Tether (USDT) Adds 35 Million Users and $12 Billion Market Capitalization Amid Market Crash!

Jakarta, Pintu News – Tether recorded record-breaking growth in users and USDT market capitalization in the last quarter of 2025, despite the general crypto market experiencing losses and high volatility due to the major liquidation event in October.

During the period, the company estimates that it added 35.2 million new users, bringing its global user count to 534.5 million. This is the eighth consecutive quarter in which the number of new users added exceeded 30 million. Tether also reported that the number of USDT holders on its blockchain network grew by 14.7 million, bringing the total to 139.1 million.

In its fourth quarter report, the company mentioned that USDT represented 70.7% of all stablecoin wallets. The number of monthly active users on the network also reached an all-time high average of 24.8 million users.

USDT supply hits new record as reserves grow

Read also: Gold Prices Go Up and Down, Is Now the Right Time to Buy Gold?

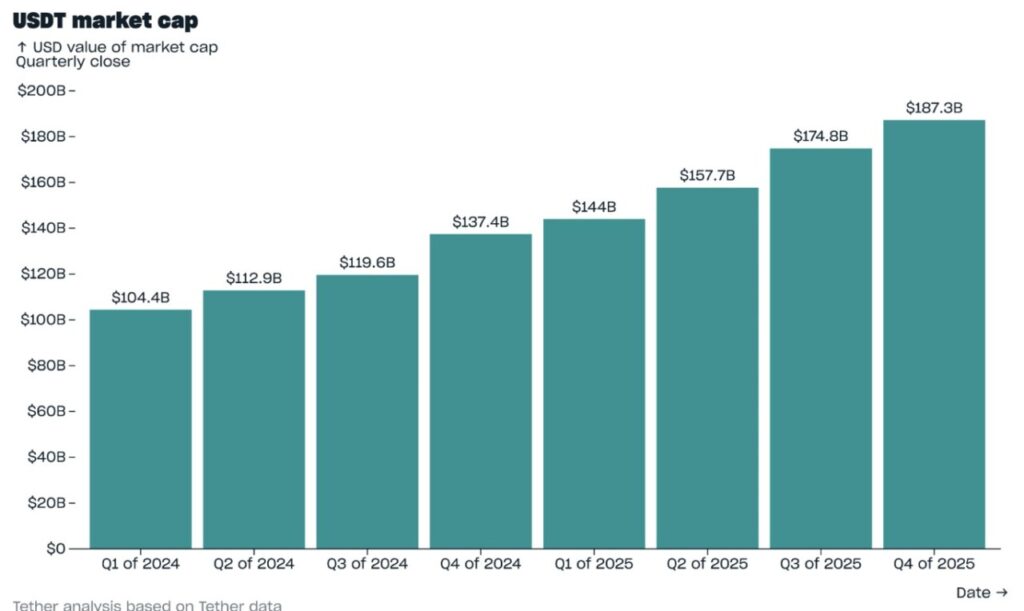

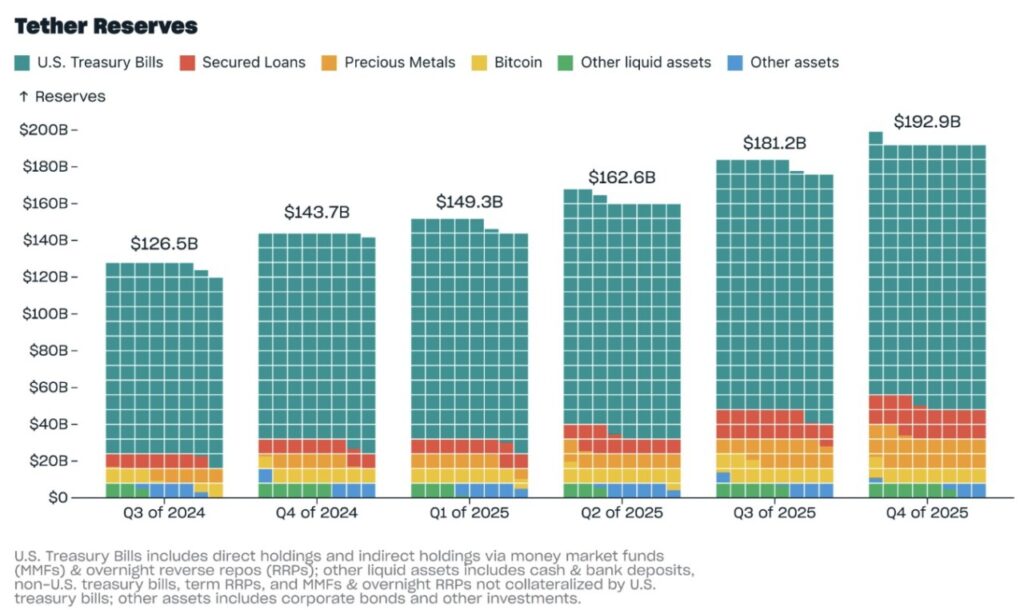

USDT’s market capitalization increased by $12.4 billion during the fourth quarter, bringing its total to $187.3 billion. Overall reserves also rose to $192.9 billion, reflecting an increase of $11.7 billion in the period. These reserves include 96,184 bitcoins, 127.5 metric tons of gold, and $141.6 billion in U.S. Treasuries.

Tether states that this growth is supported by a variety of uses beyond crypto trading.

“USDT’s continued growth comes from a diverse set of use cases that extend beyond the crypto market,” the report reads.

USDT continues to experience growth despite a sharp drop in the overall crypto market capitalization. At the end of January, the price of Bitcoin fell to around $71,200 – the lowest position since October 2024.

Tether also noted that the two largest stablecoins after USDT declined by 2.6% and 57% respectively during the same period, while USDT grew by 3.5%.

Fundraising Plan Revamped After Rejection from Investors

As the number of users grew, Tether also made adjustments to its fundraising strategy. The company is now considering raising $5 billion – much smaller than its previous target of $20 billion.

This decision was made after receiving feedback from investors who objected to the company’s overvalued valuation of $500 billion. Tether CEO Paolo Ardoino called the $20 billion figure a ceiling, and emphasized that the company is under no pressure to seek additional funding.

With a net profit of over $10 billion over 2025 and surplus reserves of $6.3 billion, Tether states that it remains financially independent. In its latest disclosure, almost all of the company’s liabilities are attributed to the tokens it has issued.

Read also: Why Crypto Prices Fall Today, February 6, 2026

Reserve Transparency and Trends in the Stablecoin Sector

In its year-end report, Tether reported total assets of $192.8 billion and liabilities of $186.5 billion, showing excess reserves. The company also detailed its holdings of U.S. Treasuries, including daily reverse repo transactions.

This change in fundraising strategy comes amid a shift in investor focus to corporate structure, reserve management, and transparency in the stablecoin sector.

Throughout 2025, Tether issued around $50 billion of new USDT – with $30 billion of that being printed in the second half of the year. This pushed the amount of USDT in circulation beyond $186 billion for the first time.

Tether’s move to shrink its fundraising target is seen as a response to valuation sensitivity in the private market, rather than a liquidity issue.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CoinCentral. USDT Issuer Tether Adds 35M New Users and $12B Market Cap Despite Crypto Slide. Accessed on February 6, 2026

- CoinSpeaker. Tether Hits ATH in Circulating Supply, but Is USDT Depegging Imminent? Accessed on February 6, 2026