XRP Price Today IDR24,193, Down 10.29%: Selling Pressure Still Dominating?

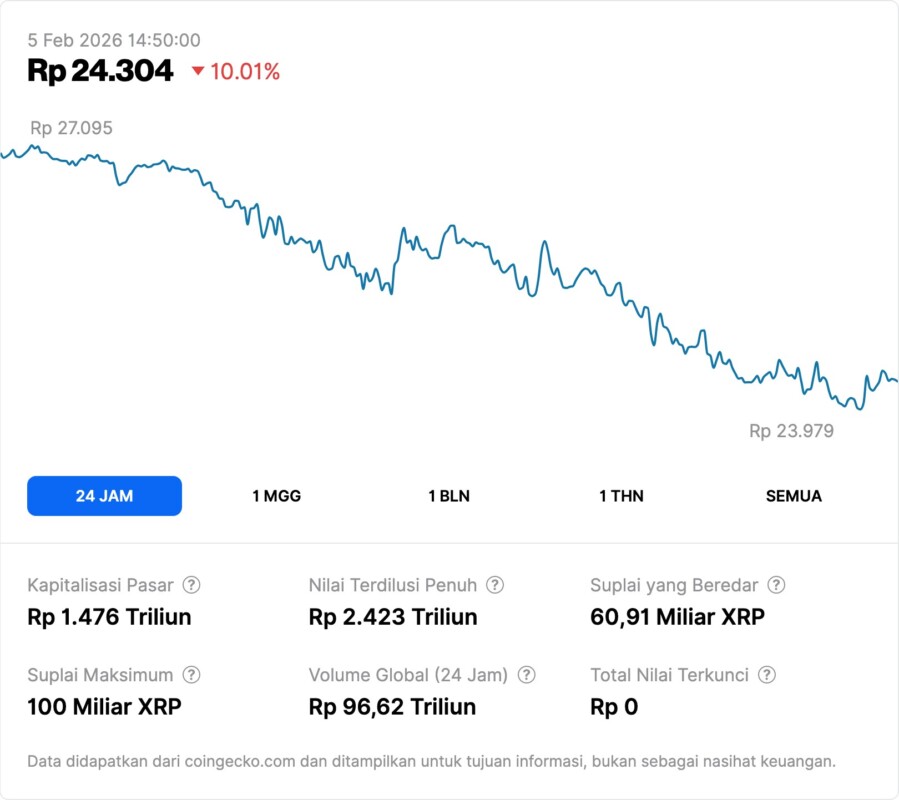

Jakarta, Pintu News – The price of crypto Ripple experienced a sharp correction in today’s trading amid increased volatility in the cryptocurrency market. Based on market data, XRP was trading at Rp24,193 per coin, down about 10.29% in the last 24 hours. This decline has put the movement of XRP back in the spotlight of investors, especially after the previous rally.

1. XRP Price Today and 24 Hour Movement

The price of Ripple (XRP) was recorded at IDR24,193 on February 5, 2026 at 2:10 pm WIB. In the last 24 hours, the XRP price was in the area of Rp27,095 before experiencing gradual selling pressure to near the daily low around Rp23,979. This pattern shows consistent weakness throughout the trading session.

The daily decline of more than 10% reflects a cautious market sentiment. Despite the deep correction, the price movement was not accompanied by extreme spikes indicating mass panic. It was more like an adjustment phase after high volatility.

Also Read: 7 Shocking Bitcoin & Crypto Facts in Epstein Files: Crypto’s Early Traces Revealed!

2. Market Capitalization and Valuation of XRP

XRP’s market capitalization currently stands at around Rp1,463 trillion. This figure places XRP as one of the largest crypto assets in the global market despite the price correction. The large market capitalization shows that investor interest in XRP is still relatively strong.

XRP’s fully diluted valuation (FDV) was recorded at around Rp2,402 trillion. The difference between market capitalization and FDV reflects that there is still a supply of tokens that are not fully circulated. This supply factor is one of the important variables in medium-term price movements.

3. Trading Volume and Market Liquidity

XRP’s global trading volume in the last 24 hours reached approximately IDR 95 trillion. This high volume indicates very active market activity despite the price drop. The large liquidity keeps XRP attractive to short-term traders in the cryptocurrency market.

High volume also indicates that the current price correction involves many market participants. In the context of crypto, this often happens during distribution or consolidation phases. However, large volume is not always a signal of an imminent trend reversal.

4. XRP Token Supply and Structure

The current circulating supply of XRP stands at around 60.91 billion XRP out of a maximum supply of 100 billion XRP. This supply structure is different compared to many other crypto assets as most of the tokens have been created since inception. Supply distribution is an important factor in the long-term analysis of XRP.

The absence of an aggressive burning mechanism makes XRP’s price movements highly dependent on market demand. XRP’s total locked value or TVL is recorded at €0, indicating that XRP is not focused on the DeFi ecosystem like other tokens. Its role is more in payment utility and liquidity.

5. XRP’s Position in the Crypto Market 2026

XRP is known as a crypto asset that targets the efficiency of cross-border payments. Unlike meme coins or DeFi tokens, XRP’s value is more associated with institutional adoption and regulatory sentiment. These factors often trigger significant volatility.

In the context of the 2026 crypto and cryptocurrency market, today’s XRP price drop reflects global market dynamics that are sensitive to macro sentiment. For novice investors, understanding the difference between technical corrections and fundamental changes is important in addressing XRP’s future movements.

Also Read: 4 Shocking Facts about Bitcoin Breaking Rp1.42 Billion: Similar to BTC April 2025 Technical Signal!

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Doors. Ripple (XRP) Price Today. Accessed February 5, 2026.