3 Standout Crypto RWAs Poised to Soar in February 2026 — Are Whales Sending a Signal?

Jakarta, Pintu News – January has come to an end, but real-world asset (RWA) tokens have yet to show a major surge across the board, despite being one of the strongest narratives in the crypto world through 2025. The sector’s performance has been mixed, with both spikes and sharp drops occurring in only a few specific tokens.

In the midst of these conditions, a small group of RWA tokens emerged that began to stand out thanks to the level of market confidence, strategic positioning, and chart patterns that began to form. in February, there were three formations worth looking out for-indicating potential staying power as well as risks that may be quietly lurking, according to a BeInCrypto report.

Chainlink

Chainlink remains one of the key leaders in real-world asset (RWA) infrastructure. But as February 2026 approaches, its technical and fundamental constellations look contradictory.

Read also: Bitcoin on the Brink? 3 Signals Still Show Risk of Falling to $63,000

Social sentiment towards LINK has decreased dramatically. Data from Santiment shows that Chainlink is currently one of the most criticized large-cap altcoins.

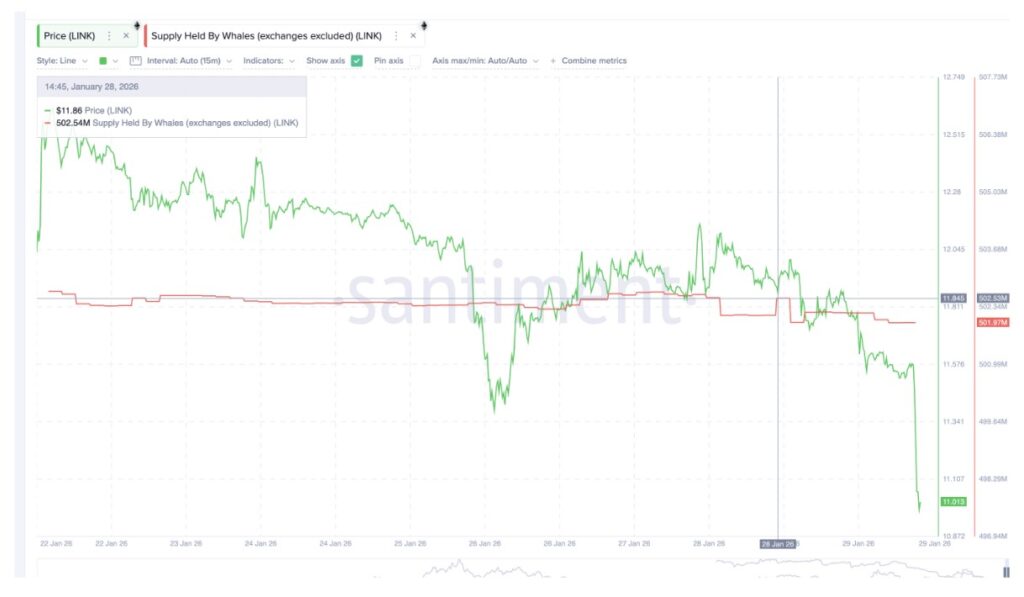

This change in sentiment is in line with whale’s recent behavior. Since January 28, whale’s holdings decreased from 502.53 million LINK to 501.97 million LINK-a decrease of about 560,000 tokens.

This gradual reduction signaled that large holders started to reduce their exposure amid weak price action and growing pessimism from retail investors.

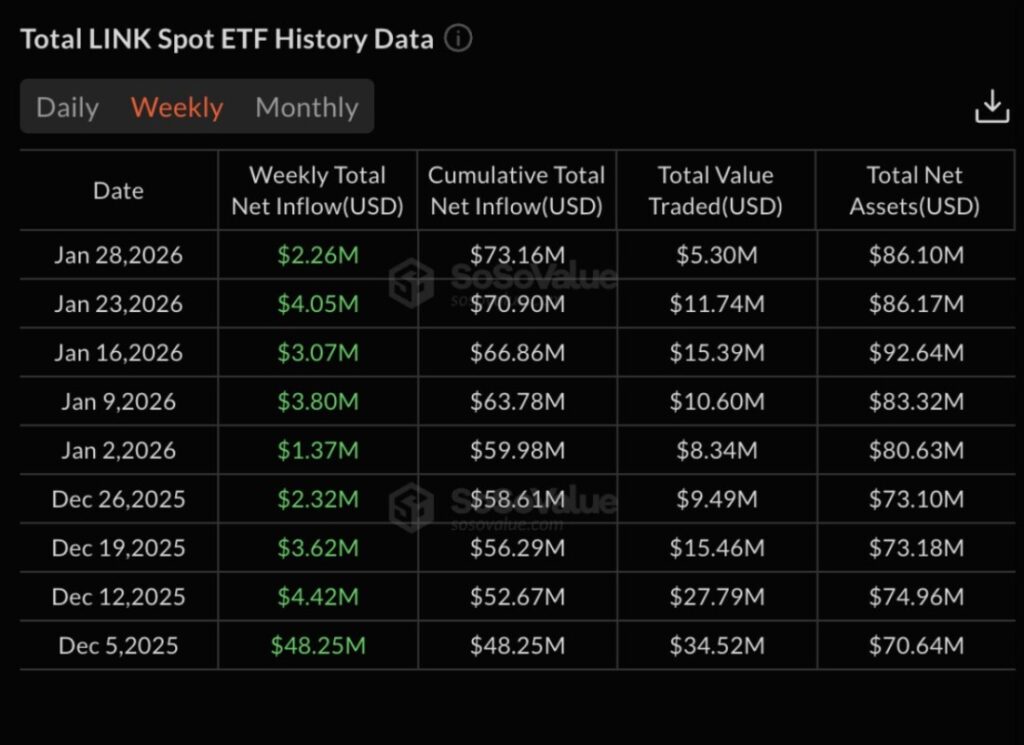

But this is where the story gets interesting. Despite whale selling, spot ETFs continue to accumulate. Chainlink is currently backed by two spot ETFs from Grayscale and Bitwise. Since its launch, each week has recorded net inflows with no weekly outflows so far.

Recent weekly additions ranged from $2.26 million to $4.05 million, pushing total cumulative inflows above $73 million. This creates a clear divergence: large holders are reducing exposure, while long-term demand from ETFs is absorbing the existing supply.

However, in terms of price, the current trend is still bearish. LINK has dropped about 7.2% in the past month and about 3% on a 24-hour basis. More significantly, LINK lost an important support level around $11.12.

If this level is not recaptured in the daily close, it opens up the potential for a drop towards $9.10-a drop of about 17% from the current price. This scenario would reinforce the caution shown by the whales.

On the contrary, if it manages to return above $11.12, the momentum could reverse upwards towards $11.82 and $12.37. For now, sentiment and price action still point to weakness, while the ETF is quietly building a long-term foundation. The next few candles will determine the dominant direction of the market.

Keeta (KTA)

Keeta is becoming one of the most prominent RWA tokens ahead of February 2026. In the past 30 days, KTA has gained around 55%, making it one of the best-performing real-world assets over that period. This rise is not the result of a sudden surge, but rather a steady uptrend since early January-indicating there is sustained demand, not just short-term hype.

However, the momentum is starting to subside. In the last 24 hours, the price of KTA has dropped by almost 10%, indicating that some traders may be starting to realize profits. This correction makes Keeta interesting – not just another momentum play.

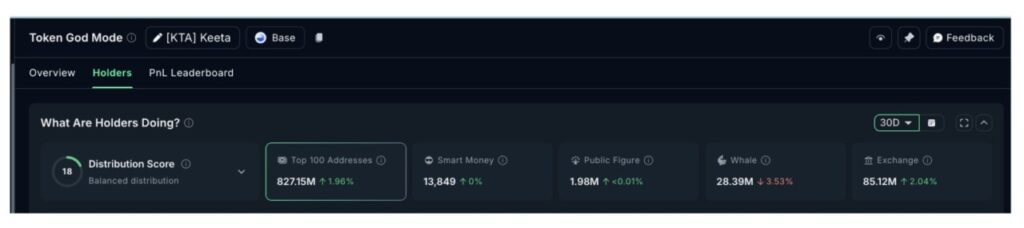

On-chain data shows a divergence of views among large holders. In the past 30 days, standard whales reduced their holdings by 3.53%, signaling a cautious stance after the strong rally.

In contrast, the mega whales increased their holdings by 1.96%. This divergence among the whale groups is important, as it reflects the disagreement: has the rally ended, or is it just a short break before continuing to rise?

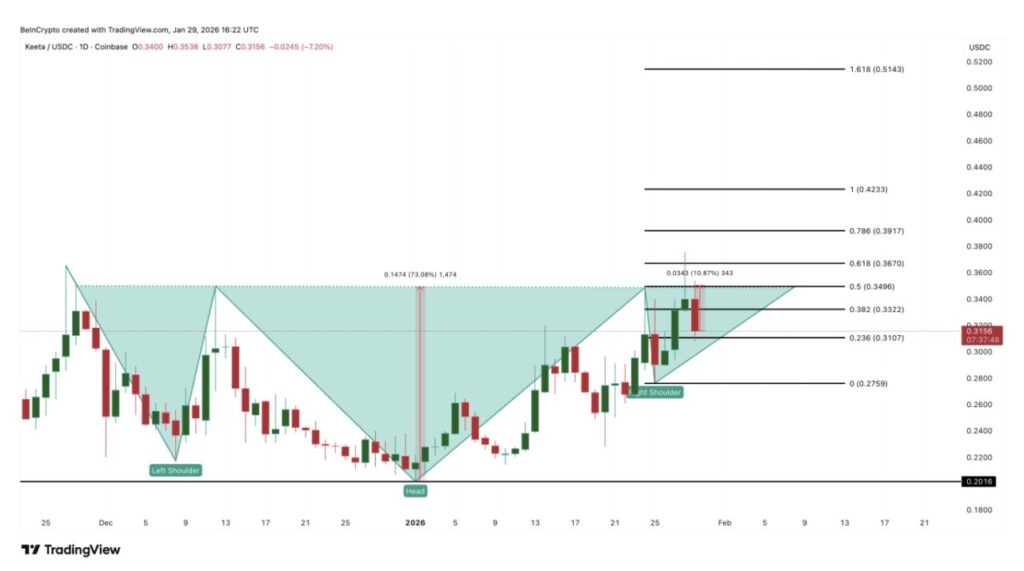

From a technical perspective, KTA’s current price chart tends to support the mega whale view. Keeta is forming an inverse head and shoulders pattern, a structure that often appears before a continued upward movement. The neckline is around $0.34, while the current price is around $0.30 – meaning that the breakout trigger is about 10% above the current price.

If the price is able to close the day above $0.34, this pattern could trigger further gains of up to around 73%, solidifying Keeta’s position as a leader in the real-world asset sector.

Read also: Crypto Market Under Pressure: When Can Crypto Prices Recover from the Bearish Trend?

Even so, the risks remain real. If the price fails to break back to $0.31 and instead falls below $0.27, then the bullish structure begins to weaken. A further drop below $0.20 would completely invalidate the technical pattern.

Keeta remains one of the RWA tokens with the strongest technical appeal to monitor, and February will be the decider-whether the mega whale’s optimism will prevail, or the broader whale group’s caution will prove correct.

Maple Finance (SYRUP)

Maple Finance is back on the list of RWA tokens worth monitoring for the second month in a row, and the reason is pretty clear. While most real-world asset tokens such as Chainlink and Keeta have declined between 3% and 10% over the past month, SYRUP has shown resilience.

In the last 30 days, SYRUP’s price is up 11.5%, and has only fallen around 1% in 24 hours – amidst the pressures that have hit the RWA market in general. This relative strength was already a positive signal, but the on-chain data makes the case even stronger.

Read also:

Whale continued to accumulate SYRUP despite a short-term correction in prices. On January 26, whale holdings stood at 455.82 million SYRUP. By January 29, this number had increased to 461.13 million. Interestingly, accumulation has resumed in the last 24 hours after a brief pause, indicating continued conviction and not just momentary buying.

The price structure supports this pattern. Since early November, SYRUP has been moving in a symmetrical triangle pattern, which reflects the tension between buyers and sellers in the medium term.

Currently, key levels are starting to become apparent. Buyers are consistently defending the $0.33 area, with the long lower tail on the candle indicating repeated demand. As long as SYRUP remains above this level, the technical structure remains positive.

The nearest upside target is in the range of $0.37. If the price manages to close daily above that level, then the triangle resistance will be broken, opening up the potential for an upside move to $0.39, $0.41, even up to $0.48 in a continued bullish scenario.

Conversely, if the price loses support at $0.33, the structure will start to weaken. A further drop below $0.30 could reverse the momentum in a bearish direction, with $0.28 being the next support level.

However, with ongoing accumulation by the whales, these lower levels are likely to be maintained-unless there is a drastic deterioration in market conditions. Among the noteworthy RWA tokens, SYRUP stands out not for its extreme spikes, but for its consistency.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. 3 Real World Assets (RWA) Tokens To Watch In February 2026. Accessed on February 6, 2026