Dogecoin Slides to $0.10 as Options Market Sends Mixed Signals

Jakarta, Pintu News – Dogecoin has suffered another price drop after a brief recovery, with its derivatives market showing clear signs that traders are starting to pull out.

According to data from CoinGlass published on Wednesday, February 4, the largest cryptocurrency meme by market capitalization recorded an 8.7% drop in open interest in futures contracts yesterday. So, how will the Dogecoin price move today?

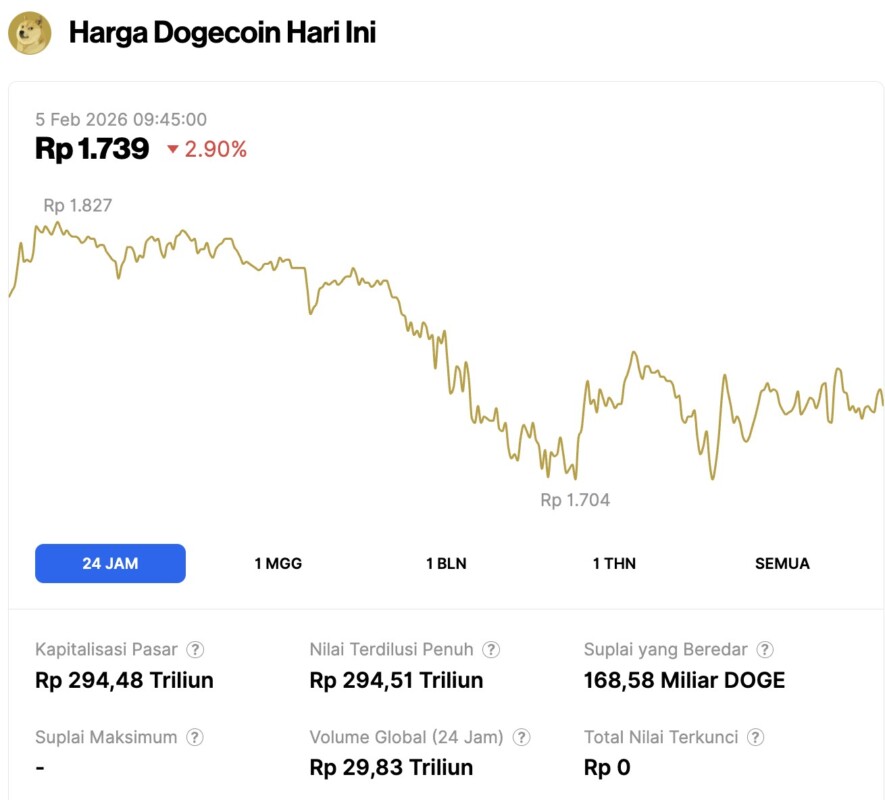

Dogecoin Price Drops 2.90% in 24 Hours

On February 5, 2026, Dogecoin’s price dropped by 2.90% over the past 24 hours, trading at $0.1036, or approximately IDR 1,739. During that period, DOGE fluctuated between IDR 1,827 and IDR 1,704.

At the time of writing, Dogecoin holds a market capitalization of around IDR 294,48 trillion, with a 24-hour trading volume of approximately IDR 29,83 trillion.

Read also: Ethereum Slides to $2,100 as Network Activity Nears a Critical Level

DOGE Futures Traders Take Caution

DOGE’s recent decline reflects growing caution among futures traders amid the uncertainty plaguing crypto markets in general. Open interest, which measures the total value of unsettled futures contracts, is now down to 10.84 billion DOGE tokens or about $1.16 billion.

This withdrawal comes as the Dogecoin price retreats to test the $0.10 level again – the lowest position in months for the popular meme asset.

The price drop that occurred alongside the decrease in the number of open positions indicates that traders prefer to actively manage risk rather than speculate on a recovery in the near future.

Traders Close Positions Instead of Opening New Ones

The drop in open interest coincided with a 43% jump in trading volume, revealing an important dynamic in the market. Traders are not being passive. Instead, they are actively reorganizing portfolios by closing existing leveraged positions rather than opening new trades.

Read also: Bitcoin Plunges to $72,000 as Analysts Point to Patterns from Previous Bull Runs

This pattern usually emerges when market participants face high uncertainty and choose to reduce exposure to volatile assets. The combination of falling open interest and rising trading volume indicates a wave of position closures across major exchanges.

This behavior reflects a shift from the speculative spirit that dominated previous trading periods. Futures traders who used to bet on price movements with leverage, now prioritize capital preservation over aggressive position taking.

Options Market Shows Mixed Signals

While open interest in the Dogecoin futures market fell sharply, the options market showed a different trend. Open interest in options rose by almost 6% over the same period, although options trading volume plummeted by 52.69%.

This difference reflects complex market sentiment. The increase in open interest in options indicates that traders are maintaining their existing hedging strategies. Many appear to still be holding protective positions that were established during more stable market periods.

However, the drastic drop in options trading volume suggests that new hedging activity is minimal. Traders on platforms like Binance tend to maintain existing positions, but are reluctant to allocate new capital for additional options contracts.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpaper. Dogecoin Price Correction Drives 8.7% Drop in Futures Open Interest. Accessed on February 5, 2026