Bitcoin Slides to $87,000 — Is the Market Poised for a Comeback?

Jakarta, Pintu News – Traditional investors in the United States have begun to reduce their exposure to Bitcoin , selling the asset through fund managers after it failed to deliver significant gains in recent weeks.

Much of this sell-off occurred through the Bitcoin Spot ETF in the US, which recorded the largest weekly net outflow of $1.33 billion – the highest figure since February 2025.

Large outflows of this nature usually reflect a bearish market sentiment. However, Bitcoin is still showing relative resilience, supported by activity from short-term holders (STHs).

This raises an important question: can STH maintain this pattern if traditional investors continue to unwind their positions? So, how will Bitcoin price move today?

Bitcoin Price Drops 1.15% in 24 Hours

As of January 26, 2026, Bitcoin was priced at $87,792, or approximately IDR 1,478,140,973 — marking a 1.15% drop over the past 24 hours. During this period, BTC reached a low of IDR 1,452,594,005 and a high of IDR 1,498,206,889.

At the time of writing, Bitcoin’s market capitalization sits at roughly IDR 29,415 trillion, while its 24-hour trading volume has surged by 189%, reaching IDR 831.63 trillion.

Read also: Bitcoin will Bull Run in 2026? Here’s Why Arthur Hayes is Optimistic!

Short-Term Holders Begin to Approach Break-even Point

Signs of a gradual shift in sentiment among short-term Bitcoin holders are beginning to emerge, particularly through changes in the Coin Age Bands, which indicate a transition towards long-term holding behavior.

The Short-Term Holder Spent Output Profit Ratio (STH SOPR) indicator, which measures whether they sell at a profit or loss, shows that the level of profitability is almost reached.

STH SOPR uses 1 as a neutral benchmark. Values above 1 mean profit-taking, while those below indicate sales at a loss. The distance from 1 reflects how big the profit or loss is.

Currently, Bitcoin’s STH SOPR value stands at 0.99, slightly below the profitability threshold. This near-neutral figure indicates a slow adjustment, driven by increased accumulation from short-term holders.

Historically, when the STH group starts to enter the profit zone, the conviction to hold the asset usually strengthens. Holders are less likely to rush to sell, as improving conditions often signal the potential for further price recovery.

The Market is Ready to Rebound

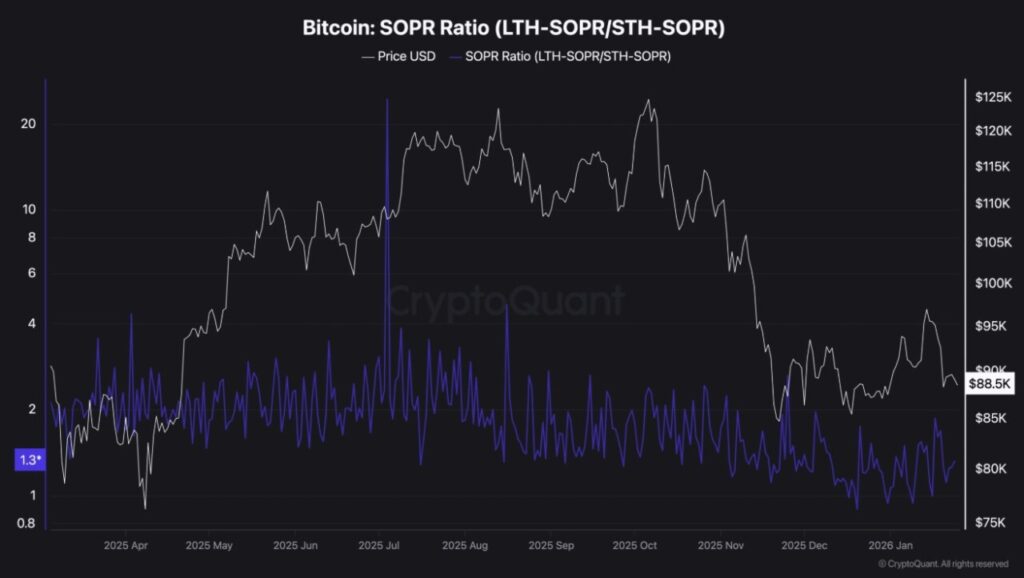

An analysis of the ratio between SOPR’s Long-Term Holder (LTH) and SOPR’s Short-Term Holder (STH) shows that current market conditions still favor further upside potential for Bitcoin.

Currently, the ratio stands at around 1.3, which is low in its historical range. When this ratio rises to extreme levels, it usually signals that Bitcoin has reached a local peak. But for now, the market is still well below that level.

Read also: When is the Best Time to Buy XRP? Here’s ChatGPT’s Analysis

This indicates that the recent price drop has not marked the end of the up-cycle, and buyers may still step in to accumulate at current price levels.

If the STH SOPR value manages to break convincingly above the neutral 1, this positive outlook will be further reinforced. As it rises, the ratio of LTH to STH SOPR is also likely to rise – a dynamic that has historically supported Bitcoin’s price strength.

Long-term holders continue to play an important role

While short-term holders play an important role in maintaining price stability and supporting a potential rebound, long-term holders (LTH) remain an equally crucial element.

For the current market structure to remain intact, LTHs need to refrain from selling in bulk. Significant distribution from this group could put immense pressure on the already limited demand.

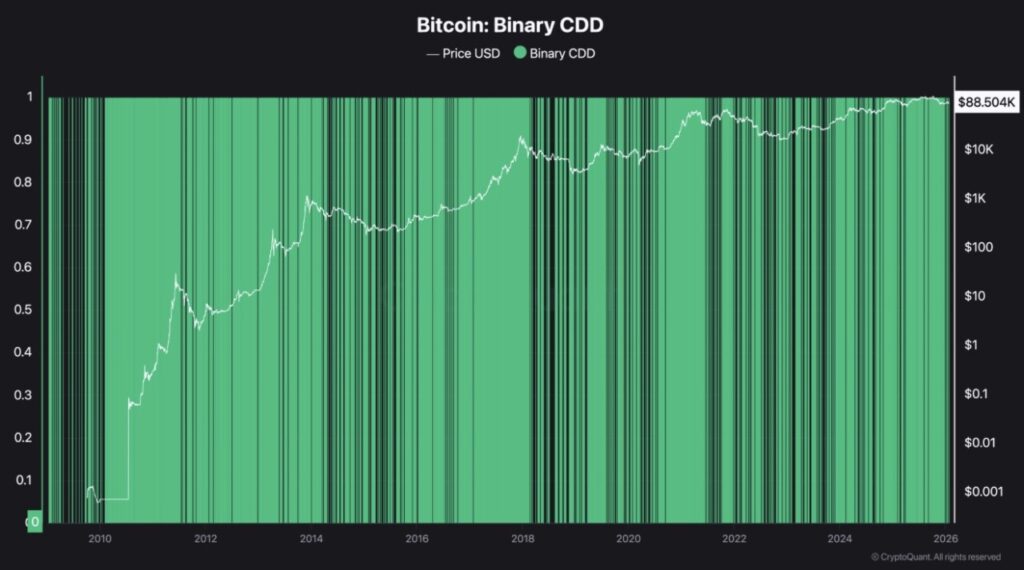

The Binary Coin Days Destroyed (CDD) indicator, which tracks whether LTHs prefer to sell or keep their coins, shows very minimal selling activity. This signals that long-term holders are still relatively passive and confident in their positions.

As long as the Binary CDD value remains at 0, market conditions are considered to remain positive overall, supporting the growing constructive sentiment in the Bitcoin market.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. Bitcoin: Why long-term holders aren’t flinching at $1.3B in ETF exits. Accessed on January 26, 2026