7 Tesla & SpaceX Facts and Bitcoin Holdings in Corporate Strategy

Jakarta, Pintu News – Several major companies owned by Elon Musk, including Tesla, Inc. and SpaceX, maintained holdings of Bitcoin as part of their treasury assets, without selling during the recent period of price declines, suggesting that both entities view Bitcoin as a long-term “digital gold” asset.

1. Tesla and SpaceX Defend Bitcoin

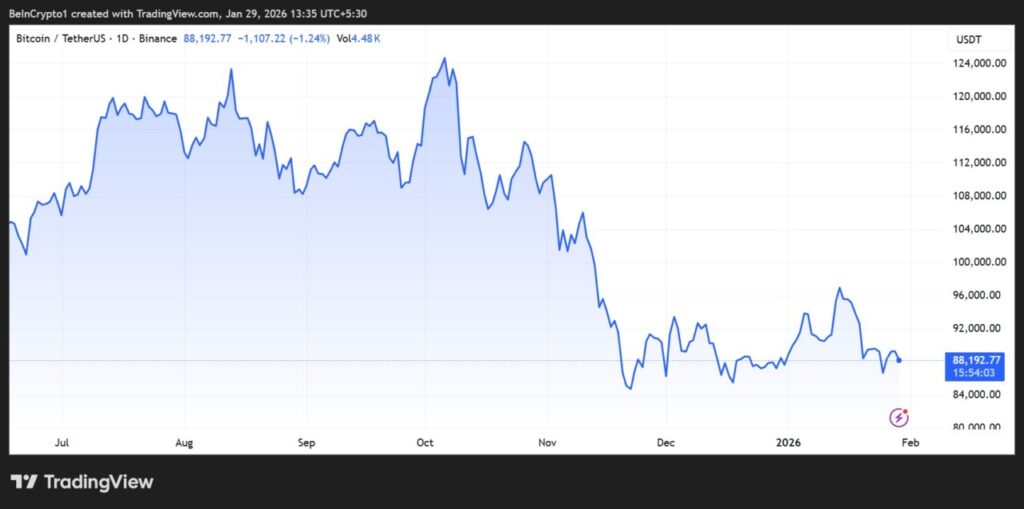

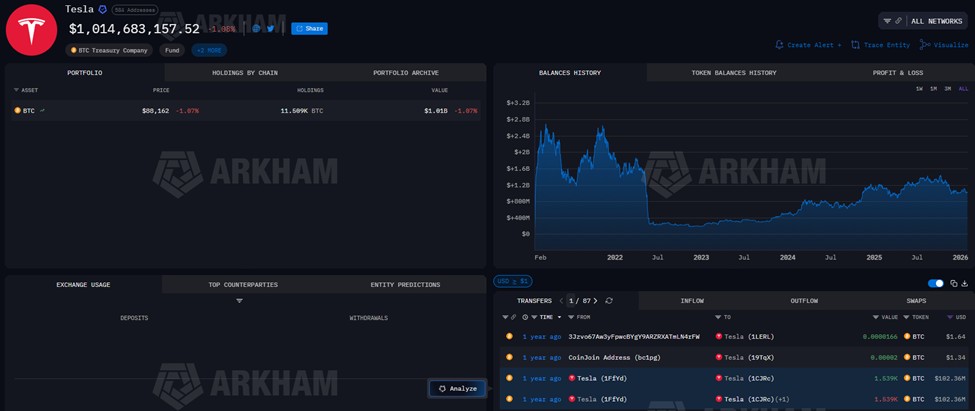

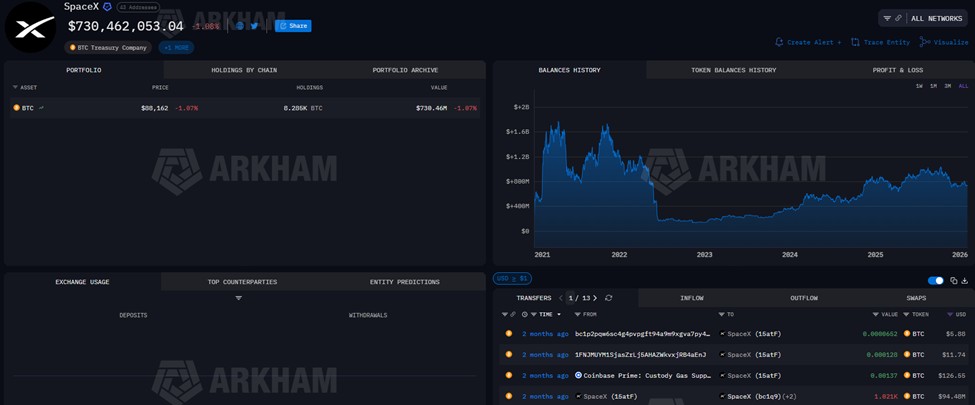

In the latest financial report, Tesla and SpaceX did not make any significant changes to their Bitcoin holdings despite the BTC price dropping by around 23%. Tesla retained about 11,509 BTC on its balance sheet with no new sales to cover losses. Similarly, SpaceX did not offload its BTC assets, demonstrating a commitment to long-term holdings.

Also Read: 7 Important Facts: Impact of Whale Sale on XRP Price

2. Bitcoin Treated as a Treasury Asset, Not Just a Short Investment

Both companies position Bitcoin not as a short-term speculation tool, but as a long-term treasury asset that functions like “digital gold” on their balance sheets. This approach implies that Bitcoin has a strategic role beyond ordinary trading. This decision demonstrates the corporations’ confidence in the long-term stability of Bitcoin’s value.

3. Accounting Impact and Mark-to-Market Loss

Even though Tesla and SpaceX did not sell Bitcoin, the mark-to-market loss due to the drop in BTC price is still recorded in accounting. This loss does not come from sales – rather, it is an adjustment to the value of Bitcoin assets recorded in the financial statements. This shows how market value fluctuations affect financial reporting without involving actual sales.

4. History of Tesla’s Bitcoin Holdings

Tesla first became a major Bitcoin investor in 2021, acquiring BTC before selling most of those holdings in the following period. In the past, Tesla has sold around 75% of their Bitcoin – a decision that was later seen as a relative loss as the price rose sharply after the sale. However, around 11,509 BTC is still held today.

5. SpaceX and BTC Active Management

Beyond just holding, SpaceX has also transferred and consolidated Bitcoin from multiple addresses to a single wallet, indicating internal management of the digital asset. On-chain data indicates SpaceX has moved large amounts of BTC as part of international treasury management. These movements were not sales, but internal reorganizations for custody security and efficiency reasons.

6. Corporate Treasury Implications

The strategy of keeping Bitcoin on the company’s balance sheet demonstrates the belief that digital currencies can serve as a value-diversifying asset among other asset classes.

This approach is similar to how traditional companies hold gold or bonds for reserve of value purposes. As such, Tesla and SpaceX show that Bitcoin is increasingly seen not just as a crypto speculation but as part of a corporate financial strategy.

7. Long-term Perspective for Investors

Bitcoin holdings by large corporations such as Tesla and SpaceX signal to the market that non-financial institutions may consider crypto assets as part of treasury diversification.

Young and novice investors should understand that such corporate strategies reflect a long-term view of Bitcoin’s role in the financial ecosystem. However, due to the high volatility of digital assets, these strategies still carry risks that should be considered in the context of wise portfolio management.

Also Read: 5 Important Insights Predicted SHIB Will Drop First Before Reaching New ATH

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

– Lockridge Okoth/BeInCrypto. Tesla & SpaceX’s Bitcoin Corporate Holdings: Treating Bitcoin Like Digital Gold. Accessed January 30, 2026.