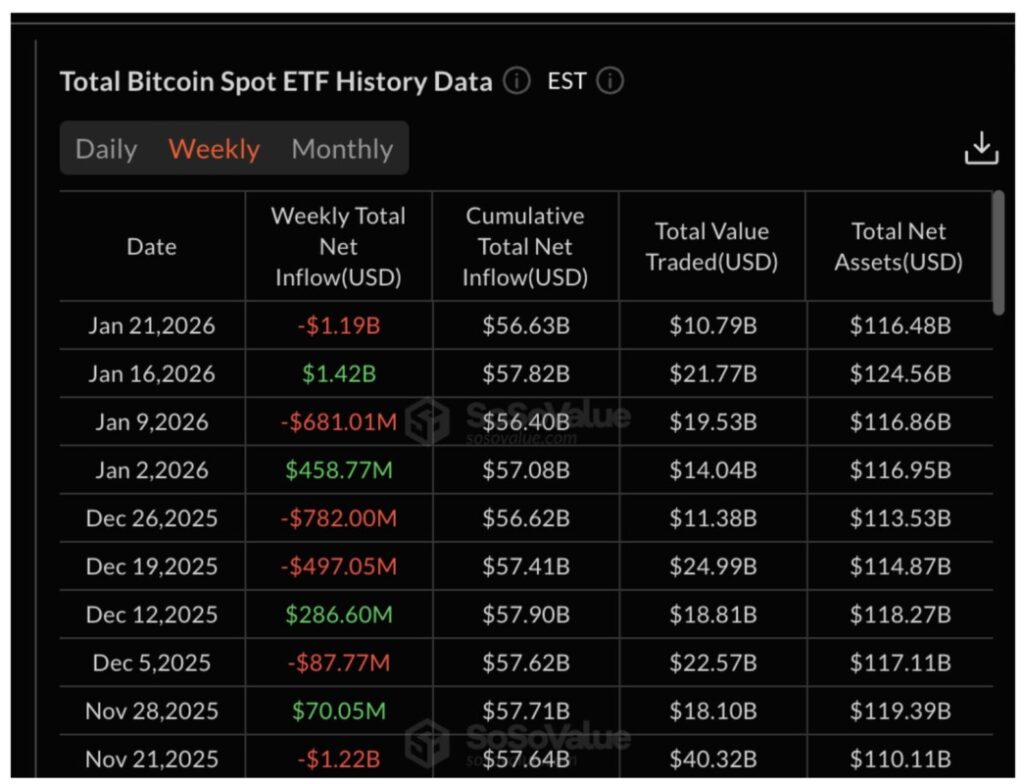

The spot Bitcoin ETF just recorded its weakest performance in 2026 and had its lowest demand week since November.

For the week ending January 21, ETFs experienced net sales of around $1.19 billion. This eliminated one of the stable sources of demand that was previously able to absorb selling pressure from holders when prices corrected.

Read also: Bitcoin Leads, Altcoins Follow – But 2026 Isn’t Like 2016: Here’s What You Need to Know!

In other words, just like long-term holders, current ETF participants also seem to be unsure of BTC’s price prospects.

At the same time, HODL Waves data-a metric based on duration of holdings-showed rising speculative participation. The group of holders with a duration of one week to one month increased their share of supply from around 4.6% on January 11 to around 5.6% currently. This translates to a nearly 22% increase in the group’s share in a short period of time.

This is important because these types of holders tend to buy when prices go down and sell when prices go back up. They do not provide strong long-term support to the price.

As such, Bitcoin is currently undergoing a transition from long-term holders and ETFs to short-term traders. Transitions like this often limit upside potential and increase sensitivity to downside.

Key Bitcoin Price Levels that Determine Risk Escalation

All four risk factors-technicals, selling by long-term holders, weak demand for ETFs, and an influx of speculative buyers-are now converging on a narrow price range.

On the upside, Bitcoin needs to close 12-hour candles strongly above $90,340 to relieve short-term pressure (i.e. above the right shoulder of the head-and-shoulders pattern). Furthermore, if the price manages to reclaim the $92,300 level, it would be more significant as it restores the price position above the important moving averages.

Until then, the bearish pattern remains active.

On the downside, if the price drops below $86,430, it will confirm the breakout of the head-and-shoulders pattern. With long-term holders selling faster, ETF demand at its lowest in months, as well as the dominance of speculative buyers, the price drop could accelerate once price support fails to hold.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin Warning: Selling Pressure Spikes 61% in a Day as 3 Other Risks Stack Up. Accessed on January 23, 2026