Gold Price Prediction for the Next 6 Months: Can it Break US$ 8,000?

Jakarta, Pintu News – The global gold market remains in focus for investors amid economic and geopolitical uncertainty, with a number of analysts issuing medium-term price projections.

Recently there have been extreme predictions that gold prices could potentially reach US$8,000 per troy ounce before the end of 2026, but such views remain speculative and are influenced by a variety of complex macroeconomic factors. Here are five key facts about gold price predictions for the next 6 months.

1. Gold Price Projections May Reach US$6,000-US$8,000

Some analysts and market models predict that global gold prices could rise further from current levels, with an extreme scenario reaching US$8,000 per troy ounce before the end of 2026. This forecast assumes a two-stage rise: first towards around US$6,000 per troy ounce, then continuing to a higher range.

However, these projections are derived from sentiment analysis and predictive models, not the general market consensus. The success of this scenario largely depends on the direction of monetary policy, safe-haven demand, and weaker global economic conditions.

Also Read: 7 Shocking Bitcoin & Crypto Facts in Epstein Files: Crypto’s Early Traces Revealed!

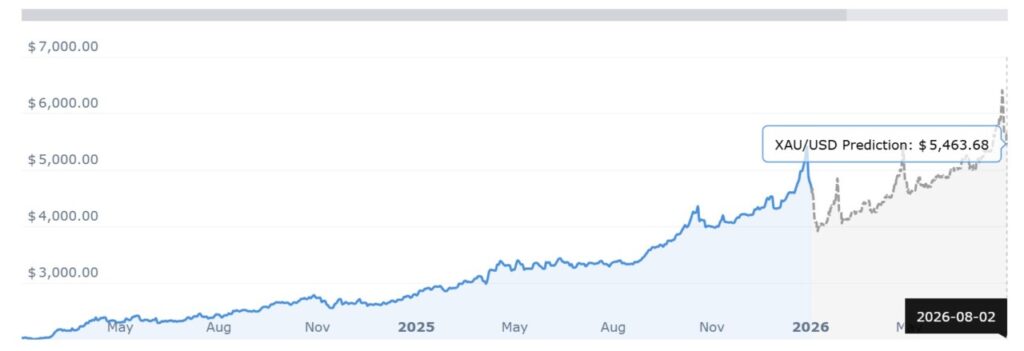

2. Model Data Estimates Prices to be Around US$5,400-US$7,000

According to data from several market statistics, gold prices are expected to hover around US$5,400 per troy ounce in the next few months, with annual estimates suggesting an average of over US$7,000 by the end of 2026. These predictions are not guarantees but reflect the range of possibilities in the medium-term price model.

This more moderate prediction indicates that the gold market still has room to strengthen even if the gains are not as sharp as the highest scenario, so prices in the US$5,000-US$7,000 range are considered more realistic by many models.

3. General Market Data Indicates a Moderate Target between US$4,000-US$5,000

Most analysts from major financial institutions expect gold prices to keep rising but at a moderate rate, with a general target in the range of US$4,000 to US$5,000 per troy ounce this year. Such predictions are supported by demand from central banks, institutional investors, and capital flows seeking hedge assets against stock and currency market volatility.

This range reflects the broader analytical consensus, which incorporates inflation, safe-haven demand and interest rate dynamics, although price volatility could still have a significant impact on the short-term.

4. Fundamental Factors Support the Rise in Gold Prices

Some of the fundamental factors driving gold prices are strong central bank demand, inflows into gold ETFs, as well as loose monetary policies in many developed countries. The decline in the value of fiat currencies and fears of inflation also keep gold attractive as a hedging asset in investment portfolios.

In addition, geopolitical uncertainties, such as global conflicts and trade tensions, often prompt investors to turn to precious metals, driving demand for spot and futures contracts.

5. Volatility Risk and Technical Barriers Remain

Despite the bullish outlook, gold prices remain vulnerable to short-term volatility due to changes in interest rate policy, a strengthening US dollar, and global stock market influences. If interest rates rise higher than expected or in the event of strong global economic stability, demand for gold as a safe-haven asset could subside, depressing prices.

Furthermore, extreme predictions such as US$8 000 per troy ounce rely heavily on strong economic risk assumptions; without a clear fundamental trigger, such levels remain highly speculative compared to more moderate predictions in the US$4 000-US$6 000 range.

Also Read: 4 Shocking Facts about Bitcoin Breaking Rp1.42 Billion: Similar to BTC April 2025 Technical Signal!

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Watcher Guru. Gold Rates Six Month Prediction:Can Gold Top The $8K Mark. Accessed February 6, 2026.