5 key things about Cardano (ADA) that crypto investors should understand in 2026

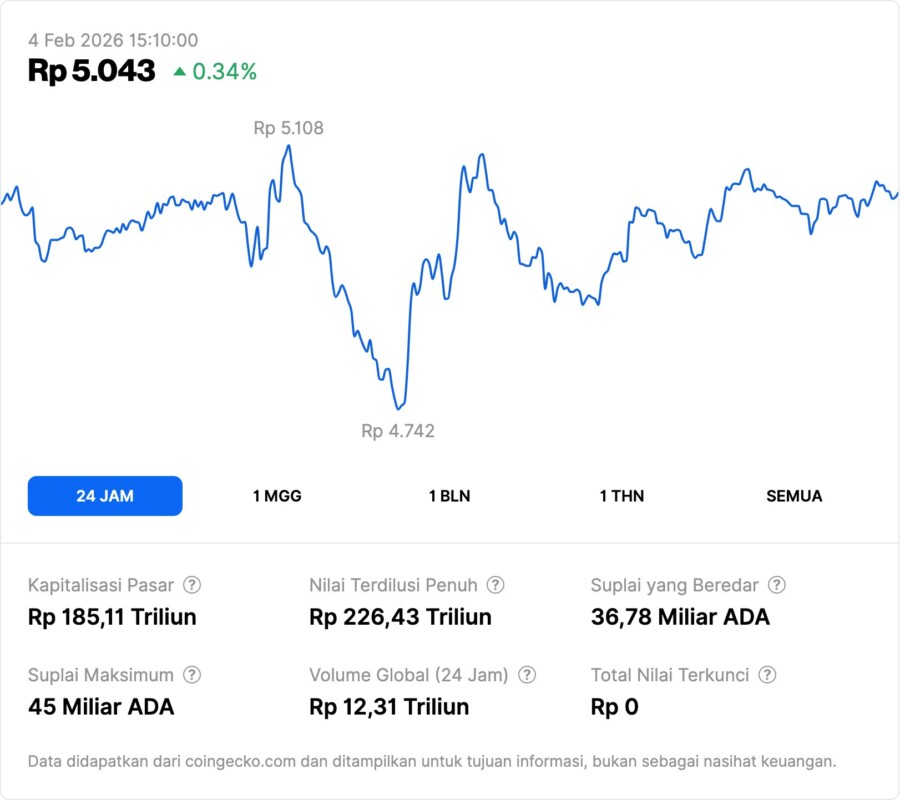

Jakarta, Pintu News – The movement of Cardano , one of the largest altcoins in the cryptocurrency market, is showing a stagnant trend in early 2026 which invites discussion among investors. The price of ADA hovering around the level of USD 0.32 (around Rp 5,366) reflects a period of calm movement and relatively does not show strong momentum for short-term breakouts. This condition needs to be understood by investors and beginners who are evaluating ADA positions in their portfolios.

1. ADA Price Remains Stagnant at around USD 0.32

At the beginning of 2026, the price of Cardano (ADA) technically tends to stay around USD 0.32 for a long period without significant fluctuations. This condition is reflected in the sideway movement, which makes some investors feel a lack of price volatility momentum. ADA briefly touched the price of USD 0.40 but was soon held back by selling pressure.

This price stability indicates that at this level there is no strong catalyst to drive a new bullish trend for ADA. This is an important evaluation factor for medium to long-term investors.

Also Read: 7 Shocking Bitcoin & Crypto Facts in Epstein Files: Crypto’s Early Traces Revealed!

2. Resistance Pressure Becomes an Obstacle to Recovery

Technical analysis shows that there is a strong resistance level around USD 0.35-USD 0.40 that often restrains upward price movements. ADA must cross this resistance area before a strong recovery trend can be established. Without breaking this level, the price could potentially repeat the sideways pattern or even go down.

This delay in breaking through resistance also reflects challenges in market sentiment, especially in a broader crypto environment that tends to be cautious towards large altcoin assets like ADA.

3. Long-term Trend Less Favorable for Bullish Action

Long-term technical indicators such as moving averages show a declining or stagnant trend in the last three to six month period. This suggests that the upward momentum is still not strong enough. Long-term indicator trends are often a guide for investors that the market direction is not yet strongly upward.

This signals that while ADA remains a great project, its upward movement may need more time or a new fundamental catalyst to start a bullish phase again.

4. Ecosystem Still Building Infrastructure

The Cardano project itself continues to make updates to its network and ecosystem, including stablecoin integration and protocol enhancements to support smart contracts. Despite this, the launch and adoption of new features has not been enough to trigger a significant price spike to date.

Investors need to distinguish between long-term technological developments and short-term price movements, as the two, while interrelated, move at different rhythms.

5. Investor Capital Focus is Expanding to Other Projects

In these situations of price stagnation, investor capital is often compelled to seek faster growth opportunities in other projects, including altcoins or crypto protocols that exhibit higher initial price movements. These capital shifts can affect the relative liquidity and demand dynamics for ADA.

This preference shift factor is not just about price, but also reflects a risk assessment of the network utility, liquidity, and long-term adoption potential of each crypto project.

Also Read: 4 Shocking Facts about Bitcoin Breaking Rp1.42 Billion: Similar to BTC April 2025 Technical Signal!

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cryptopolitan Media. Cardano (ADA) Stagnates at $0.32: Investors Prefer This New Crypto Protocol After 3x Jump. Accessed February 4, 2026.