Bitcoin Plunges to $74,000, Falling Below Its Fair Value for the First Time!

Jakarta, Pintu News – The price of Bitcoin plummeted past the crucial support level of $80,000, hitting a nine-month low, and causing the liquidation of $2.6 billion worth of trader positions.

According to data from BeInCrypto, a 6% drop pushed the Bitcoin price down to $77,082 before making a small recovery. This marks the first time Bitcoin price has touched such a low level since April 2025.

Then, how will the Bitcoin price move today?

Bitcoin price drops 4.91% in 24 hours

As of February 2, 2026, Bitcoin was trading at $74,982, equivalent to approximately IDR 1,264,071,735, marking a 4.91% decline over the past 24 hours. During this period, Bitcoin hit a low of IDR 1,264,071,735 and reached a high of IDR 1,333,898,084.

At the time of writing, Bitcoin’s market capitalization is estimated at IDR 25,714 trillion, while 24-hour trading volume has dropped by 21%, settling at around IDR 989.62 trillion.

Read also: 3 Altcoins that Have the Potential to Beat Bitcoin, Ethereum, and XRP by February 2026

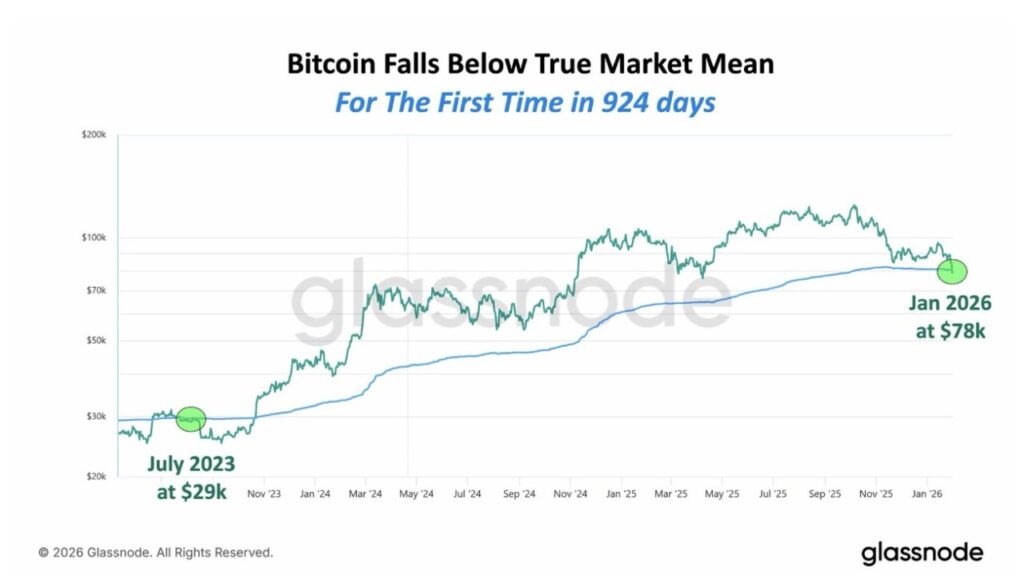

Bitcoin falls below ‘fair value’ for the first time in years

The latest price movement pushed Bitcoin to fall past important boundaries in on-chain analysis for the first time in years.

Data from Glassnode confirms that Bitcoin fell below its True Market Mean – currently at $80,500 – for the first time in 30 months. The last time this level was broken was at the end of 2023, when the price of the asset was only around $29,000.

Historically, a breach of this level marks a switch from a bullish cycle to a medium-term bearish trend.

Now, BTC holders are facing a harsh reality as the Short-Term Holder Cost Basis (short-term holder average buying price) has risen to $95,400, while the Active Investor Mean stands at $87,300.

With current market prices well below both averages, the market is facing a huge wave of unrealized losses.

This technical weakness triggered a massive liquidation event on global crypto derivatives exchanges.

Selling Pressure Gets Stronger

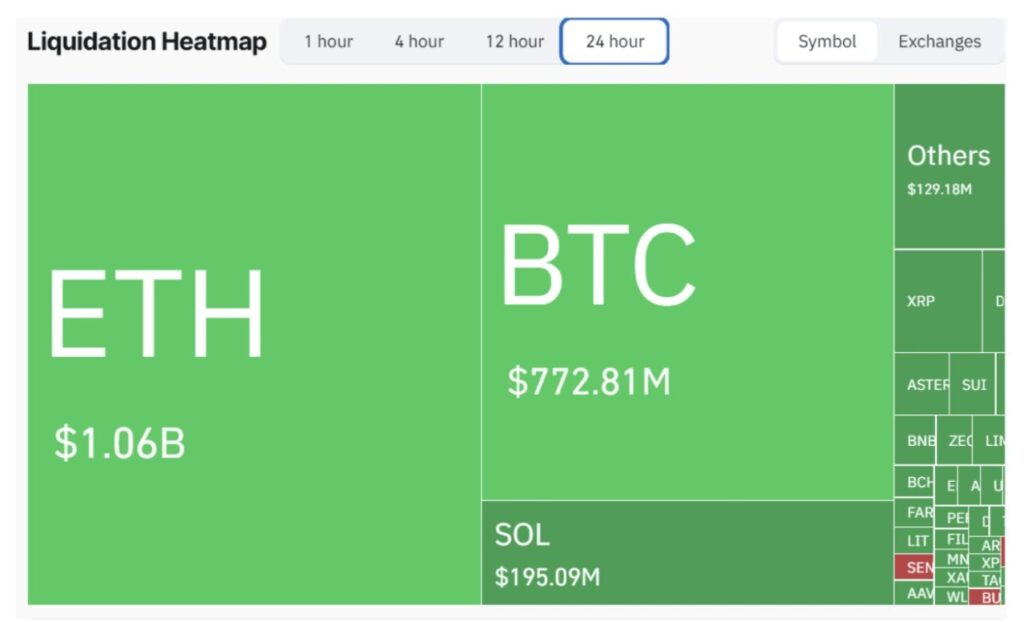

Based on data from CoinGlass, this price crash led to the liquidation of traders’ positions worth approximately $2.58 billion.

Read also: 3 Altcoins that Crypto Whale Hunted in February 2026, What Makes Them Stand Out?

The most affected were “long” positions (those betting the price will rise), accounting for $2.42 billion of the total loss. This was the largest long liquidation event in the last three months.

Ethereum traders suffered the most severe losses, with $1.15 billion in positions liquidated, while Bitcoin accounted for over $772 million in losses.

This large long squeeze event shows that market participants used too much leverage to defend the $80,000 level, only to be crushed by increasingly strong selling pressure.

CryptoQuant CEO, Ki Young Ju, attributed this huge drop to BTC buyers’ liquidity fatigue. He mentioned that the Realized Cap is currently “flat”, signaling that new capital to fuel the bull market has disappeared.

According to him, while early investors are still making profits from purchases during the 2025 rally, there are no new institutional fund flows to absorb the existing supply.

“MSTR is the main driver of this rally. Unless Saylor sells heavily, we won’t see a -70% drop like in previous cycles,” he added.

Under these conditions, Ju expects the market to enter a flat consolidation phase within a wide range, until a new price floor is formed.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin Crash Below $80K Triggers Market Liquidation. Accessed on February 2, 2026