Bitcoin’s Chances of Breaking $90,000 Are Slim as the Options Market “Throws Up Its Hands”

Jakarta, Pintu News – Bitcoin is under pressure again after dipping below US$63,000, its lowest level since November 2024. A correction of around 30% since failing to break US$90,500 on January 28 has made the market doubt the potential for a quick rebound.

Weak US labor data and fears of giant capital expenditures in the artificial intelligence sector reinforced the bearish sentiment. Amid this situation, the options market assesses the chances of Bitcoin returning to US$90,000 before the end of March as slim.

Bitcoin’s Chance to US$90,000 According to the Options Market

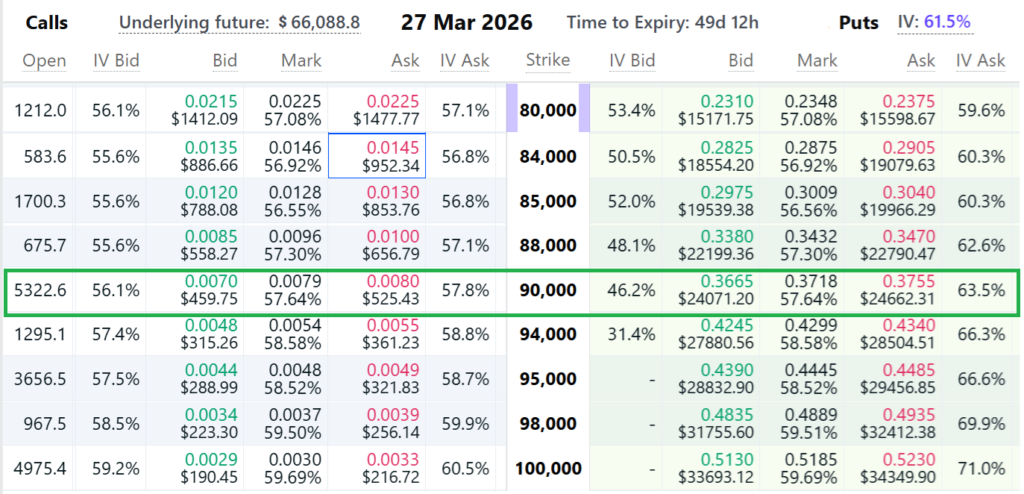

Data from derivatives exchange Deribit shows that call options to buy Bitcoin (BTC) at US$90,000 with a maturity of March 27 are trading at around US$522. Based on the Black-Scholes model, this price reflects a less than 6% probability for BTC to hit US$90,000 by the end of March.

In contrast, a put option to sell at US$50,000 on the same date is priced at around US$1,380, implying a roughly 20% chance of a deeper decline. This price structure illustrates that the market is anticipating the downside more than an aggressive rally scenario.

The selling pressure was amplified by investors’ increasing risk aversion to riskier assets, including cryptocurrencies. BTC’s drop to around US$62,300 on Thursday signals that the market is still skeptical about the growth prospects of the US economy. Under these conditions, protective options (puts) tend to be more attractive than speculative options (calls) that rely on rallies to new highs.

Also read: Bitcoin Slumps to $60,000, MicroStrategy Now Hunted for “Catastrophic” Risk

Quantum Risk, “BTC Hoarder” Debt, and the Cross-Asset Correction

Some market participants are reducing crypto exposure due to two factors: emerging quantum computing risks and fears of forced liquidation from companies hoarding Bitcoin with debt and equity. Christopher Wood of Jefferies, for example, removed a 10% Bitcoin allocation from his model portfolio citing the potential for quantum computers to crack private keys. Such concerns exacerbate sentiment when the price is already in a downtrend.

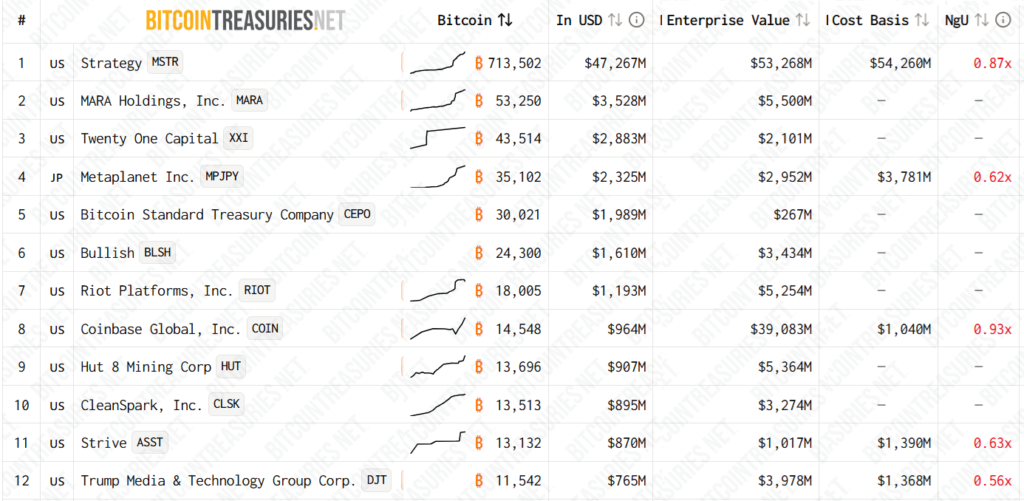

On the other hand, Bitcoin-owning public companies such as Strategy (MicroStrategy) and Metaplanet have recorded enterprise values that are starting to fall below their BTC acquisition costs. This raises concerns that a prolonged bear market could force the sale of some holdings to meet debt obligations.

Risk-off pressures are also evident in other asset classes: silver fell around 36% in a week after hitting a new record, while large stocks such as Thomson Reuters, PayPal, Robinhood, and Applovin also corrected in line with Bitcoin’s decline.

Read also: US economy makes all markets collapse, not just crypto?

Layoff Data and AI Shopping Boom Worsen Sentiment

On the macro front, US labor data added to the pressure. In January, US companies announced 108,435 layoffs, up 118% from the same period in 2025 and the highest January figure since 2009.

At the same time, unemployment has not surged and inflation has not fallen enough to justify aggressive rate cuts. This mix of signals leaves the market giddy: growth is slowing, but financial conditions are still tight.

Sentiment was also hit by a projected capital expenditure boom in the AI sector. Google expects its 2026 capex to reach US$180 billion, up from US$91.5 billion in 2025, while Qualcomm shares fell 8% after giving weaker growth guidance due to supplier capacity being diverted to high-bandwidth memory for data centers.

Investors think AI investments will take longer to generate returns due to competition, energy constraints, and scarcity of memory chips. In this climate, risk appetite for cryptocurrencies, including Bitcoin (BTC), tends to recede.

Conclusion

In brief, the options market currently rates the chances of Bitcoin returning to US$90,000 before the end of March as very slim, at only around 6%. The pressure comes from a combination of factors: quantum risk concerns, potential forced selling from indebted BTC-owning companies, surging layoff data, and uncertainty of AI investment returns.

Bitcoin’s drop to around US$62,300 reflects more of a risk and liquidity adjustment phase than a simple technical correction. Until there is more clarity from economic data and policy outlook, the scenario of a quick rally to US$90,000 seems increasingly unrealistic in the very short term.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Cointelegraph. Will Bitcoin rebound to $90K by March? Here’s what BTC options say. Accessed February 6, 2026.

- Generated by AI