5 Critical Points for Solana (SOL) in the February 2026 Crypto Trend-Determining Demand Zone

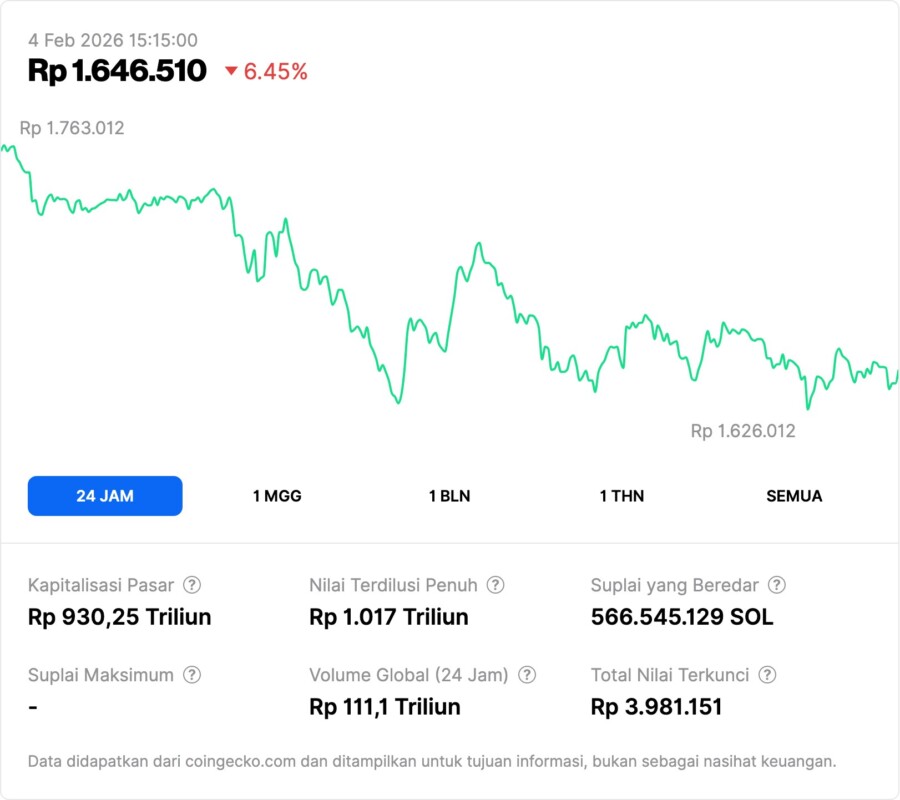

Jakarta, Pintu News – Solana , one of the largest altcoins in the cryptocurrency ecosystem, is back in the spotlight after the asset’s price retreated towards an important demand zone. This zone is considered a technical region that can determine whether SOL’s strong trend continues or falters. In a still-vulnerable market, price movements in this area provide important signals that are relevant for investors and newbies.

1. Solana Returns to Critical Weekly Demand Zone

Solana (SOL) is currently in the weekly demand zone which has historically often been a major pivot point. This demand zone reflects an area where buyers are likely to step in and hold prices. If the support in this zone holds, the previous uptrend still has a chance to re-load.

This level is seen as key as it signals whether the bull momentum is still holding or starting to weaken. This support defense can illustrate the dominance of demand despite the high selling pressure in the crypto market. This zone has become very important in the current price structure of SOL.

Also Read: 7 Shocking Bitcoin & Crypto Facts in Epstein Files: Crypto’s Early Traces Revealed!

2. Trend Reload Opportunity If Buyers Persist

If buyers manage to hold the demand zone, there is a potential trend reload or uptrend continuation for Solana. For crypto investors, this could be a technical signal that SOL’s bullish momentum is still alive. Solidity within the zone is an indicator that selling pressure is not yet fully dominant.

It should be noted, however, that this confirmation does not automatically guarantee a major uptrend, but rather provides an indication of a possible trend continuation based on historical price patterns. Investors need to wait for price and volume confirmation for further decisions.

3. Breakdown Risk Threatens Longer Consolidation

Conversely, if the demand zone fails to hold, the risk that the SOL price enters a longer breakdown or consolidation phase increases. This kind of condition usually makes the price move in a narrow range with no clear direction. This reflects the weaker dominance of the crypto market.

A drop below this zone is often followed by price action that fluctuates in the lower support area, which can mean high volatility with less chance of a rebound. Investors need to anticipate a prolonged sideways or chop market scenario.

4. The Role of $119-$135 Zone as Demand Support

The technical zone between approximately USD 119 to USD 135 has been identified as an important support area. This is a region where historical demand often emerges and helps maintain the short-term market structure. A hold in this zone indicates that buyers are still present at certain price levels.

If SOL can hold above $135, it signals that demand momentum is strong and prices could try to head towards the next resistance. Conversely, if this support breaks, the price direction will likely be under greater selling pressure, triggering further downside pressure.

5. On-Chain Indicators Show Real Demand

Several on-chain data points signal strong demand in this technical zone, including an increase in the number of active addresses and weekly transaction volume. These indicators show that Solana network activity is not only shaped by short-term speculation.

This spike in activity provides context that a rebound or hold in the zone is supported by demand from active network users, rather than purely speculative action. This is relevant for medium-term investors looking for confirmation of market fundamentals.

Also Read: 4 Shocking Facts about Bitcoin Breaking Rp1.42 Billion: Similar to BTC April 2025 Technical Signal!

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

- NewsBTC. Solana Returns to a Critical Demand Zone – Trend Reload or Breakdown Risk? Accessed February 4, 2026.