7 Impacts of Bitcoin Price Dropping Below US$66K (Rp1.12 Billion): All Investors Should Know!

Jakarta, Pintu News – Bitcoin has come under sharp pressure recently, dropping below the US$66,000 level in the wake of dwindling market liquidity and a global sell-off in the tech sector. This drop is not just about price, but reflects broader risks in the cryptocurrency market as well as its impact on altcoins, ETFs and investor sentiment. Here are seven important things that beginner to professional investors need to know.

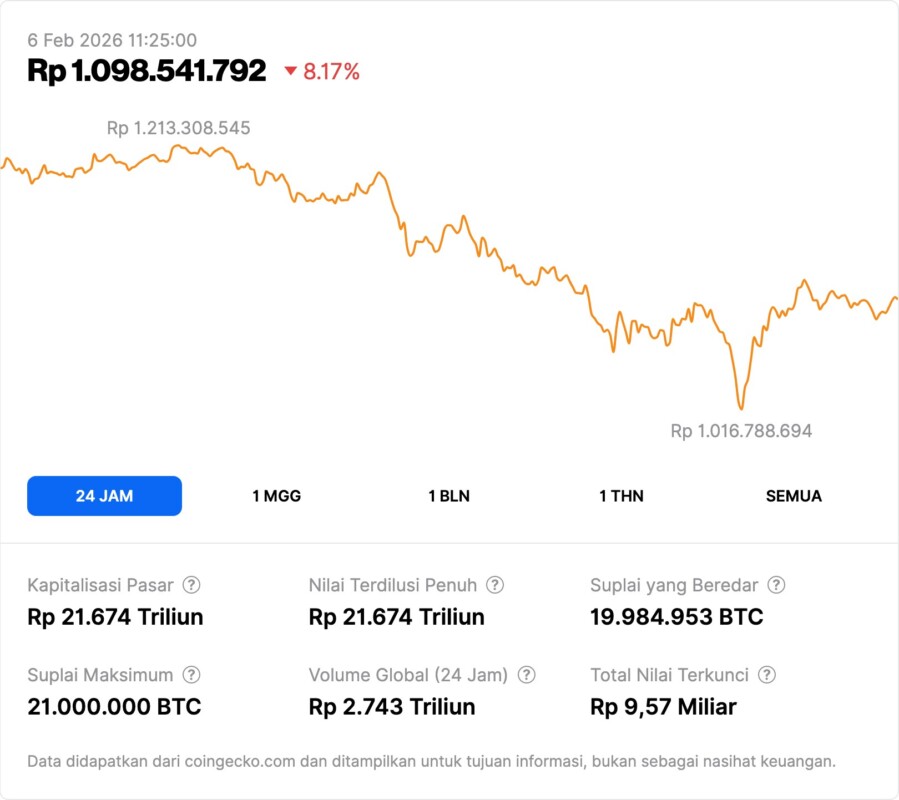

1. Bitcoin Price Decline to Watch Out For

Bitcoin’s price has plummeted to its lowest level since October 2024, reaching less than US$66,000 per unit in the last few trading sessions. The drop comes after global tech assets experienced a major selloff that spilled over into riskier markets including crypto. Since its historical peak of around US$126,000 in October 2025, BTC is now down almost 50 percent of its value. Strong price drops like this are indicative of the high volatility that characterizes the crypto asset market.

Also Read: 5 Crypto that Whale is Eyeing in February 2026, Quietly Accumulating Amid Volatility

2. Thinning Market Liquidity Accelerates Correction

One of the main causes of the BTC price drop is the dwindling market liquidity. This figure occurs when there are few buyers and many sellers, making price movements sharper during selling waves. As a result, stop-losses and leveraged positions are triggered, triggering large liquidations in the derivatives market. This makes market reactions even more sensitive to global economic news.

3. Impact on Altcoins and the Broader Crypto Market

Not only Bitcoin, many other crypto assets followed a similar downtrend. Data shows that Ethereum and XRP also experienced significant declines alongside the BTC correction. In a sell-off phase like this, altcoins often experience more pressure due to their smaller liquidity and market capitalization compared to Bitcoin. Altcoin investors need to understand that BTC price trends are often an indicator of broader market risk.

4. Bitcoin ETFs Fall and Capital Flows Out

Bitcoin-based investment products such as ETFs are also not spared from the impact of the price drop. Some ETFs have recorded sharp declines in value or experienced significant capital outflows. This indicates that institutional investors and large capitals are starting to withdraw exposure from crypto, which then puts additional pressure on the market. When ETFs experience outflows, it often reflects an overall weaker market sentiment.

5. Macroeconomic Risks Affecting Risk Markets

BTC’s price decline was also influenced by broader global economic conditions, including a sell-off in the tech stock market. When investors are concerned about a potential recession or monetary tightening, they often reduce their exposure to riskier assets like cryptocurrencies. This can be seen in the correlation between the tech market and BTC, where the sell-off in tech stocks has a direct impact on crypto prices.

6. Investor Sentiment Gets Negative

Sharp price movements made investor sentiment even more negative. High trading volume with selling pressure suggests that many market participants do not yet see a strong turning point for buying. This negative sentiment may prolong the bearish period if not immediately offset by strong fundamental sentiment or new positive news. Crypto market indices sometimes reflect high levels of fear when volatility increases.

7. Educational Opportunities and Risk Management Strategies

While market pressures are strong, this is also an important educational moment for new investors. Learning about risk management, portfolio diversification, and understanding conservative trading strategies can help reduce the impact of volatility. Mature investors typically set risk limits, understand the beta of cryptocurrencies relative to traditional markets, and don’t overreact to short-term price fluctuations. Education and preparation can make investment decisions more rational in times of uncertainty.

Also Read: 3 Crypto Underrated in February 2026 that Investors are Starting to Look at, Not Just Hype!

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Investing. Bitcoin price today plunges below $71k as global tech sell-off hits risk assets. Accessed February 6, 2026.