7 facts about Bhutan’s $22.4 million BTC sale amid crypto slump

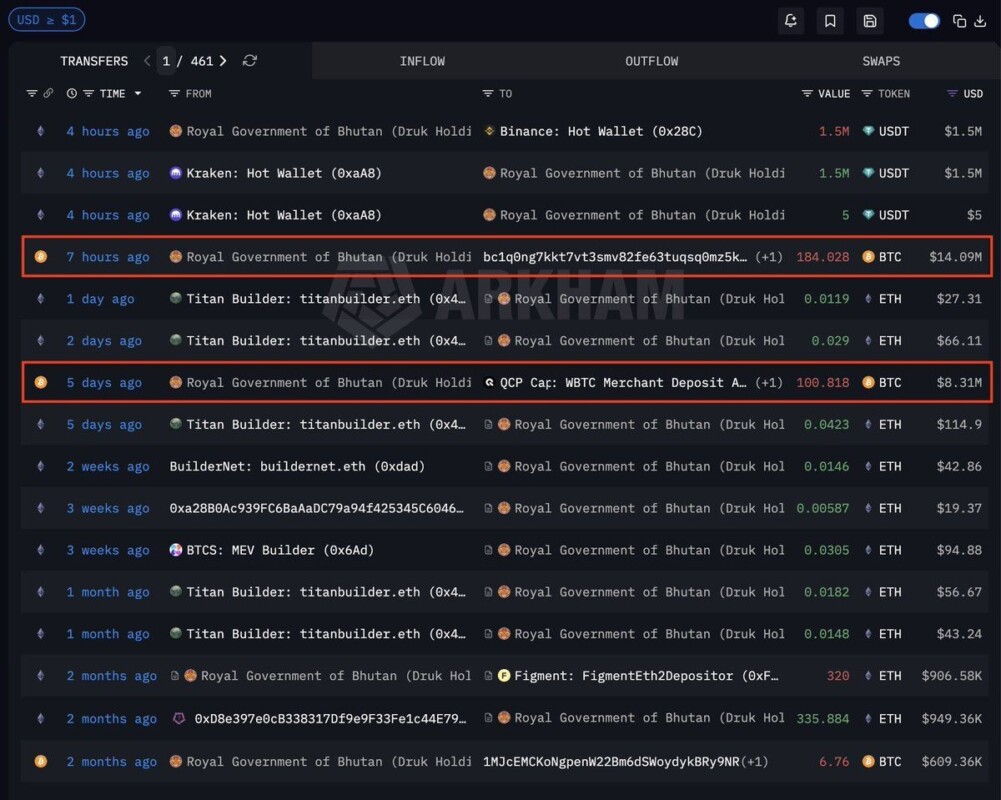

Jakarta, Pintu News – The small South Asian nation of Bhutan is in the spotlight of the cryptocurrency market after making a series of large Bitcoin transfers from their state wallet totaling around US$22.4 million (around Rp380 billion) in the past week.

The transaction sparked a wide-ranging discussion on how emerging digital assets strategy when the global crypto market is facing immense pressure and their portfolios are experiencing sharp declines.

1. Bhutan Moves US$22.4 Million Worth of Bitcoin

In recent days, Bhutan transferred 184 BTC (~US$14 million) and 100.82 BTC (~US$8.3 million) from their government-owned wallets to addresses associated with institutional market makers such as QCP Capital. This transfer comes after a relatively long period of calm in the country’s crypto wallets. The move attracted attention as the value of Bitcoin moved was not a small amount and occurred amidst a weak market.

This transaction suggests that Bhutan is taking active action on its digital reserves, although it is unclear whether this means outright sales or some other strategy. Such activity is often seen as a signal that the country is considering liquidity or portfolio adjustments.

Also Read: 5 Crypto that Whale is Eyeing in February 2026, Quietly Accumulating Amid Volatility

2. Bhutan’s Crypto Portfolio Drops by Over 70%

Recent data reveals that Bhutan’s crypto asset portfolio has dropped by more than 70% from a peak of around US$1.4 billion to around US$412 million currently. This decline is due to a combination of periodic sales by the government and the depreciation of Bitcoin prices in the global market.

A portfolio decline of this magnitude reflects how sensitive digital assets like Bitcoin are to volatile market conditions. For global investors, this is a clear example of the risks when large investments are held by non-traditional entities such as countries.

3. Bhutan has been mining Bitcoin since 2019

Bhutan started Bitcoin mining operations in 2019 by utilizing abundant and cheap hydroelectric energy. This approach allowed the country to accumulate BTC assets on a large scale and briefly made Bhutan one of the largest Bitcoin holders in the world.

During the initial phase of mining, it was very profitable due to low energy costs compared to the high Bitcoin price. However, this changed after the Bitcoin halving event in 2024, which increased the mining cost per BTC dramatically.

4. Mining Efficiency Decreases and Costs Increase

After the halving in 2024, the reward per Bitcoin block is reduced, which means the effective cost of mining one BTC has almost doubled. This made some of Bhutan’s mining operations less efficient and prompted the country to strike a balance between mining and realizing profits on the assets already generated.

As a result, Bhutan reduced active mining volumes and focused more on selling its existing reserves rather than continuing to add new assets.

5. Bitcoin Sales Managed to Minimize Market Impact

Analysts note that Bhutan’s Bitcoin sales approach tends to be in measured amounts, rather than large dumps into the spot market that could trigger price volatility. Transfers to institutional market makers like QCP Capital allow large blocks to be processed more finely without drastically affecting the Bitcoin price.

This strategy is similar to the “block trade” approach in traditional capital markets, where large sales are organized through institutions that can cope with market liquidity.

6. Impact to Crypto Market Sentiment

Large Bitcoin movements recorded from country wallets are often a signal that the global crypto market pays attention to. Many traders see it as an indicator of potential selling pressure, which can reinforce bearish sentiment especially when the market is weak.

However, without direct evidence of large Bitcoin deposits to spot exchanges leading to mass selling, some analysts suggest that this could simply be a portfolio reorganization or preparation for another transaction.

7. Example of Country Strategy in Digital Assets

The Bhutan case shows that states can be active and flexible in managing crypto assets as part of national reserves. Unlike individual investors, states usually have access to more complex strategies including allocation between long-term holding and measured sales.

Investors in the crypto market can see this as an important lesson on how large actors position themselves in market cycles, and why an understanding of on-chain data and macro context is key before making major investment decisions.

Also Read: 3 Crypto Underrated in February 2026 that Investors are Starting to Look at, Not Just Hype!

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

BeInCrypto. Bhutan Sold $22.4M in Bitcoin Amid Portfolio Decline of Over 70%. Accessed February 6, 2026.